Given the way reinsurance rates moved at the recent January renewals, particularly in property catastrophe lines, the market should expect further “broad-based price increase” at the next sets of renewals in April and at the mid-year, Moody’s believes.

For the rating agency the most telling factor in predicting future reinsurance price increases is the fact that rates increased on many loss-free U.S. property catastrophe accounts in January.

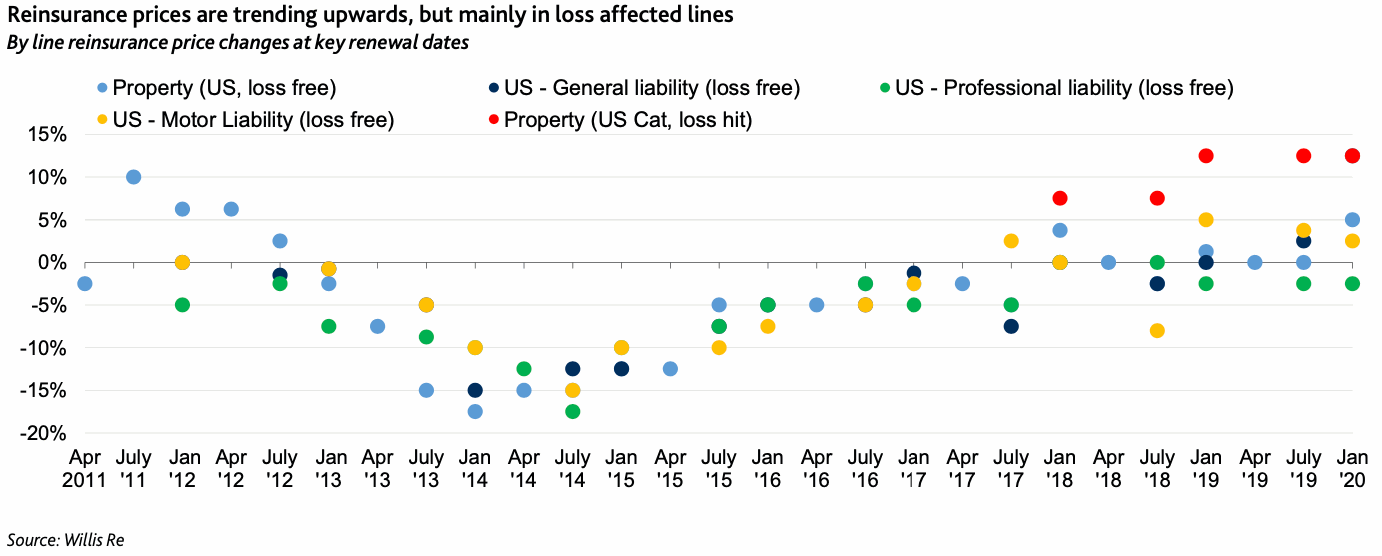

Moody’s Investors Service highlights data from reinsurance broker Willis Re, which shows that while loss-affected property catastrophe renewals saw prices rising up to 20% in January 2020, loss-free catastrophe pricing rose as much as 5% in the United States and Caribbean, while being generally flat on a global basis.

“The rise in US loss-free catastrophe prices suggests that further increases are likely when the bulk of US reinsurance contracts roll over in July,” the rating agency explained in a recent report.

The agency feels that January provided ample evidence for the future trajectory of reinsurance pricing through 2020, feeling in particular that catastrophe exposed accounts are likely to face further firming at the Japan and U.S. renewal seasons.

Moody’s summarised, “Overall, the January reinsurance renewals confirm our expectation that prices will firm in 2020, driven by an industry-wide reassessment of risk and return, rising claims and losses on certain casualty lines, as well as low interest rates and rising retrocession prices.”

It’s the kind of broad-based price increases that many in reinsurance have been hoping for, which suggests higher return potential for insurance-linked securities (ILS) players as well.

In fact, for some ILS funds, the availability of higher pricing in traditional reinsurance may also enable them to reduce the overall expected loss of some of their portfolios, without affecting return potential.

In recent years some ILS funds have been taking on a little more risk in order to meet returns, but the price firming seen and that is expected to continue may help to reverse that trend.

Moody’s notes that property catastrophe reinsurance pricing has exhibited a firming trend since January 2018 now, with consecutive renewals seeing some levels of price increases, especially for loss-affected accounts and regions of the world.

As reinsurance companies and ILS funds or capital market players reassess the need for rate, to sustainably underwrite in some peak catastrophe zones and also for so-called secondary perils, this is manifesting in the most sustained price rises for some years.

Profitability has a lot to do with this, as too do capital levels in the industry.

The dent to retrocessional reinsurance capital after the consecutive years of heavy losses, as well as to aggregate contracts, has stimulated a need for rate and the resulting capacity crunch has helped to drive greater urgency for higher pricing as well.

However, Moody’s notes that, “The increase has not been broad-based, with loss-affected lines benefiting significantly more than loss- free business. The January 2020 renewals were consistent with both of these trends.

“While rising prices are favourable for reinsurers, their concentration in loss-affected lines – to some extent counterbalancing earlier claims payouts – limits their positive impact on profitability. At the same time, prices across the broader portfolio are still lower than they were before they began to fall in 2012.”

Moody’s uses the exhibit below to display rate movements using data from reinsurance broker Willis Re’s renewal reports.

However, Moody’s expects the return of more broad-based price increases in April at the Japanese reinsurance renewals and at the mid-year when the U.S. accounts renew.

“We expect more broad-based price increases in April and July, the key renewal dates for Japanese and US reinsurance contracts respectively,” the rating agency said.

The rating agency also noted that the reason things were more muted at the January renewals is due to the European focus and the tendency of some major reinsurance firms to “forego price increases that are more urgently required elsewhere” as they can sustain a lower cost-of-capital for European business due to their global diversification versus the peak peril zones.

The decline in retrocession capacity and the fact ILS fund growth stalled to a degree around the January reinsurance renewals are seen as the key drivers of price increases experienced.

But still Moody’s hopes for more at the upcoming renewals, but again we have to point out that capacity levels may be a key determinant in how successful the industry is at achieving more broad-based rate firming in April, June and July.

If ILS capacity returns to outright growth, as it’s beginning to seem it might (just look at the assets under management of the ILS fund sector) and major reinsurers continue to display a growing appetite to capitalise on higher rates (using third-party capital to assist in property catastrophe zones), then all bets may well be off when it comes to forecasting price trajectory.

Upwards price movement of some description seems assured at the next sets of reinsurance renewals, the loss activity alone suggests that will be the case.

But how much, or how “broad-based”, that will be remains to be seen.

Read all of our coverage of reinsurance renewal trends here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.