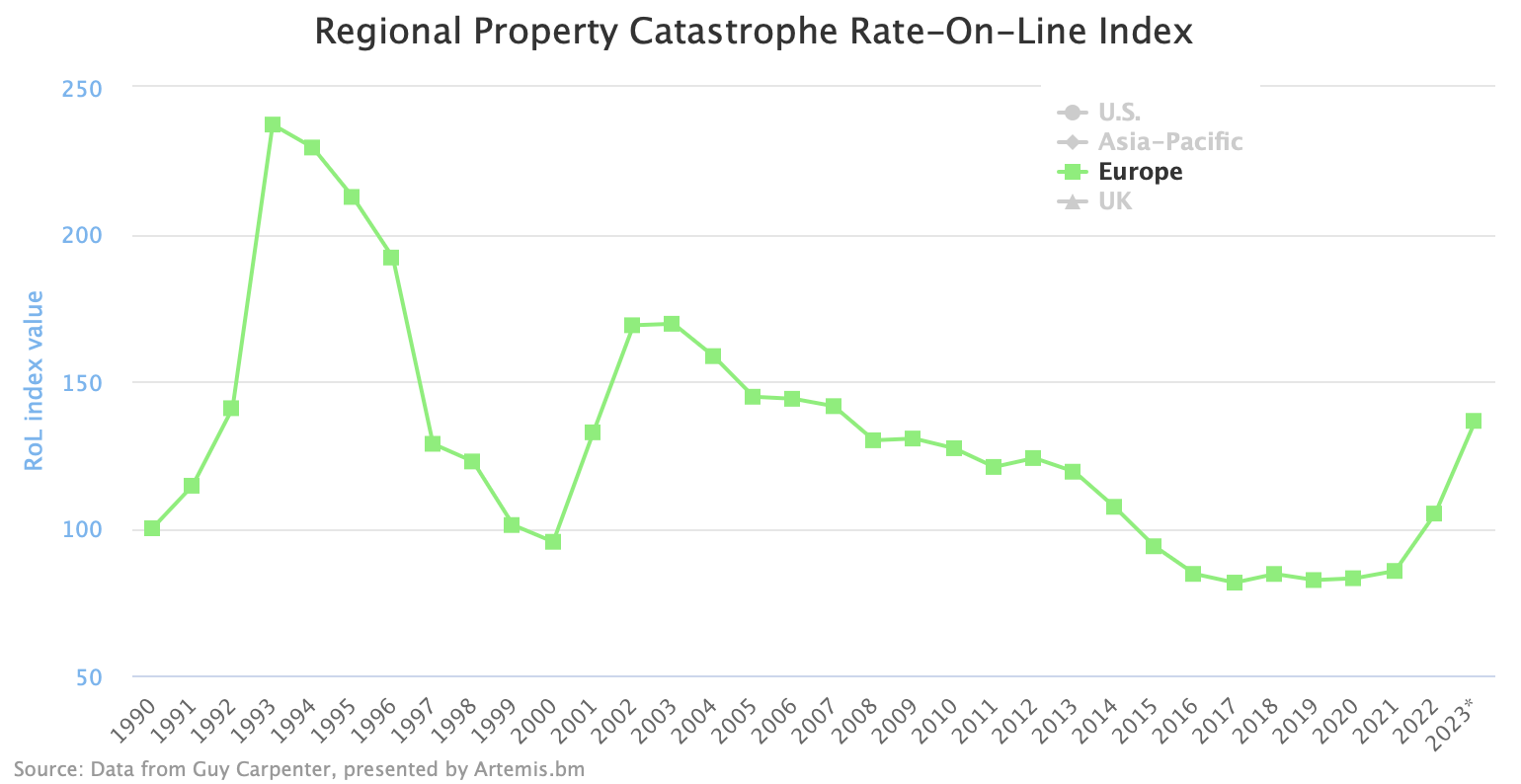

Property catastrophe reinsurance rates-on-line in Continental Europe rose strongly for the second consecutive year at the January 1st 2023 renewal season, according to the latest data from broker Guy Carpenter.

Having risen by almost 23% at the January 2022 renewal, partly stimulated by the significant flood losses seen in Germany in the summer of 2021, Guy Carpenter’s property catastrophe rate-on-line index for Continental Europe has risen by a further 30% at 1/1 2023.

That is the biggest single rise in this Index since 2001, taking the average rate-on-line back to levels close to those seen in 2007.

It’s quite the reversal from the soft reinsurance market environment in Europe, where rates have seemingly been inadequate and kept almost artificially low by the dominance of the big four global reinsurance firms.

The softness of European property catastrophe reinsurance rates has driven many insurance-linked securities (ILS) funds to pull-back from the region in recent years.

While at the same time, the number of catastrophe bonds covering European perils has decreased significantly, as a proportion of annual issuance.

The 30% rise in Guy Carpenter’s Continental Europe Property Catastrophe Rate-On-Line Index means it has now jumped 60% in just two years, providing a significantly more attractive rate environment in the region.

However, we understand from some sources that this is still not seen as a sufficient or sustainable level of pricing across the market, with some programs seen as now relatively well-priced, but other reinsurance towers still seen as underpriced given their loss experience.

The Continental Europe Property Rate on Line Index from Guy Carpenter is a proprietary index of European property catastrophe reinsurance Rate-on-Line movements.

The data is sourced from real, brokered excess-of-loss reinsurance placements. Guy Carpenter has maintained this index since 1990, making it the longest-standing source of insight into US cat reinsurance pricing.

The Index is updated after the January 1st renewals each year and is calculated by analysing the change in reinsurance rate-on-line (RoL) year on year across the same renewal base.

Having bounced along the bottom of the soft market since 2016, the resurgence in European property catastrophe reinsurance rates should serve to make than market more appealing to ILS funds and investors.

It may also make catastrophe bonds a more interesting alternative source of reinsurance capacity for cedents in the region, as pricing of coverage may now become more balanced across the traditional and capital markets.

You can analyse this reinsurance rate-on-line data from Guy Carpenter using our interactive chart.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.