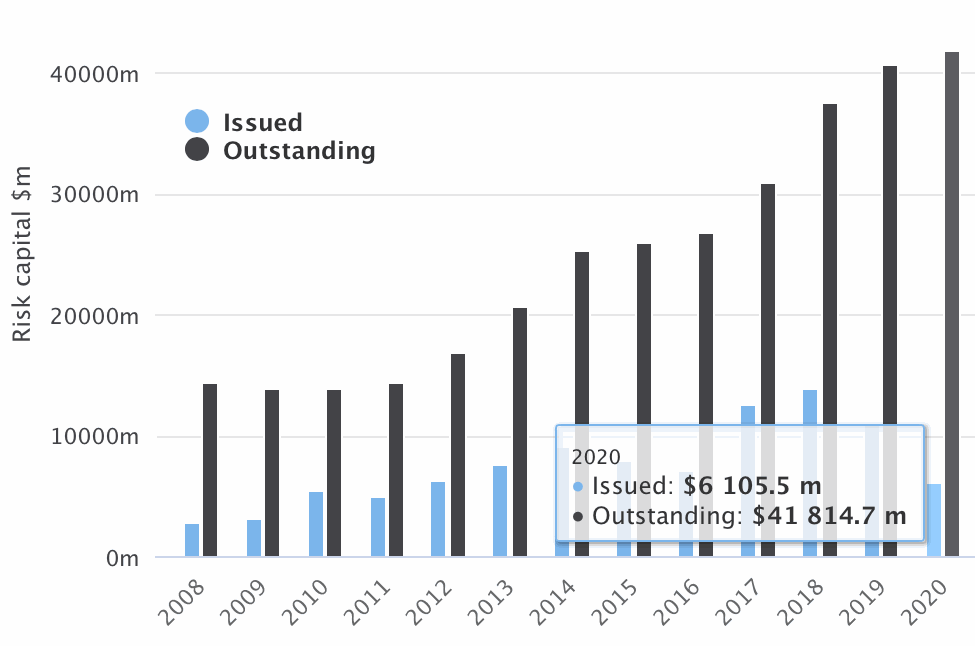

Catastrophe bond and related insurance-linked securities (ILS) market activity remains buoyant despite the impacts seen from the Covid-19 pandemic, with primary issuance already reaching $6.1 billion in 2020, according to Artemis’ Deal Directory data.

Primary market issuance of catastrophe bonds and related insurance-linked securities (ILS) grew by $375 million just this week, thanks to the successful completion of the latest cat bonds from Swiss Re, Lousiana Citizens Property Insurance Corporation and the New York MTA, which took the total over $6.1 billion as of yesterday.

The year started with a record first-quarter of 2020, when Artemis recorded just over $5 billion of risk capital issued across 27 transactions, some $3.9 billion of which was focused on transferring pure catastrophe insurance and reinsurance risks to the capital markets.

The second-quarter was then impacted by the Covid-19 pandemic, that sent financial markets into a decline and impacted investor confidence, which ultimately caused some new catastrophe bond issues to be delayed and a couple to be pulled completely from the market as sponsors opted for traditional reinsurance..

Despite the slowdown and hit to investor confidence, which affected all asset classes globally and not just reinsurance and ILS, we’ve already seen just under $1.06 billion of new cat bond and related ILS issuance completed in the second-quarter of 2020.

Which has taken the total issuance for the year to just above $6.1 billion and catastrophe bond and related ILS risk capital outstanding to over $41.8 billion, according to Artemis Deal Directory data.

Of the over $1 billion of cat bonds and related ILS already issued in the second-quarter of 2020, $461.22 million of risk capital was from the Operational Re III Ltd. transaction that provides operational risk reinsurance to Credit Suisse, $20 million from a private Eclipse Re Ltd. (Series 2020-02A) cat bond, $200 million from French reinsurance company SCOR’s Atlas Capital Reinsurance 2020 DAC (Series 2020-1) cat bond, $215 million from reinsurance firm Swiss Re’s latest Matterhorn Re Ltd. (Series 2020-3) issuance, $60 million from the Catahoula Re Pte. Ltd. (Series 2020-1) cat bond from Louisiana Citizens and $100 million from the MetroCat Re Ltd. (Series 2020-1) parametric cat bond sponsored by the New York MTA.

Almost $4.5 billion of the cat bond risk capital issued so far in 2020 features property catastrophe risks, while $461 million covers operational risks, $984 million covers mortgage reinsurance risks and $200 million health insurance or medical benefit related risks.

There was an additional $80 million element of extreme mortality retrocesisonal reinsurance coverage issued within Swiss Re’s Matterhorn Re Ltd. (Series 2020-2) back in February, but the tranche in question also covers named storms so is dual-purpose.

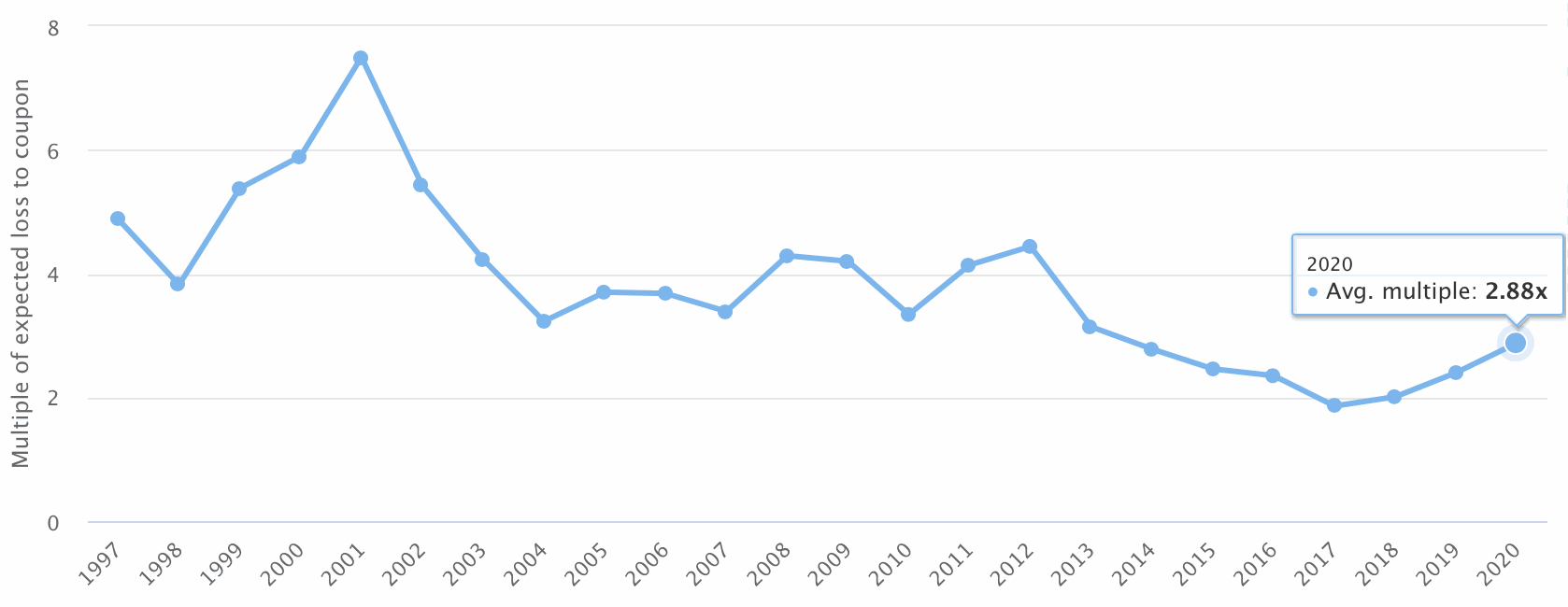

It’s worth noting the uptick in catastrophe bond returns seen in 2020 so far, something that is set to increase over the coming months and as more of the pipeline transactions we currently see get completed.

The chart above displays the average multiple at issuance of catastrophe bonds for which we have the necessary data within our Deal Directory.

The average multiple of the catastrophe bond market stands at 2.88 times the expected loss so far for 2020 issuance that has completed and could rise further in the coming weeks.

That’s up from 2.4 times EL in 2019, 2.01 times EL in 2018 and a low of 1.86 times EL back in 2017, reflecting the rising returns of catastrophe bonds over recent years that was kicked off by catastrophe losses in 2017.

There are still a significant amount of cat bond maturities to come in the rest of the second-quarter of 2020, so issuance will have a job to beat them and continue the rise in cat bond risk capital outstanding.

But with another $1.25 billion at least already listed in our Deal Directory and still to complete this quarter, plus more new cat bonds to come, while we could see a dip in risk capital outstanding at some stage this year, catastrophe bond issuance levels look set to be strong and by the end of the year further outright growth of the cat bond market should be seen.

Analyse every catastrophe bond using the Artemis Deal Directory, Artemis Dashboard and our statistics and charts.

For full details of first-quarter 2020 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year.

For full details of first-quarter 2020 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year.

Download your free copy of Artemis’ Q1 2020 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.