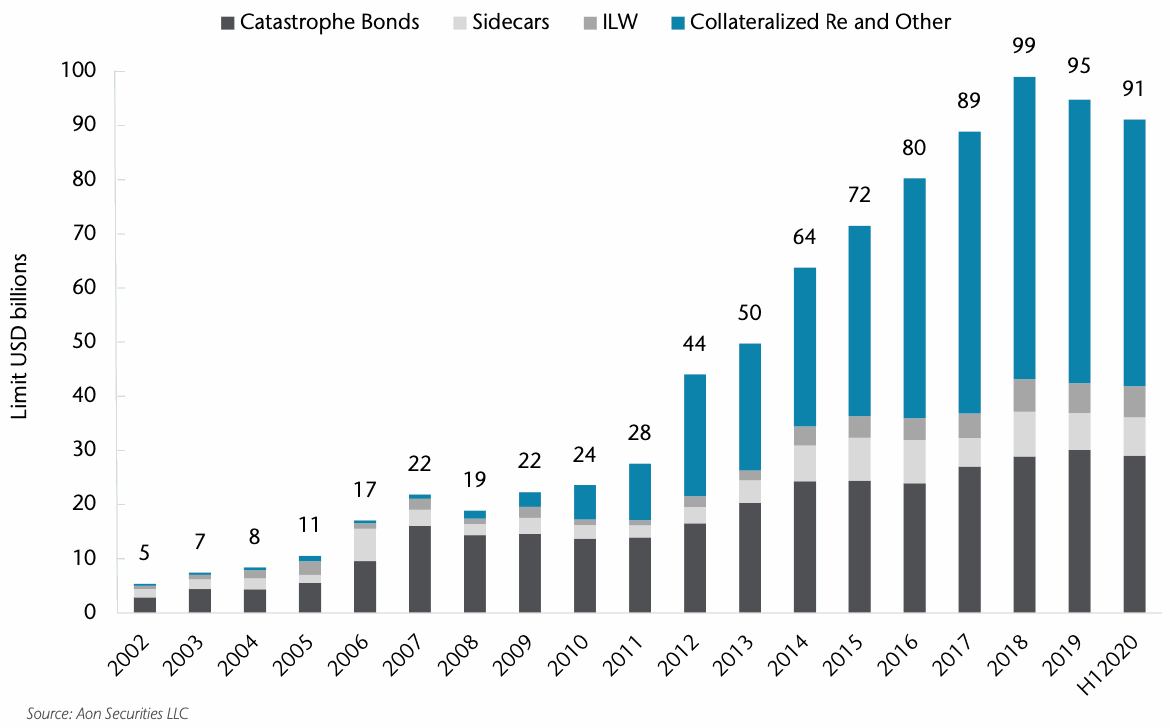

The collateralized reinsurance market segment of insurance-linked securities (ILS) is expected to contract further, according to broker Aon, although it will likely remain the largest segment of ILS for the foreseeable future it seems.

In Aon Securities’ latest annual ILS market report, the capital markets unit of the global insurance and reinsurance broker explains that the collateralized reinsurance segment shrank by 6.5% in the first-half of 2020.

At the end of 2019 the collateralized reinsurance segment totalled $52.7 billion of the ILS market’s limit.

But by June 30th 2020, that figure had dipped back to $49.3 billion.

Aon believes there is further for collateralized reinsurance to shrink, saying that it expects this segment “to continue to contract.”

This is partly due to the expectation of more trapping of collateral due to the exposure to COVID-19 business interruption that some ILS funds hold.

Aon Securities explained, “Investor appetite for collateralized reinsurance can be more sensitive to loss activity than catastrophe bonds, due to the propensity for losses at lower return periods, including ancillary losses associated with the COVID-19 outbreak.”

ILS funds continue to employ high-quality fronting to help them deploy into the reinsurance markets on a collateralized basis, the report explains, as they leverage the strength of a reinsurers balance-sheet alongside their own efficient capital.

The recent years of catastrophe losses and the resulting issues of trapped capital, plus the fact rates are now much firmer and so deploying capital into reinsurance contracts only exposed to losses at higher-return period is more attractive.

This is driving more interest from investors in catastrophe bonds and more liquid, as well as lower-volatility strategies.

“Although the segment continues to form the largest part of the ILS market by capacity volume, some investors have allocated away from the class in favour of more liquid, tradeable instruments,” Aon explained.

As a result, in the catastrophe bond market, Aon Securities notes “strong demand for new issuances.”

Going forwards, bearing in mind the disruption caused by the COVID-19 pandemic, Aon Securities believes liquid strategies may prosper.

“We expect there to be additional emphasis on liquidity leading to more growth in liquid investment strategies,” they explained.

Also read: Cat bond market in a strong position with busy pipeline: Schultz, Aon.

Analyse catastrophe bond issuance and data using our Deal Directory, Dashboard and Charts.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.