The economic costs of the devastating wildfires that have hit California in recent weeks has continued to rise, with the latest estimate from the local government suggesting that around 8,400 structures, largely homes, have now been completely destroyed by the blazes.

At least 10 wildfires continue to burn int he state of California, although the situation has improved somewhat in recent days in the north where the most damaging wildfires had occurred.

At least 10 wildfires continue to burn int he state of California, although the situation has improved somewhat in recent days in the north where the most damaging wildfires had occurred.

But in the south, in San Diego County, strong winds have helped to rapidly spread a new wildfire, raising the prospects of an increasing damage bill.

Insurance and reinsurance markets are anticipating one of the largest wildfire losses in history now, with the recent events perhaps the largest insurance industry loss from wildfires ever.

Estimates suggest that the final toll will be in the billions, with Moody’s suggesting insurance and reinsurance markets could face a $4.6 billion bill for the damage and the Insurance Commission of California saying that preliminary insured loss data counts $1.045 billion of claims already.

Two fires in Sonoma and Napa Counties have contributed the majority of the structural damage and destruction.

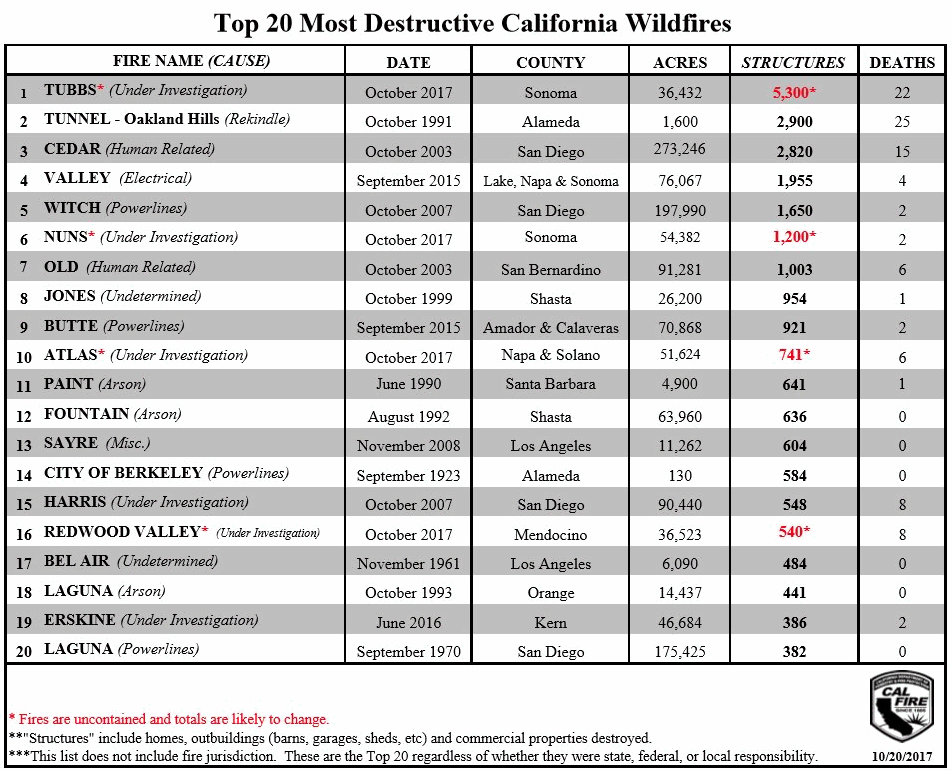

The Tubbs Fire, which has impacted the city of Santa Rosa so severely, is now estimated to have caused the destruction of 5,300 structures, while the Nuns Fire is estimated to have destroyed another 1,200 and also affected the east of Santa Rosa.

In total over 245,000 acres of California have burned due to the recent wildfires and 11,000 firefighters fought the blazes. 42 lives were lost from this recent wildfire outbreak.

The Tubbs Fire with its 5,300 structures destroyed is now put as the most destructive California wildfire on record.

Add in the number of structures damaged, but not destroyed, and California state sources suggest the property impacts are now approaching 10,000 structures in total.

The California wildfires continue to burn and the fire weather forecast suggests that the first half of this week could see more of the Santa Ana winds which can fan the flames and spread wildfires very quickly.

The U.S. National Weather Service explained; “The duration, strength, and widespread nature of this Santa Ana wind event combined with extreme heat will bring dangerous fire weather conditions to Southwest California through Tuesday.”

With high temperatures expected into the 90’s or more there is the potential for new fire outbreaks and existing ones to spread rapidly, which continue to raise the cost of wildfire losses for insurance and reinsurance interests. NOAA says the fire weather situation in southern California will be critical through Monday and Tuesday at least.

The most extreme fire weather is expected in southern California, but forecasters also expect the northern area of the state will experience more weather that could exacerbate the wildfire situation in these areas as well.

Farmers Insurance, State Farm, Liberty, Allstate, Travelers, Nationwide Mutual, Chubb, AIG, Tokio Marine, National General, Allianz and QBE, are among the top property insurers in the state of California, so will take a significant share of these losses.

Reinsurance firms and some ILS funds or collateralized reinsurance vehicles could face a share as well, with some multi-peril and aggregate structures potentially more at risk due to these fires following the heavy toll of the hurricane season.

You can see the location of the California wildfires as well as their extent on the map below. The map is zoomed on the worst areas, but if you zoom out you will see that California is facing a number of wildfire outbreaks across the state currently.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.