While the recent survey we conducted alongside Synpulse, looking at the adoption of environmental, social, and governance (ESG) practices in the risk transfer, reinsurance and insurance-linked securities (ILS) markets, found that ESG is perceived as very important, there is an evident gap between perception and actual practice.

During the third-quarter of 2020 we teamed up with boutique consulting firm Synpulse to conduct a survey looking at the maturity of ESG with insurance, reinsurance, ILS and risk transfer market.

This was the first environmental, social, and governance (ESG) survey of its kind, analysing how companies in the risk transfer market have incorporated ESG factors into their strategies and operations.

The full results will be presented next week and survey participants will receive specific benchmarking information, so they can evaluate their own levels of maturity when it comes to adopting ESG strategies and practices against their competitive landscape.

But, while perceived as extremely important, adoption and ESG practices may not be as mature as you would think, with just a small fraction of survey respondents actually having taken action that is reflective of their very positive sentiments towards ESG.

There are a number of challenges seen as inhibiting the progress towards ESG adoption in the insurance, reinsurance ILS and risk transfer markets, which clearly hold back maturity and create this gap.

Firstly, the results of the survey suggest a lack of resources dedicated to ESG adoption at many firms, with no dedicated person and little investment to-date.

Unsurprisingly, non-dedicated ILS fund managers (so broader asset managers that offer ILS strategies) and insurers are better organised from a resource perspective than dedicated ILS fund managers.

Reinsurance firms efforts are also less well-organised, which could be due to fewer having formal ESG policies in place.

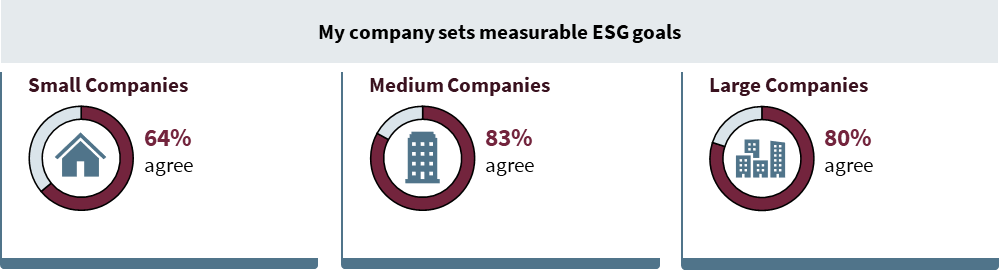

Secondly, a lack of clearly defined, measurable goals in ESG strategies is seen another stumbling block to embedding ESG practices at the operational level.

Synpulse explained, “Although the majority of those surveyed agree that measurable ESG goals are being set (see figure below), many of our survey respondents have voiced that these are currently either not defined clearly enough in ESG strategies or the goals themselves are considered unsatisfactory.”

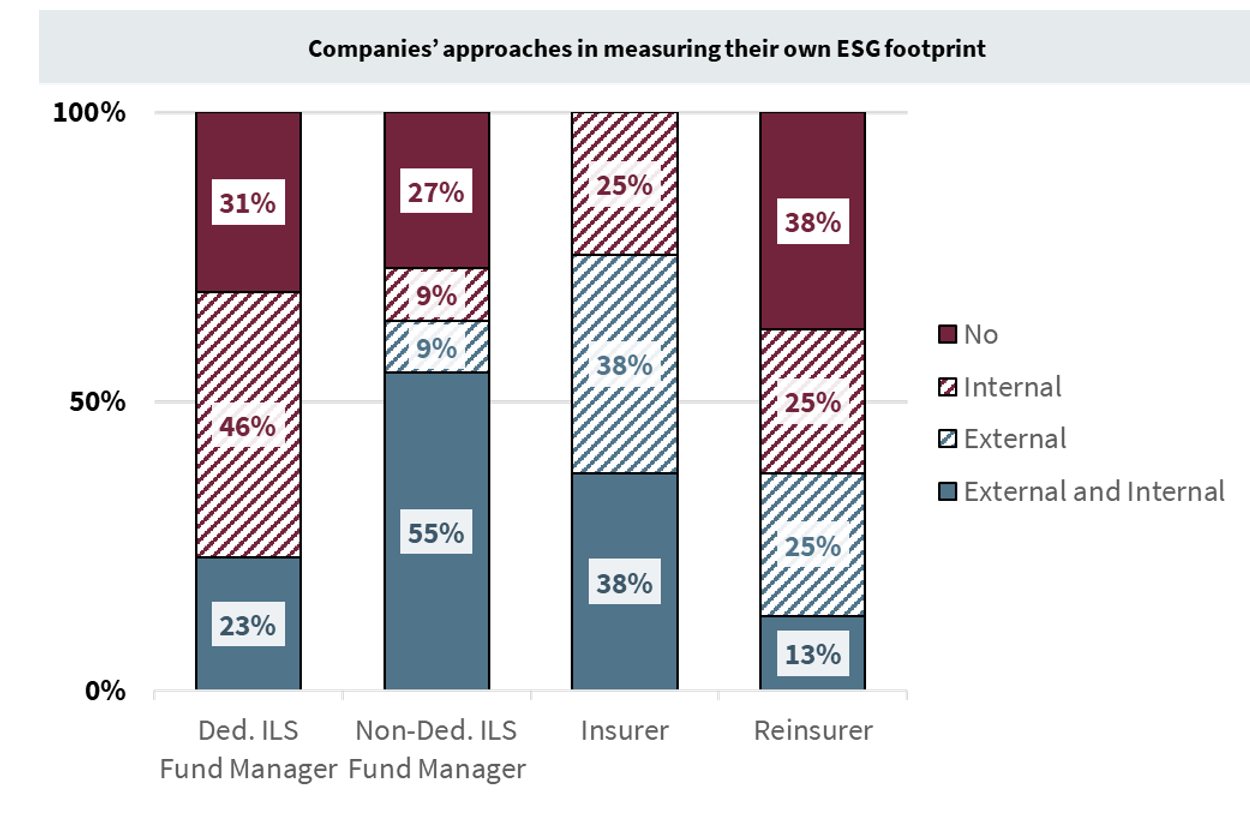

Our survey also asked participants whether they are actually measuring their ESG footprints, with differences evident and some regions and types of risk transfer market participants clearly having room to catch up.

“The approach adopted by non-dedicated ILS fund managers and insurers shows that these two peer groups assess their ESG performance more comprehensively than dedicated ILS fund managers − who mainly focus on measuring their ESG footprint internally − and reinsurers − almost 40% of whom do not assess it at all yet,” Synpulse explained. “There is a positive sign in that most dedicated ILS fund managers and reinsurers will be stepping up their efforts in this area by increasingly involving external parties.”

Synpulse inferred this as 70% of the dedicated ILS fund manager and reinsurance respondents to the survey said that measuring their ESG performance with an external rating or score was seen as important for their business.

The third challenge faced related to transparency and disclosure in the risk transfer value chain.

While our survey found that 90% of respondents felt screening parties and elements of risk within the value chain against ESG criteria was important, it’s less clear that this is actually occurring in a significant way.

Synpulse explained the finding, “The survey indicates that overall efforts to assess external elements do not yet cover the risk transfer value chain comprehensively. Companies primarily focus on downstream parties such as covered risks and clients when analyzing external parties for ESG adherence.

“This downstream focus might result from the fact that investors pay more attention to where incoming business is sourced from, and what type. This is another area that companies serious about ESG can improve in to get an accurate picture of the impact related to their interactions with external parties.”

There are significant challenges in being able to look-through reinsurance, retrocession and ILS contracts to see the covered business underneath and analyse how every protected party does its business, or embraces ESG itself.

While ILS, as well as insurance and reinsurance, clearly has very positive ESG characteristics, in terms of the provision of disaster and broader insurance risk capital and the societal good that provides, once you look beneath the mechanism itself things get a little murkier.

Transparency is lacking the further down the chain of risk transfer you go, with retrocessionaires often not having a clear view of the underlying insurance policies.

This can pose specific issues for the ILS market, as some institutional investors need to know, for example, that their investments are not in any way doing any societal or environmental harm. But it is very challenging to know exactly that every underlying insured adheres to the same ethos.

A strict analysis of ILS contracts on an ESG basis therefore would likely find many lacking currently, which heightens the importance of adoption in the industry as end-investors are becoming increasingly focused on ensuring their allocations are ESG friendly across all asset classes.

As regulation also comes into play, particularly in Europe, embracing ESG could become a matter of high importance for the ILS market, to ensure it has access to the full-range of investors.

Embracing ESG in ILS can also become an enormous opportunity, as large investors around the world are lacking fixed income opportunities that meet strict ESG requirements, something ILS and instruments such as catastrophe bonds can do with a bit of effort and greater transparency or disclosure along the chain.

There’s clearly a lot of work to do, but the high level of perceived importance of ESG suggests that risk transfer, re/insurance and ILS market participants will work towards increased adoption and maturity of ESG factors in their business and decision-making.

Patrick Roder, Associate Partner at Synpulse summarised these survey findings, “The survey findings on progress in implementing ESG at the operational and process level are sobering. While the will exists, more dedicated resources, clearer defined goals, more accurate and comprehensive measurement, and better standards and data disclosure are required if companies in the risk transfer market are to achieve their stated aspirations.”

The full risk transfer market ESG study will be available to download around next week and our email newsletter subscribers will be among the first to know, so sign up here to be informed when the study is published.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.