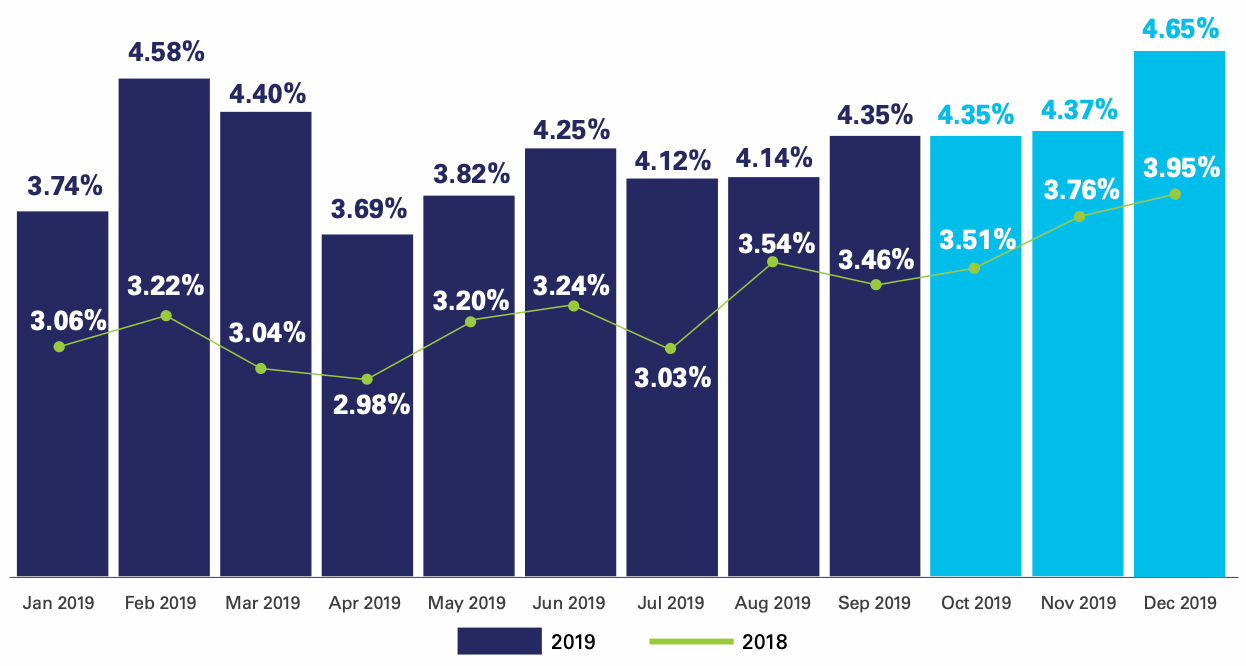

U.S. commercial property insurance rates continued to accelerate, in terms of rate firming or hardening, towards the end of 2019, with December seeing the highest monthly rate increases of the year.

The IVANS premium renewal rate index shows that the fourth-quarter of 2019 saw a strong finish to the year for commercial property insurance, as this segment of the market continued to renew at higher levels, with rates increasing compared to the previous quarter.

In fact, U.S. commercial property insurance business ended the year with its highest monthly premium renewal change of 2019, with December seeing a 4.65% rise.

Overall, Q4 2019 saw an average commercial property insurance premium renewal rate change of 4.46%, up from 4.2% in Q3.

Premium renewal rates for commercial property insurance business have steadily accelerated throughout the second-half of 2019, with catastrophe exposed and loss impacted accounts seeing many of the largest increases.

Every month in 2019 has seen a higher rate of commercial property rate change in the U.S. according to IVANS, signifying the pressures on performance and also capacity that have hit accounts and markets.

The U.S. market for property insurance at the larger and more specialised end of the scale is firming consistently and at an increasing pace, presenting opportunities for large reinsurance capacity providers that tap this business directly, as well as for insurance-linked securities (ILS) fund operators who are attracted to pools of this kind of risk.

For the ILS funds that provide reinsurance capital to back pools of primary property business sourced from MGA’s and other originator relationships, the rising premiums in commercial property risk, particularly catastrophe exposed, will feed through into higher returns for this business we’d imagine.

This bodes well for the insurance-linked securities (ILS) players that look to access their risk from further towards the front of the market chain, as commercial and larger property, particularly catastrophe exposed, continues to experience rate firming.

The firming of property insurance continues apace in the U.S., but at the same time reinsurance has not moved so quickly as perhaps expected at the January renewals.

But with the retrocession market tight and rates seen to be rising there, while the front-end property business is also firming, it suggests that the reinsurance piece in the middle will respond later this year when more U.S. business renews.

Otherwise, reinsurance capital providers will be experiencing a situation where their ceding clients are successful in securing higher rates, while at the same time paying more for their own retro protection.

At some point the reinsurance providers will have to push for more rate while this scenario of firming on the front and back-end of the market continues, while their middle remains squeezed and seeing less impressive firming.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.