Having forecast that the catastrophe bond market could turn neutral towards the end of 2021 earlier this year, the latest data from Lane Financial shows that rate trajectory did pull-back in the final quarter of the year, with the year ending in relatively muted fashion.

What was a hard market in catastrophe bonds and insurance-linked securities (ILS) through 2020, was seen to weaken through the first and second-quarter of 2021, leading consultancy Lane Financial LLC to warn that pricing could return to neutral through to the end of the year.

As we’ve reported on catastrophe bond issues through the last year, details of which you can see in our Deal Directory and also read about in our latest cat bond market report, some softening of pricing was evident right the way through 2021.

Helping to soften catastrophe bond rates-on-line through 2021 was ample interest from the insurance-linked securities (ILS) investor community.

In particular, the UCITS catastrophe bond fund segment grew significantly through 2021, with our data on that part of the cat bond fund market showing that the assets under management (AuM) of the main UCITS cat bond fund strategies increased by 28% to a new high at just over US $8.64 billion.

This has helped to keep capital abundant to satisfy the issuance needs of catastrophe bond sponsors and in many cases driven upsizing of issues, as well as some deals to price down.

However, the actual pricing trajectory has been more muted, with a mix of pricing up and down as new cat bonds have been marketed, of late, with investors clearly establishing a floor on price and demanding returns they feel are commensurate with the risks they are investing in, despite the strong inflows of new capital.

That’s a healthy dynamic for the catastrophe bond market as it enters 2022, with rates and pricing still attractive, comparable to traditional reinsurance and retrocession, but not sliding too significantly across the whole year 2021.

Lane Financial had called for the the hard market in catastrophe bonds and insurance-linked securities (ILS) to come to an end and it seemed to do that or be approaching that point, for the cat bond segment at least, through 2021.

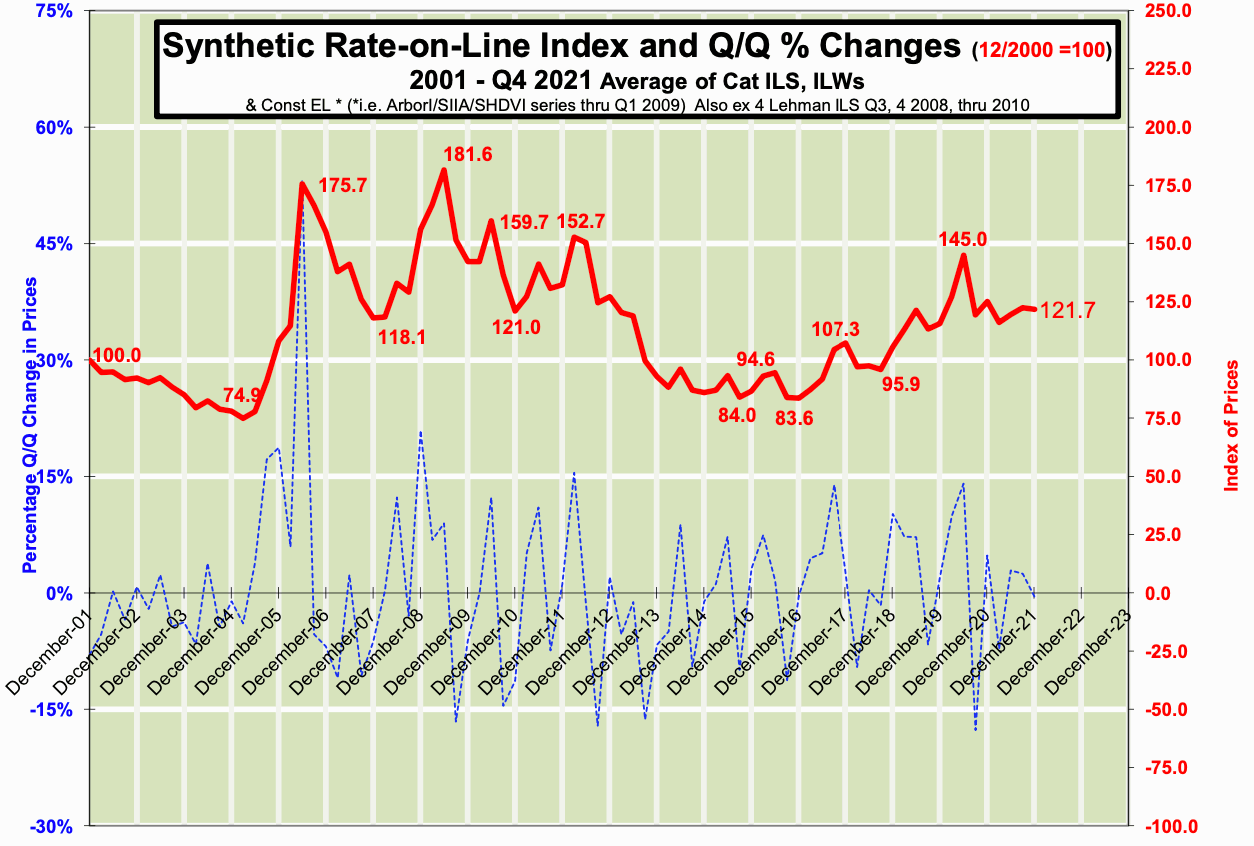

Lane Financial’s synthetic rate-on-line Index fell slightly at the end of 2021, down from 122.4 index points at the end of Q3, dropping 0.6% to 121.7

Lane Financial’s index data shows a very slight decline in pricing for the final quarter of 2021, but this was really very minimal and it’s hard to read into this what trajectory the Index will take through 2022.

Which makes the catastrophe bond market look very neutral at this stage, as Lane Financial had forecast.

A neutral marketplace is no bad thing, as it means value can be secured in cat bonds by their sponsors, with risk capital reasonably attractively priced still.

While at the same time it means cat bond returns are not getting compressed particularly for fund managers and investors in the catastrophe bond asset class.

Lane Financial’s synthetic rate-on-line Index makes use of data from catastrophe bond, insurance-linked security (ILS) and industry-loss warranty (ILW) markets, offering an approximation of premiums being paid (or rate-on-line) for ILS and cat bond backed reinsurance or retrocession. It is considered one of the ILS sector bellwether benchmarks.

Looking at the latest data, it seems we’re still a way off from a soft market being called for the catastrophe bond sector, but should pricing continue to decline that may not be a long way off.

As a result, it will be the discipline of fund managers and investors that define whether we maintain a neutral pricing state, overall in catastrophe bonds, or whether softening does return in 2022.

You can download all of Artemis’ quarterly catastrophe bond market reports here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.