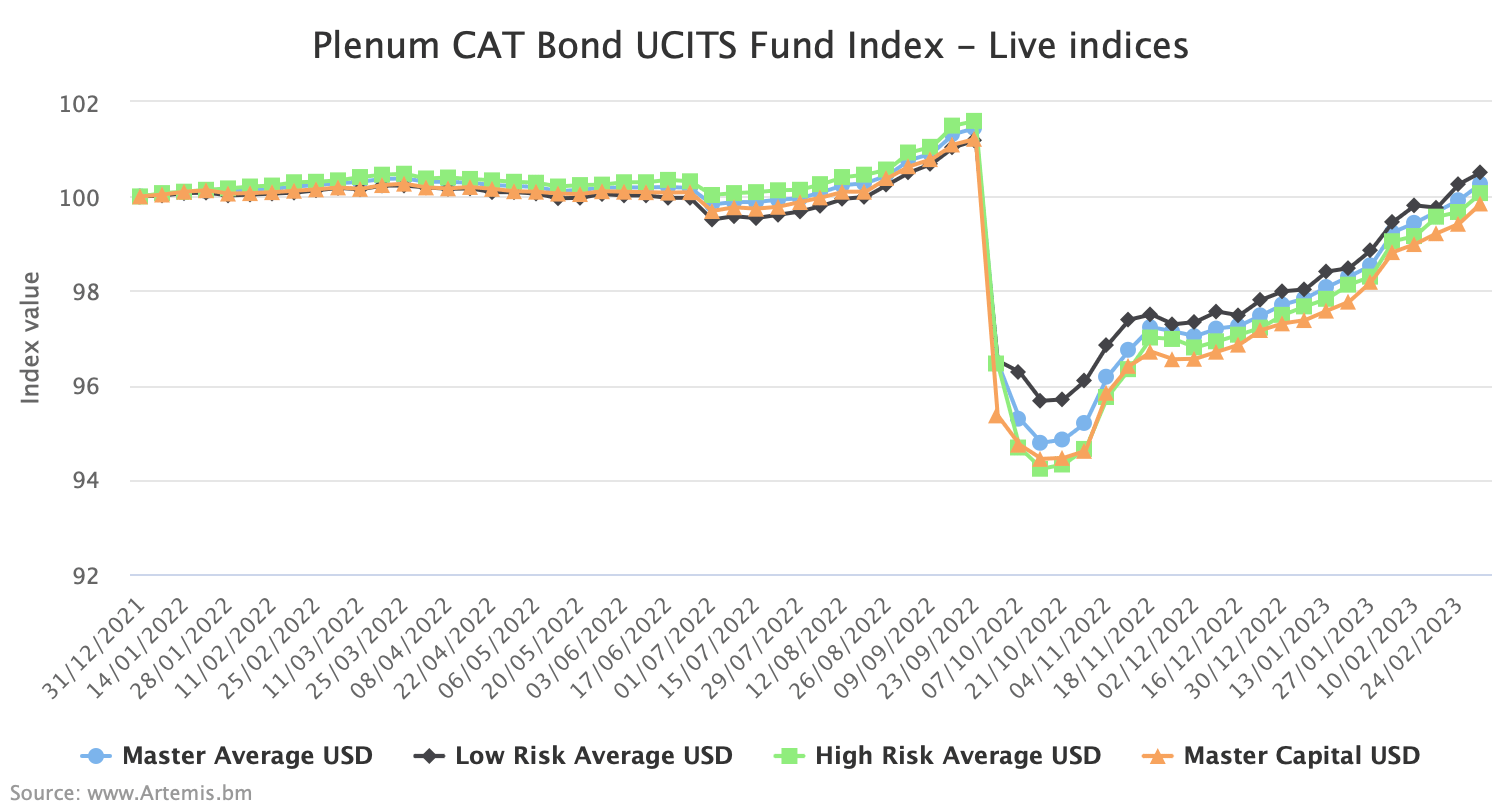

Catastrophe bond funds in the UCITS format have reported very strong returns year-to-date, with the average return across the main UCITS cat bond strategies now reaching 2.62% as of March 3rd.

As we explained before, catastrophe bond investment funds structured in the UCITS format had reported a record start to 2023.

The average return across the leading UCITS cat bond funds had already reached 1.77% as of Friday February 10th.

The strong cat bond fund performance has continued through the rest of February and as of marks set on Friday March 3rd 2023, the average return across the UCITS cat bond funds was a very impressive 2.62% for the year so far, continuing the record-setting pace of performance this year.

The Plenum CAT Bond UCITS Fund Indices have now gained between 4.13% since hurricane Ian, as the recovery in value continues.

Click on the chart below to access an interactive version.

Even more impressive is the annualised performance, as for the lower-risk cohort of UCITS cat bond funds, returns are now positive over the last 12 months.

In fact, the low-risk UCITS cat bond fund average 12 months performance to March 3rd 2023 now stands at 0.33%.

Higher-risk cat bond funds are still down, but only slightly at -0.27%, while the master average across the cat bond funds tracked by this index is now -0.01% for the last 12 months.

With the strong forward-looking return potential of catastrophe bonds, driven by recovery in value after Ian and reversal of spread widening, plus higher risk-free rates, and much higher pricing of new cat bonds invested in, these cat bond fund indices should all turn positive for the 12 months very soon, while recovering back to pre-hurricane Ian levels should also be possible in the coming months.

As we reported last week, some cat bond and ILS funds are set to recover to their pre-Ian levels by the end of March, but across the market, such as with the view an index provides, it could take a little longer given the range of strategies available in the cat bond and ILS fund world.

These catastrophe bond fund indices, calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a useful source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.

The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

Analyse interactive charts for this UCITS catastrophe bond fund index.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.