The hard market in catastrophe bonds and insurance-linked securities (ILS) continued to weaken through the second-quarter of 2021, leading consultancy Lane Financial LLC to warn that pricing may return to neutral through to the end of the year.

Lane Financial’s analysis of catastrophe bond and insurance-linked security (ILS) pricing data shows that there is a continued weakening of the once hard market.

The company warned a quarter ago that softening had begun and the hard market could be coming to an end.

We’ve also reported this in our last two quarters of catastrophe bond market reports, as spreads have narrowed and multiples declined for new catastrophe bond issuance.

The falling prices of new issuance, as almost every cat bond in recent months has priced down, some far below guidance, has provided a clear signal of strong demand from investors and as a result a softening rate environment.

The appetite from investors for more predictable, named peril focused, higher-layer access to reinsurance market returns has helped to drive a surge in cat bond issuance and interest, resulting in significant growth for some cat bond funds as well.

Lane Financial’s data demonstrates the effects of this high investor demand, showing that hardening slowed significantly in the catastrophe bond and ILS market for another quarter in succession.

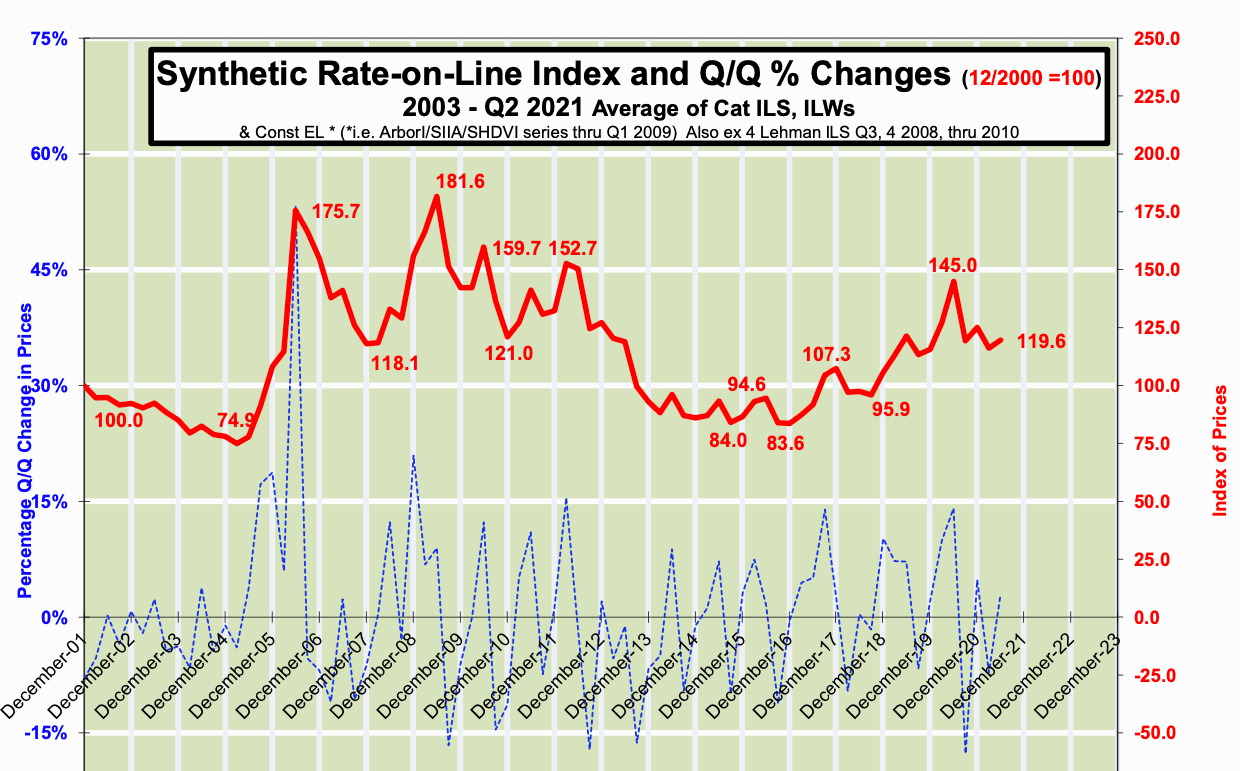

Catastrophe bond and ILS rates-on-line, as measured by Lane Financial’s synthetic rate-on-line Index, did increase slightly in the quarter, by roughly 3%.

But this is much slower than was previously seen last year.

Lane Financial’s synthetic rate-on-line Index makes use of data from catastrophe bond, insurance-linked security (ILS) and industry-loss warranty (ILW) markets, offering an approximation of premiums being paid (or rate-on-line) for ILS and cat bond backed reinsurance or retrocession. It is considered one of the ILS sector bellwether benchmarks.

Lane Financial is anticipating that if the market remains free of large catastrophe losses, its ILS rate-on-line index may tick along relatively flat through the rest of this year.

Explaining, “There is continued weakening of the hard market. If the summer remains event free, we expect pricing will be neutral by year-end.”

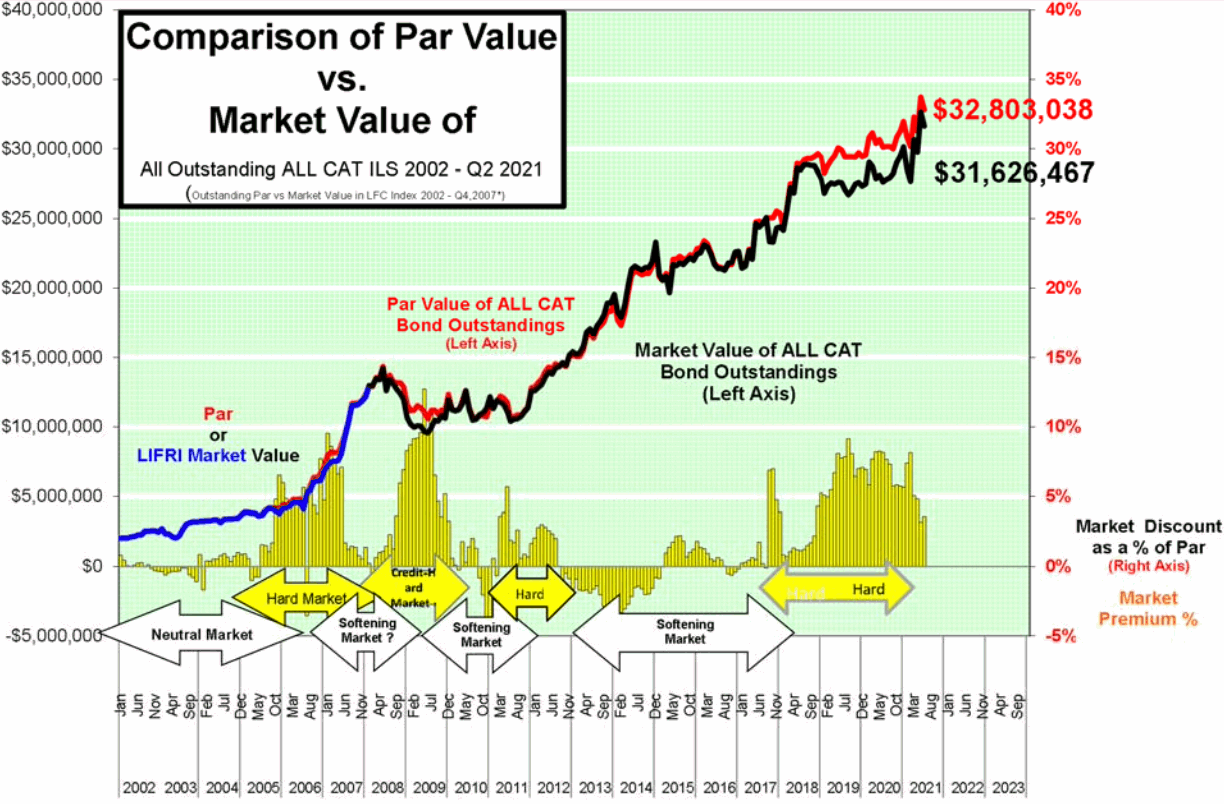

During the last quarter, the gap between cat bond and ILS par-outstanding and the marked-to-market value of those ILS has also narrowed further, which Lane Financial has said is also a sign of a market returning to a flat to softening state.

You can see in the chart above how the gap between par and market valuations of outstanding catastrophe bonds and ILS had widened during the hard market period, shaded below.

Whether we return to a true softening, or just a relatively flat market with pricing not rising or declining across catastrophe bonds and ILS remains to be seen.

Appetite of investors has risen significantly and there will be a temptation to raise new capital among managers, which could pressure rates.

The other side of the equation is traditional and collateralised reinsurance, whether that softens at all, as this would also add pressure to the cat bond market’s pricing.

As we’ve said before, there is a need to keep catastrophe bond rates competitive and for the market to demonstrate the efficiency of direct access to risk bearing institutional capital.

But that shouldn’t be at the expense of returns above expected loss, as the market still needs to generate a margin of return and be compensated for the risk it takes.

You can download all of Artemis’ quarterly catastrophe bond market reports here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.