Catastrophe bond issuance in 2021 has continued to accelerate and with the completion of the latest transaction, the total amount of risk capital issued in pure, Rule 144a syndicated property cat bond transactions has reached $11.1 billion, now surpassing the previous annual record set last year.

With one month left to run in 2021 there are already another seven catastrophe bond issues in the market, which between them promise to add more than $900 million in additional property catastrophe risk capital to this annual issuance figure and another $100 million to come from a mortality cat bond deal.

Meaning the total issuance figure for 2021, based just on Rule 144A property catastrophe bonds, is already likely to surpass $12 billion, meaning the annual cat bond issuance record will be comfortably broken at year-end.

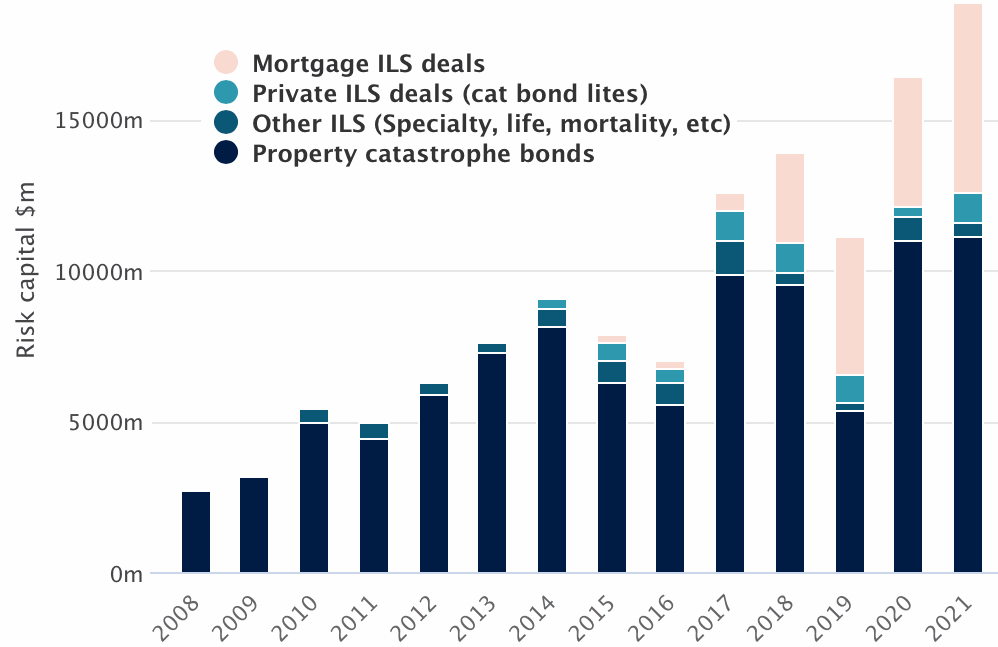

You can analyse issuance of property catastrophe bonds, cat bonds covering other lines of business, private cat bonds and mortgage ILS, by year in the chart below (click on the image for an interactive version).

If you add in cat bonds covering other types of risk, such as life, health, or specialty lines, another $470 million or more can be added to the 2021 issuance figure, just based on deals completed as of today.

In 2021, we’ve also tracked an annual record of more than $1 billion in private cat bonds (or cat bond lites), as sponsors increasingly look to secure reinsurance capacity through these cost-effective issuances.

So, with nearly $11.1 billion of pure property catastrophe bonds now issued, plus $470 million of other line of business cat bonds, and just over $1 billion of private cat bonds, the issuance figure to-date for these types of deals has almost reached $12.6 billion.

Mortgage insurance-linked securities (ILS) issuance is also at an annual record level in 2021 as well, with almost $6.3 billion of mortgage ILS deals tracked by us at Artemis, as the major US mortgage insurers continues to source increasing volumes of reinsurance from the capital markets.

So the only segment that currently does not look set to reach a new annual record is the bucket of catastrophe bonds that cover other lines of business (life/health/specialty).

But, whatever way you slice and dice the securitized issuance of the ILS and cat bond market, it’s been a particularly impressive year so far.

An important note for our readers: Because of the record activity levels in the catastrophe bond market over the last two years and the continued expansion of the mortgage insurance-linked securities (ILS) market, we’ve recently been working hard to separate out mortgage deals from the majority of our charts and analytics.

From today, our headline annual issuance and market outstanding figures, as shown on the homepage, Deal Directory & Dashboard, will only include pure Rule 144A property catastrophe bonds, other line of business cat bond deals and private cat bonds or ILS that we have information on.

Mortgage ILS information will still be included in some charts where it is useful for comparison purposes and you will be able to filter it out (such as our popular cat bond and ILS issuance by year and type of deal chart).

We hope this makes our data more comparable with other reporting entities, such as the leading ILS brokers. However, we will continue to include private cat bond deals and every cat bond covering another line of business in our headline figures, as the ILS investor-base and ILS fund managers find these largely comparable for their portfolios.

Changes you may notice include: The homepage figures for issued and outstanding now exclude mortgage ILS, as do our standard set of catastrophe bond and ILS market charts, while new mortgage ILS specific charts have been added to allow those interested to track developments in that marketplace.

For any questions about what’s included in our data services, or to discuss these changes, please feel free to contact us.

With the above note in mind, risk capital outstanding, including property cat bonds, other cat bonds and private cat bond or ILS deals we’ve tracked, now stands at $36.03 billion, which represents market growth of nearly $2.7 billion since the end of 2020.

That’s an impressive 8% increase in size of the outstanding market of catastrophe bonds and other related ILS in just an eleven month period.

With seven new property catastrophe bonds being marketed to investors and fund managers at this time and more likely to launch in the coming weeks, the issuance total for 2021 will set a strong new annual record.

We’re already on-track for close to $13.6 billion of issuance, across pure property cat bonds, other line of business cat bonds and private cat bond deals, a figure which may rise by year-end if any more new transactions come to market.

With market conditions still looking positive in the catastrophe bond space, the stage is already set for a busy 2022 as well.

Stay tuned to Artemis for news of every catastrophe bond and related ILS transaction that comes to market, as well as other structures including reinsurance sidecars.

You can view information on every catastrophe bond issued so far in 2021 and all prior years, totalling over 800 individual issues, in the Artemis Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 800+) contained in our catastrophe bond & ILS Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 800+) contained in our catastrophe bond & ILS Deal Directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.