The outstanding market size of catastrophe bonds and related insurance-linked securities (ILS) continued to grow in the first-quarter of 2021, reaching new highs of $34.34 billion, based on property cat, life, health and specialty or other line of business cat bonds, or $48.13 billion if you include the mortgage ILS deals we have listed on Artemis.

Both figures are the highest Artemis has ever recorded and reflect the continued strong appetite for fully securitized reinsurance related coverage among sponsors and for access to the returns of reinsurance related risks among investors, resulting in a period of very strong demand for catastrophe bonds and other similarly structured ILS deals of late.

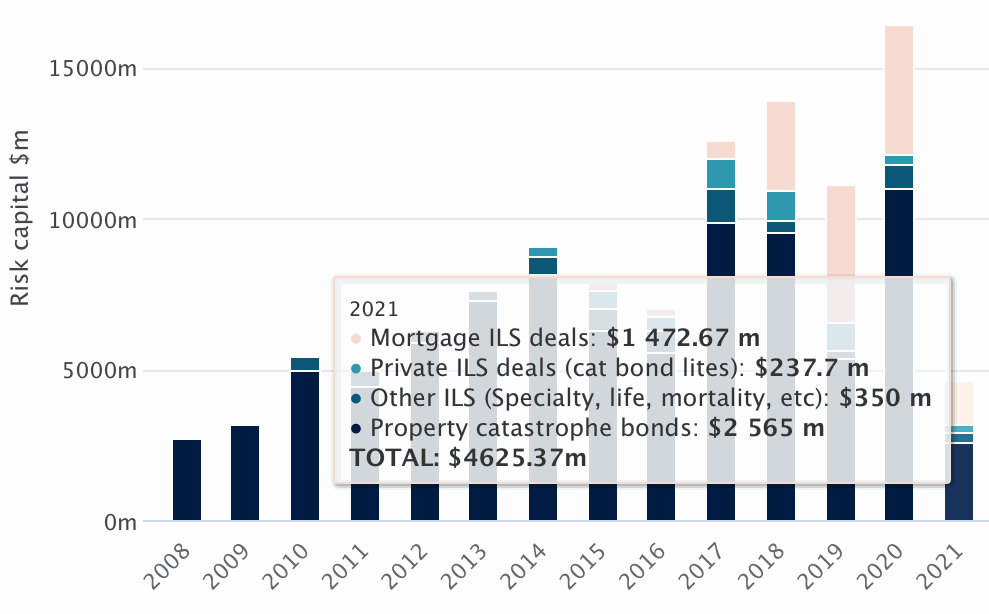

That first-quarter issuance can be broken down as: roughly $2.6 billion of 144A property catastrophe bonds; $350 million of other line of business cat bonds (in this case health and financial guarantee risks); $238 million of private property cat bonds; and $1.47 billion of mortgage insurance-linked securities (ILS).

Analyse the break-down of catastrophe bond and related ILS issuance by type using our chart below (click on the image or here to access a dynamic chart):

The outstanding market size, for catastrophe bonds and related insurance-linked securities (ILS), has continued to grow, as ceding companies increasingly view securitized access to the capital markets for reinsurance as an attractive and efficient option for transferring peak risks, diversifying their risk capital sources and locking in multi-year capacity from investors.

Taking just 144A publicly traded catastrophe bonds covering property, specialty, life and other risks, as well as private cat bonds, the outstanding market stood at $34.34 billion at the end of March 2021.

That’s slight growth since the end of 2020, when the figure stood at $34.1 billion, reflecting the fact new issuances in Q1 2021 just managed to outpace the level of maturing cat bonds seen.

Over the last year though, since the end of Q1 2020, the outstanding market, based on 144A property and other lines of business catastrophe bonds as well as private cat bonds, has grown by roughly 3%, from $33.32 billion to now stand at the new all-time-high of $34.34 billion.

Stay tuned to Artemis as we move through the second-quarter of 2021, which is forecast to be a busy period for new catastrophe bond issuance and we’ll detail every transaction in our Deal Directory.

We’ll keep you updated on all catastrophe bond and related ILS transaction issuance, as well as evolving trends in the cat bond and insurance-linked securities (ILS) market.

For full details of first-quarter 2021 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

For full details of first-quarter 2021 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

Download your free copy of Artemis’ Q1 2021 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.