The CCRIF SPC (formerly the Caribbean Catastrophe Risk Insurance Facility) has announced that its payouts made to Caribbean governments due to the impacts of hurricane Irma will reach $31.2 million, while the facility has now passed $100 million of payouts to members since its launch.

All of the $100 million of payouts have been made to members within 14 days of the catastrophe events that triggered their parametric insurance policies occurred. 12 of the 17 CCRIF members have benefited from payouts so far, with 6 members now having received payouts following hurricane Irma.

All of the $100 million of payouts have been made to members within 14 days of the catastrophe events that triggered their parametric insurance policies occurred. 12 of the 17 CCRIF members have benefited from payouts so far, with 6 members now having received payouts following hurricane Irma.

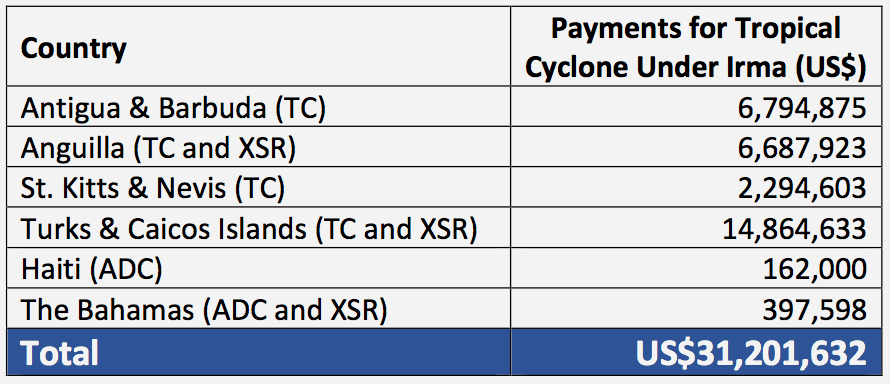

Payouts under parametric excess rainfall (XSR) policies to Anguilla, Turks & Caicos Islands and The Bahamas are the latest following hurricane Irma.

Anguilla and the Turks & Caicos Islands had also received payouts under their parametric tropical cyclone (TC) insurance as well, as had Antigua & Barbuda and St. Kitts & Nevis. Meanwhile Haiti and the Bahamas also received small payouts due to a new feature of the CCRIF, policies Aggregate Deductible Cover (ADC) clauses.

The full list of CCRIF hurricane Irma payouts can be seen below:

CCRIF CEO Isaac Anthony said; “The injection of short-term liquidity that CCRIF provides when a policy is triggered is not intended to cover all the losses on the ground following a disaster, but is designed to allow governments to reduce their budget volatility and to provide much needed capital for emergency relief such as clearing of debris and other clean- up activities, restoring critical infrastructure, and most importantly providing humanitarian assistance to the affected population, thereby reducing post-disaster resource deficits.”

The CCRIF provides rapid payouts thanks to the use of parametric triggers and also the capacity from global reinsurance markets that underpins the facility. The speed of payout is vital for disaster relief purposes, with governments able to receive money from parametric insurance policies often much faster than international aid can arrive.

Reinsurance markets play a vital role, as does the pooling of risk across the region, helping to make the parametric policies more affordable.

Anthony explained; “By pooling the catastrophe risks of our members into a single diversified portfolio, we are able to save our members approximately 50 per cent in individual premium payments compared to if they were to purchase identical coverage individually.”

CCRIF Chairman Milo Pearson added; “The role of the international donor community cannot be overemphasized. Our development partners have supported the buildout of the facility’s risk bearing capacity assuring its financial sustainability as an independent entity over the long term and above established national benchmarks for catastrophe insurers.”

Following the impacts of hurricane Irma the CCRIF urges its members to make greater use of its parametric coverage, as the level of coverage available is directly related to the premium countries pay.

“Member countries must focus in the coming years on scaling up insurance coverage where ‘adequate’ coverage levels should not fall below 25 per cent of the overall government exposure to earthquake, hurricane and excess rainfall risk on an ongoing basis (i.e. relative to the annual average loss) and particularly for larger shock events,” CEO Anthony explained.

The CCRIF and the techniques of risk pooling and tapping the international reinsurance markets for backing have shown their worth with hurricane Irma.

Now, with hurricane Maria still in the water there is a chance that Dominica at least could be due a payment from the CCRIF for that storm. The levels of payouts seen from the 2017 hurricane season suggests that reinsurance capacity will be paying at least some of these claims, helping to support the CCRIF in supporting its members following the disaster.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.