The catastrophe bond market “finds itself at a record-breaking pace” according to Aon Securities and this is expected to continue through the rest of 2021 and into next year, while keen pricing is also likely to remain a feature of new issuance.

Aon Securities, the capital markets and ILS focused unit of the insurance and reinsurance broker, believes that investors are set to continue to focus on alternative assets which show a relative lack of correlation and have other attractive features like secondary liquidity.

This has driven new capital into the sector, as insurance-linked securities (ILS) fund managers have been able to build on their catastrophe bond funds and portfolios with the help of fresh inflows from investors.

This freshly raised capital has supported market issuance, Aon Securities noted in its latest report, leading to a second-quarter of 2021 that was “record-setting for the ILS market on multiple fronts.”

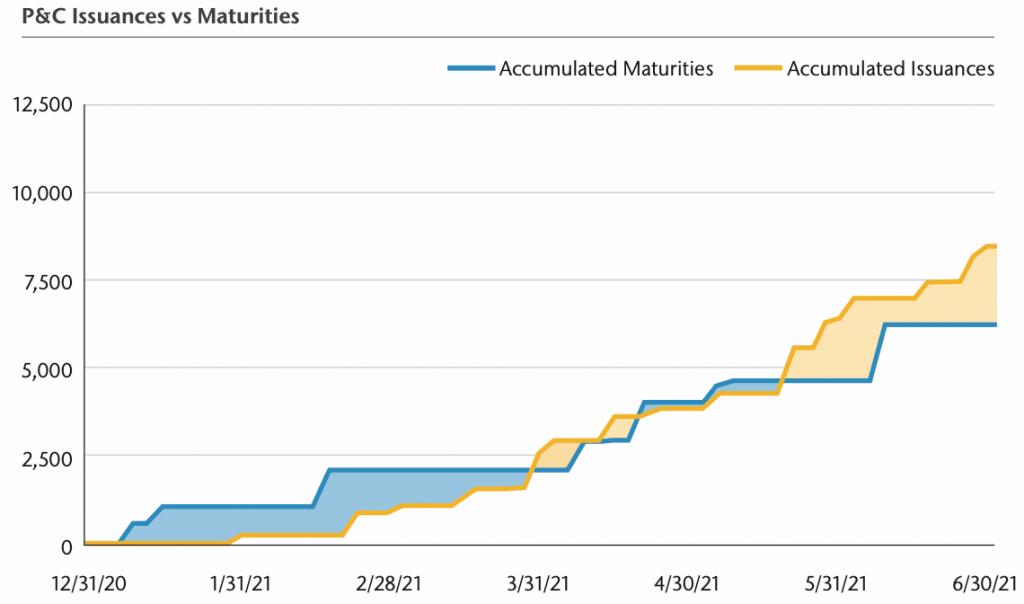

It was always expected to be a busy quarter with a significant $4.5 billion of maturing cat bonds and funds to be redeployed as a result.

But Aon Securities said that, “The momentum extended well beyond the capital redeployment and was robust for both investors and sponsors.”

With first time sponsors achieving attractive terms on their catastrophe bonds in the first-half of 2021, so gaining reinsurance coverage from the capital markets at keen pricing, Aon Securities believes this will help to drive more new sponsors to the market.

“The level of achievement from first time issuers in the second quarter was highly encouraging and we believe it has ushered in substantial avenues of opportunity for new sponsors to access the ILS market for their risk transfer needs,” the company said.

Adding, “It was a great time for issuers to complement their risk transfer programs by accessing the capital markets as spreads competed with traditional reinsurance levels, tightening approximately 15 to 20% year-over- year.”

Now, the record pace and attractive pricing is set to continue, Aon Securities believes, with all factors pointing to a busy end of the year ahead and likely a robust start to 2022 as well for the catastrophe bond market.

“With approximately $3.7 billion of cat bonds set to mature, investors unencumbered cash positions and the positive outlook on their capital raising efforts, we expect this market’s momentum to power through the second half of 2021 and pricing levels to persist,” Aon Securities explained.

It’s a very positive outlook, as many of the factors needed to foster strong ILS market growth are coming together in 2021.

Catastrophe bond pricing is extremely competitive with traditional reinsurance and retrocession, while investor appetite for ILS in cat bond form is also high and rising.

While at the same time, sponsors are looking to alternatives, to diversify their reinsurance towers and bring new capital into the mix.

All of which suggests the record pace of catastrophe bond issuance seen so far in 2021 is likely to continue.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.