After a particularly busy first-half of 2021 for catastrophe bond issuance, global reinsurance firm Swiss Re’s Capital Markets unit believes that a $50 billion market is possible by 2025 and that two drivers of further insurance-linked securities (ILS) market growth could be pandemic risk and ESG.

In its latest Insurance-Linked Securities Market Insights report, Swiss Re Capital Markets highlights the robust issuance seen in H1 2021.

In its latest Insurance-Linked Securities Market Insights report, Swiss Re Capital Markets highlights the robust issuance seen in H1 2021.

“With new capital raised, many primary new issues were heavily oversubscribed and upsized, while also testing lower spread levels than originally announced,” the company explained on the prior year.

Adding that, “This trend continued through the first half of 2021, and when all was said and done the market saw USD 8.5bn in new issuance, a record for a half-year period.”

This record first-half of issuance for the catastrophe bond market in H1 2021, which we detailed in our latest quarterly market report here, was driven both by investor interest in the asset class and sponsor interest in the capital markets as a source of reinsurance capacity.

The level of issuance seen was sufficient to propel the overall outstanding cat bond market to another period of expansion.

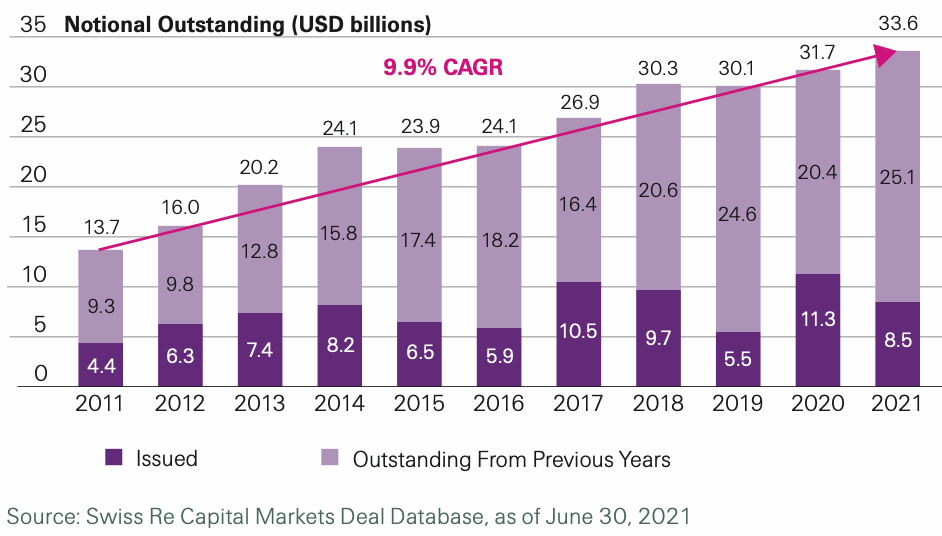

Swiss Re Capital Markets said that, “With strong issuance recorded, it’s no surprise that the overall catastrophe bond market (measured by bonds outstanding) has also grown significantly over the period, by USD 2bn according to our calculations.

“This keeps the market on trend for nearly 10% growth per annum since 2011.”

But this growth may be set to continue on-trend as well and Swiss Re Capital Markets highlighted two key areas of opportunity for ongoing ILS market growth.

“Looking forward we see encouraging opportunities for further growth across the market,” the company stated.

The first of these is pandemic risk, an area where capacity has been lacking in the traditional insurance and reinsurance market after the outbreak of COVID-19.

But the need for pandemic reinsurance and retrocession remains apparent and Swiss Re itself recently sponsored a cat bond that provides pandemic risk protection successfully.

“Pandemic exposed bonds have been a feature of the market almost since its inception, but that market has never grown like the natural catastrophe bond segment,” Swiss Re Capital Markets (SRCM) explained.

Going on to highlight that, “Swiss Re recently returned with a new Vita issuance and we’re optimistic that offering pandemic risks will be an area of growth for the ILS market in the next few years.”

The second driver of future market growth is unsurprisingly highlighted as ESG, or environmental, social, governance related trends.

“A prominent trend in recent years has been towards ESG and sustainable investments. Given the social benefits and resilience that insurance provides, we foresee a strong rationale for inclusion of ILS strategies in sustainability focused investment mandates,” SRCM said.

However, SRCM cautioned that, “To realize the full benefits of that trend we envision a need for more disclosure within ILS transactions, in particular on the underlying portfolios of risk being transferred.”

Looking ahead, SRCM believes that catastrophe bonds are likely to near or beat their annual issuance record in 2021 and that as a result, “the market is on track for its third consecutive year of growth.”

If the current growth rate continues and opportunities such as the aforementioned pandemic risk and ESG are realised, SRCM said that “a USD 50bn market is possible by the end of 2025.”

By Swiss Re’s measure the outstanding 144A catastrophe bond market was $33.6 billion in size at the end of the first-half, so to reach $50 billion for the same covered perils and types of transactions by 2025 would represent significant growth in terms of the overall cat bond investment opportunity.

That would be extremely positive for existing managers and investors, as well as for other investors who find reinsurance and catastrophe risk related assets an attractive diversifier.

However, it’s easy to envisage that if the ESG interest in ILS proves a significant catalyst for growth, it could serve to keep pricing attractive for sponsors, which in turn could drive further transaction flow for the cat bond market, making $50 billion a figure that could even be surpassed.

But Swiss Re Capital Markets is right to point out that realising the full benefits of the ESG wave of interest requires a robust response and far greater transparency, from across insurance, reinsurance and also the ILS market.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.