The devastating flooding across western and central Europe of recent days is expected to drive both economic and insured losses into the multiple billions of Euros, according to Aon’s Impact Forecasting unit.

Impact Forecasting, the catastrophe risk modelling and meteorology unit of insurance and reinsurance broker Aon, notes that while it remains too early for financial loss estimates, the extent of the flooding seen and the severity of damage, will drive a particularly costly European catastrophe industry loss.

“There is notable precedent for large-scale, multi-national events that leave substantial impacts,” Aon’s Impact Forecasting team explained.

At least 202 people have been reported killed by the recent European floods, with Germany suffering the greatest human impact with 163 deaths so far, while Belgium reported 36.

But with almost 1,000 others injured, largely in Germany and many still missing, there is a strong likelihood the human impact rises further.

Thousands of properties have been inundated by the flood waters, leading to a strong chance of a meaningful financial impact.

Germany experienced the worst, with several small and large tributaries of the Rhine river overflowing.

“The combined cost of the flooding across Europe was anticipated to reach well into the billions of EUR. The highest portion of anticipated insured losses from the event was expected in Germany,” Impact Forecasting has said.

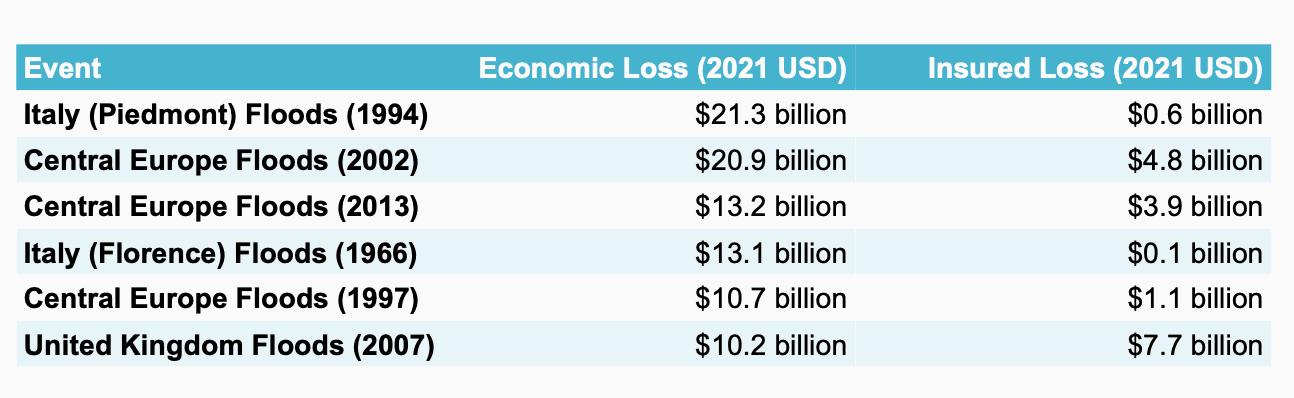

The Impact Forecasting team have provided a useful table of major European flood events and their resulting industry losses, 2021 equivalent

Importantly, they explain, “One notable point in the historical loss table above is the significant portion of the economic losses that went uninsured. Some regions – like the United Kingdom and Germany – do have more robust insurance take-up for residential and commercial assets, though wide gaps do remain.”

Adding that, “The observed footprint and scale of damage from this event makes it highly likely that both the overall economic and insured loss will each be measured in the multiple billions (EUR).”

Take-up rates of flood insurance are still relatively low and Aon’s team provide some insight into the worst affected areas.

“There are significant regional differences in insurance take-up. In the hardest-hit regions from the July 2021 floods, take-up rates include 47 percent in Nordrhein-Westfalen; and only 37 percent in Rheinland-Pfalz; 44 percent in Hessen; 38 percent in Bayern; but 94 percent in Baden-Württemberg.

“This suggests that while there is likely to multi-billion-dollar (USD) industry loss in Germany from this event, the overall economic loss will be substantially higher.”

The floods are thought very unlikely to have an impact on the catastrophe bond market, while insurance market losses will only be a fraction of the overall economic impact, which shows the evident flood risk protection gap and the opportunity for cat bonds to help close it, according to Plenum Investments.

There could be some impacts to private insurance-linked securities (ILS) (collateralised reinsurance) though, if the industry loss escalates into the multiple billions.

But identifying the scale of loss impact to ILS funds will be challenging and it is only likely to be a relatively small component of the insurance and reinsurance industry-wide impact, with traditional re/insurers likely to bear the brunt of the costs.

This will include a relatively significant share flowing to the major German reinsurance firms, it is assumed, as well as to other large European players.

The German insurance association (the GDV) had likened the flooding to the 2013 event the country had experienced.

It’s also notable that the impacts from the recent flooding come on the back of a costly recent period for European insurance and reinsurance exposed players.

Impact Forecasting explained, “This will be a continuation of what has been one of the most expensive six-week periods in Europe for the insurance industry in years. A series of severe convective storm (SCS) outbreaks in late June – June 17- 25 and June 28-30 – has already been estimated to result in a combined insured loss of USD4.5 billion. The overall economic loss was even higher at nearly USD6.5 billion. That equals the costliest SCS two- week stretch on record with the peril for the European insurance industry. Most of that damage was due to catastrophic hail, tornadoes, and flash flood incidents in Germany, Switzerland, France, Austria, and the Czech Republic.”

Also of note, Ernst Rauch, the Chief Climate and Geo Scientist at Munich Re commented on the potential link of such events to climate change, saying, “We have observed a significant increase in damages and damage frequency over the past decades in the case of thunderstorms accompanied by local heavy rain, hail or tornadoes. There are clear indications that part of the growing damage cannot be explained solely by socio-economic factors, but is due to climate change.

“The cause of the recent storms is a low pressure system that hardly moves forward and constantly brings new moisture. Such persistent weather patterns are becoming more frequent and are very likely related to climate change and in particular the rapid warming of the Arctic. We have to assume that these damages will increase in frequency and intensity.

“The issue of prevention must become much more prominent. In the long run, the expected increased damages are much more expensive than if we start now with prevention, which in the end will dampen the increase in damages.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.