Reinsurance brokerage Aon Benfield underlined the continued, and impressive growth of multiple features of the insurance-linked securities (ILS) market during 2015, including ILWs, cat bonds, sidecars, and the rapidly expanding collateralized reinsurance space.

Artemis reported recently that broker Aon Benfield estimated that the wealth of alternative reinsurance capital in the global reinsurance market increased by 12% in 2015, totalling an impressive $72 billion.

In its April 2016 Reinsurance Market Outlook report Aon notes “continued increases in collateralized reinsurance placements helped push alternative capital to USD72 billion,” a sub-sector of the ILS space that has experienced significant growth in recent years.

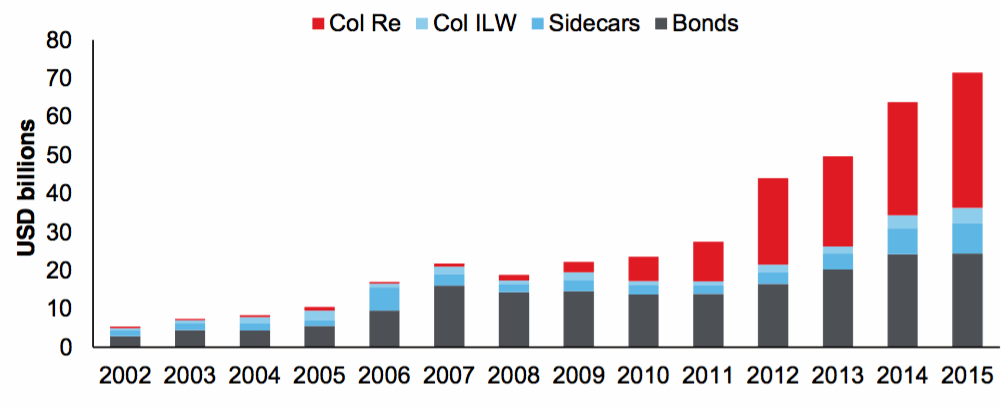

Development and growth of catastrophe bonds, collateralised reinsurance and ILS - Source: Aon Securities

As highlighted in the above chart provided by Aon, the ILS market as whole as been on an impressive growth path in recent years, with collateralized reinsurance placements now claiming the largest slice of the ILS pie, according to Aon.

However, evidence of the increased acceptance of ILS structures and features among both sponsors and capital markets investors can be seen, as collateralized ILWs and sidecars were also utilised more in 2015 than previous years.

“Sidecar and collateralized ILW capital also increased to nearly USD8 billion and USD4 billion respectively. While the actual total capital attributed to both of these segments remains well below collateralized reinsurance, the percentage increase in both was well into double digits for 2015,” said Aon.

Combine this with the catastrophe bond market ending 2015 with total outstanding capacity of almost $26 billion, the highest volume ever recorded by the Artemis Deal Directory at the end of any year, and it’s not surprising that many in the insurance, reinsurance and ILS space expect alternative capital structures to continue to gain momentum.

Growth across a range of ILS structures during 2015 at a time of continued softening in the global reinsurance landscape supports the increased sophistication of investors and sponsors, which continue to show a willingness to expand the reach of ILS, ultimately taking a larger and larger share of the overall reinsurance market pie.

The wealth of third-party investor-backed capacity that is available to primary insurers and global reinsurers can provide an efficient alternative to traditional reinsurance or retrocessional capacity, enabling cedents to reduce costs and diversify at times of market turmoil and limited profits.

It remains to be seen if the ILS market will continue its impressive expansion in the coming months, but a record-breaking volume of Q1 issuance in the catastrophe bond market is certainly a promising start for the sector.

Furthermore, as Aon and other insurance and reinsurance linked companies continue to underline the growing presence of the ILS market and its beneficial, efficient features, it will likely raise the profile and ultimately acceptance of the space as a viable, permanent asset class within the global risk transfer landscape.

The global reinsurance market remains overcapitalised owing to inflows of capacity from both traditional and alternative sources. With profits hard to come by and competition remaining stiff it’s likely more and more companies will look to the capital markets in order to diversify their risk profile, suggesting continued growth for the ILS sector.

Sidecar ventures, cat bonds, ILWs and collateralized reinsurance placements potentially offer clients a more efficient means of risk transfer than available in the traditional markets, and whether firms choose to bring ILS in-house or work with existing managers and/or funds, it’s likely that some form of ILS will supplement/benefit existing reinsurance programmes.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.