The gap between the supply and demand of reinsurance protection has narrowed in recent times and, at the same time, global reinsurance capital has increased to a record-breaking $585 billion, according to Aon Benfield.

Global reinsurance brokerage Aon Benfield has estimated that overall reinsurance capital increased by 4% during the first six months of 2016, to a new high of $585 billion, which is roughly $10 billion higher than at the end of 2014.

At the same time, the broker has said that the capacity gap in the sector can be seen to have narrowed as demand for reinsurance protection has grown over the last 18 months.

Chief Executive Officer (CEO) of Aon Benfield, Eric Anderson, said; “The catalyst for this increased demand for property and casualty reinsurance include factors such as the emergence of poor underwriting results in certain casualty classes, outsized losses from regional exposures, and the introduction of the Solvency II regulatory regime across the European union.”

The supply/demand imbalance in the global reinsurance landscape has been a hot industry topic for some time now, as an abundance of both alternative and traditional reinsurance capacity continues to enter the space, fuelling competition and driving down rates.

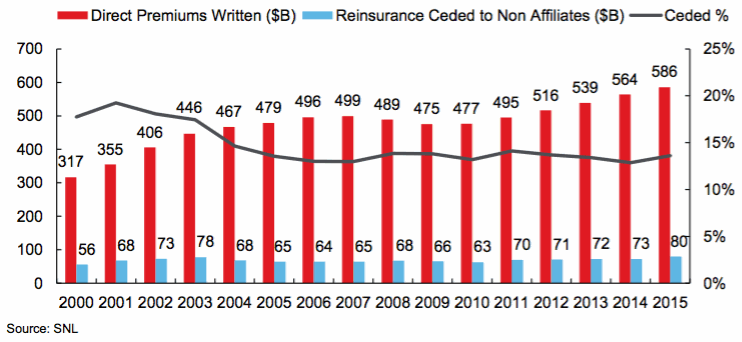

But in more recent times, insurers and reinsurers have been seen to purchase more reinsurance protection, and Aon Benfield highlights that “the cession ratio across the global property and casualty insurance industry registered a small rise for the first time in several years.”

A trend the firm expects to continue for the remainder of 2016, and highlighted by the graph below, provided by Aon Benfield.

Historical US non-affiliated reinsurance cession ratios

While insurers have benefited from cheaper, more efficient reinsurance protection in the softening landscape, reinsurers have also been able to take advantage of the efficient source of retrocession cover.

“At a time of heightened earnings sensitivity, reinsurers are increasingly utilizing cost-effective retrocession coverage to manage tail risk within their risk tolerances,” explained Aon Benfield in its latest Reinsurance Market Outlook report.

Traditional reinsurance capital grew by 3% during the first-half of 2016 to $510 billion, while alternative reinsurance capital increased by a further 5%, to roughly $75 billion, explains Aon Benfield, in its latest Aggregate report.

But importantly, while the total volume of global reinsurance capacity increased, the gap between supply and demand has actually narrowed, a trend that helps to mitigate any further pressure on pricing as a result of an oversupply of capacity.

“Reinsurance capital is currently at peak levels, as further declines in interest rates have built the stock of unrealized gains on bond portfolios and boosted the relative attractiveness of non-correlating insurance risk among institutional investors. At the same time, more reinsurance is being purchased,” said Aon Benfield.

“The lower pricing points delivered by alternative capital are clearly a factor, but the broader point is that reinsurance is growing in relevance as a proven mechanism for sharing risk, managing capital and controlling earnings volatility in the current environment,” continued the firm.

Furthermore, the reinsurance broker expects that regulatory advances in certain regions of the globe will also push up demand for reinsurance protection in the near future, underlining the increasing relevance and need for reinsurance protection.

The Reinsurance Market Outlook report highlights the property catastrophe space, mortgage segment, cyber, and crop industry as key growth areas for the re/insurance market in the coming months and years.

With advances in technology and with catastrophe modelling improving all the time, enabling a broader range of peril regions to be explored and served by insurers, reinsurers, and insurance-linked securities (ILS) players, it’s possible that the demand for reinsurance protection will continue to rise.

While there has been much discussion of the supply/demand imbalance in the space and the resulting overcapitalised state of the reinsurance marketplace, if the sector is serious about covering large, emerging risks such as cyber and terror, then it’s likely that the current capital levels are far from adequate.

This highlights the need for not only traditional insurance and reinsurance capital, but also the features and willingness of the ILS space to participate in areas outside of the competitive property catastrophe space.

It will be interesting to see whether the base of traditional and alternative reinsurance capital continues to expand alongside the expectation of increased demand for protection from cedents.

The willingness and ability of the insurance, reinsurance, and ILS space to protect against the world’s perils is clear, so it’s up to the companies and organisations around the globe to innovate and develop bespoke, efficient solutions in response to increased growth opportunities.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.