Investors seeking diversified sources of return, particularly with little correlation to broader financial market factors, remain key drivers of allocations to the alternative asset classes of the world and appetite for these assets continues to grow.

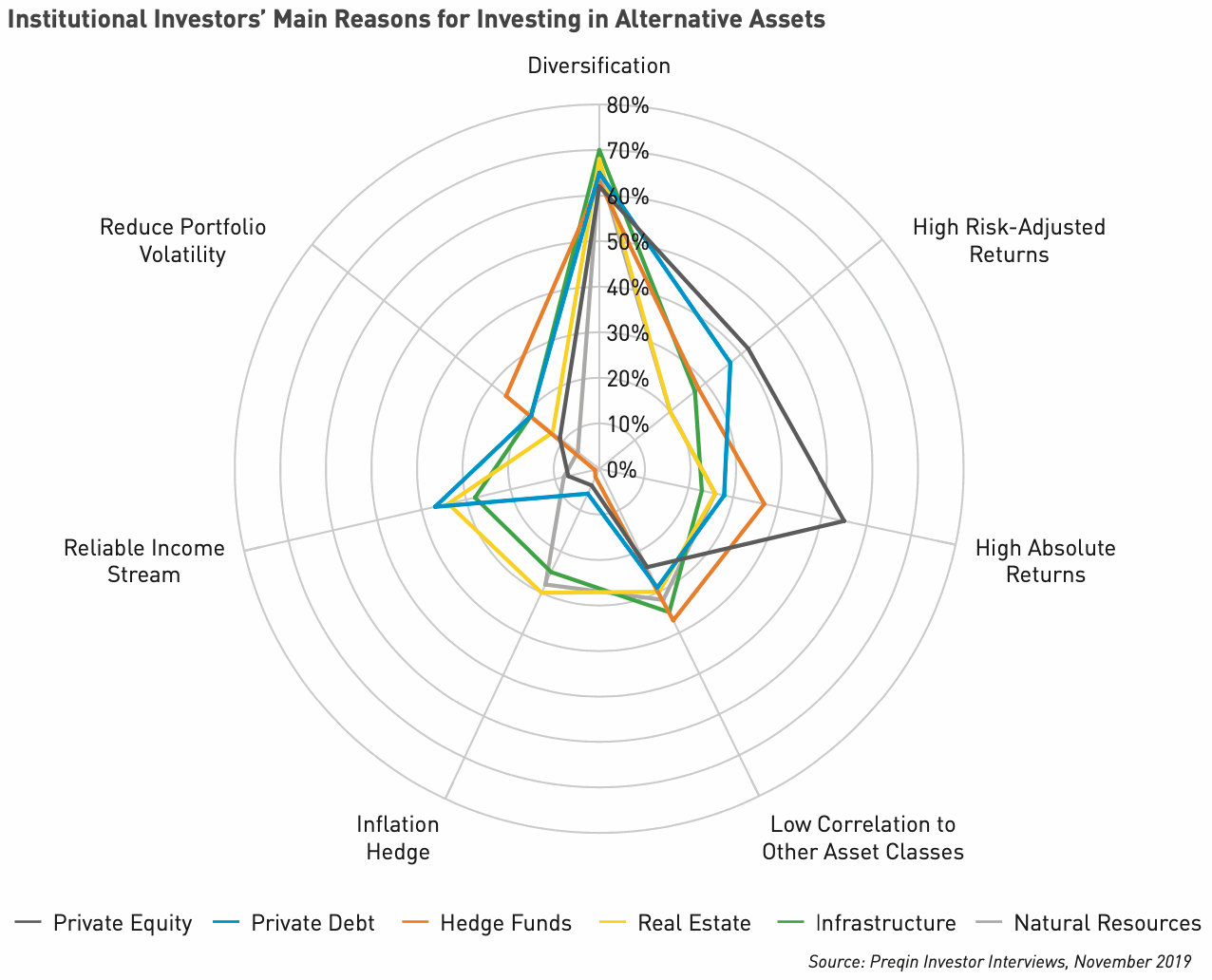

Data from alternative investment specialist information service provider Preqin shows that investors allocating to alternatives continue to rank the diversification benefits as their key motivation for deploying capital into the space.

The data is from before the Covid-19 pandemic situation escalated, but given how that drove many asset classes down in terms of value, the investment communities view on alternative asset classes could now be even more positive as a result of the evident lack of correlation shown by assets including insurance-linked securities (ILS).

This bodes well for continued investor attention on reinsurance linked returns and the insurance-linked securities (ILS) asset class, as one of the least correlated investment opportunities around that can still deliver an attractive, diversified source of returns over the longer horizon.

Having surveyed 400 major investors on their alternatives strategies, Preqin said, “Amid a slowing global economy and geopolitical uncertainty, the alternative assets industry has continued to grow. Assets under management ballooned to in excess of $10tn as yield-hungry investors poured capital into alternatives, and no wonder: most investors we surveyed said that they were satisfied with the performance of their portfolios in 2019.”

Nicole Lee, Head of Content at Preqin commented on the findings of the investor survey, “The position of the market cycle is still at the forefront of investors’ minds –even more so in 2020 as we see major stock indices record sizeable losses. But if anything, this concern is only increasing their appetite for alternative assets. Strong performance has broadly met expectations, and investors are doubling down on the sector to keep providing returns in difficult times.Choppy waters are ahead, and the industry is not immune to trouble, but for now investors are still seeking alternatives.”

When it comes to investing in alternatives the motivation for investors are numerous, but chief among them remains diversifying an investment portfolio, as the results of Preqin’s survey show below.

Overall, Preqin believes that investors are likely to increase alternatives allocations, but are also likely to reallocate their investments within the space.

Private equity could be an area that suffers, while hedge funds could benefit having had a better year in 2019.

It’s possible that insurance-linked securities (ILS) and reinsurance focused investment funds or vehicles could benefit from this trend and if nothing else the desire of investors to remain in alternatives, but to reallocate within it, is only likely to raise the awareness of the ILS fund market at this time.

ILS investments continue to meet the mandate of investors looking for less correlated returns that can diversify their overall portfolios, hence interest in the asset class is high right now and set to rise with issuance of catastrophe bonds in particular.

This has meant that a number of catastrophe bond funds are reopen in 2020, having been shuttered for a few years, and as such marketing activity has been heavier in recent months as well.

With cat bond issuance continuing apace (after the slight Covid-19 lull), it is likely that awareness of cat bond fund strategies continues to grow in the investor community. With these a good source of diversifying and alternative returns, this is likely to attract increasing numbers of investors over the rest of this year.

The question then will be whether investors can allocate effectively, or even sufficiently to make a difference, in ILS strategies at this time. But at the very least, awareness of ILS strategies and cat bonds in particular is certainly on the rise..

Looking ahead Preqin notes, “Across each alternative asset class, a minimum of 77% of investors are planning to maintain or increase their capital commitments in the next 12 months. And looking ahead to the longer term, at least 81% will maintain or raise their allocations.

“Although global markets could well be at an inflection point, and uncomfortably high asset pricing is a concern for investors in most asset classes, our study clearly shows that investors are keeping faith with alternatives. Given the historical evidence of returns through good times and bad, this strategy may well turn out to be justified.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.