The global catastrophe protection gap reached 64% in 2020 as roughly $171 billion of natural catastrophe and severe weather losses were not covered by insurance and reinsurance, one of the largest brokers Aon has said.

Aon’s latest annual catastrophe report highlights climate influences on a significant number of impactful events in 2020 and the brokers’ CEO Greg Case calls for organisations to ensure they are protected against the global risk of concurrent events.

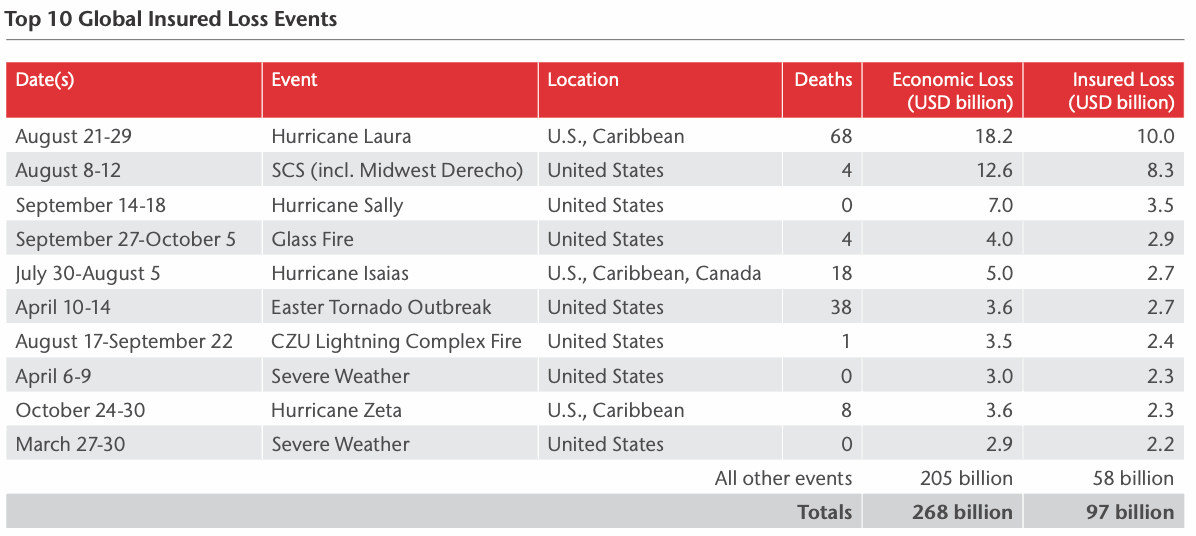

Aon’s report includes 416 natural catastrophe and severe weather events from 2020, which the broker estimates drove economic losses of US $268 billion, some 8% above the average annual losses for this century.

“Costs continue to rise due to a changing climate,” Aon explained, as well as the fact more people are moving into hazard-prone areas and there is an increase in global wealth.

Out of the total economic losses, private sector and government-sponsored insurance and reinsurance programs only covered US $97 billion, resulting in a protection gap of 64%.

While 64% is still very high, Aon notes that the protection gap for 2020 was the fourth lowest on record after 2005, 2018 and 1992.

That is due to the fact the United States experienced its costliest year for natural disasters on record in 2020, while having the highest level of insured losses for the year.

So it’s important to note that the protection gap remains very significant in many other regions of the world, where insurance and reinsurance penetration remains very low and uptake is not increasing as fast as exposure increases, in many cases.

“The global response to the socioeconomic volatility caused by the COVID-19 pandemic has increased focus on other systemic risks – particularly climate change – and is causing a fundamental reordering of business priorities. This report highlights the increasing likelihood of ‘connected extremes’ and reinforces that leading organizations of the future will be defined by their ability to manage the global implications of concurrent catastrophic events,” explained Greg Case, CEO of Aon. “In a highly volatile world, risk remains ever present, is more connected and, as a result, is also more severe – and 2020 has underscored this reality. It has also emphasized the need for enhanced collaboration between the public and private sectors, which will be essential to close the rising protection gap and build resilience against natural catastrophes.”

Aon’s report highlights the need to narrow the protection gap, by targeting the underinsured and increasing access to affordable insurance products.

As well as the financial toll, over 8,000 people lost their lives due to natural catastrophes in 2020.

Tropical cyclones, including hurricanes, drove the highest cost during the year, at more than US $78 billion in direct economic damage.

Flooding was the second most costly peril at US $76 billion, while severe convective storm was third at US $63 billion.

From a climate perspective, Aon highlights that NOAA pegged 2020 as the world’s second-warmest since 1880 for land and ocean temperatures at +0.98°C (+1.76°F) above the 20th-century average.

Steve Bowen, Director and Meteorologist for Aon’s Impact Forecasting team, stated, “The world continues to evolve as it is faced with new challenges around natural perils. While many private and public sector entities primarily focus on physical and human hazard risks, an increasing number of global regulative bodies are further pivoting towards how to handle emerging transitional and subsequent reputational risks. This is especially true as the financial and humanitarian risks surrounding climate-enhanced events become more evident on a daily basis. Focus at the corporate and federal levels will be critical around investments in risk mitigation, resilience, and sustainability as the landscape around climate change solutions continues to accelerate with renewed urgency.”

Severe convective storms drove the highest costs in the United States during 2020, as we’ve previously detailed.

Hurricane Laura was the most significant insurance and reinsurance market loss, at $10 billion, followed by the midwest U.S. Derecho at $8.3 billion of insured losses.

In economic terms, the largest loss of the year was seasonal monsoon flooding in China, at $35 billion, followed by hurricane Laura and Cyclone Amphan.

Aon’s full catastrophe report can be accessed here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.