According to recent data from the Bermuda Monetary Authority (BMA), use of insurance-linked securities (ILS) such as catastrophe bonds shrank among Bermuda-based insurance and reinsurance firms between 2019 and 2020, but other often collateralized structures such as ILW’s and quota shares increased in prevalence.

The latest stress test results from the regulator show that Bermuda’s insurance and reinsurance market remains well-protected against major global systemic events, such as large catastrophes.

Reinsurance and risk capital plays a significant role, but as ever its use changes depending on market forces and also buyer appetites, as well as pricing.

Overall, the BMA’s data shows that the level of reliance on reinsurance capital among Bermuda’s re/insurers actually increased by 7.1% in 2020, compared to the prior year.

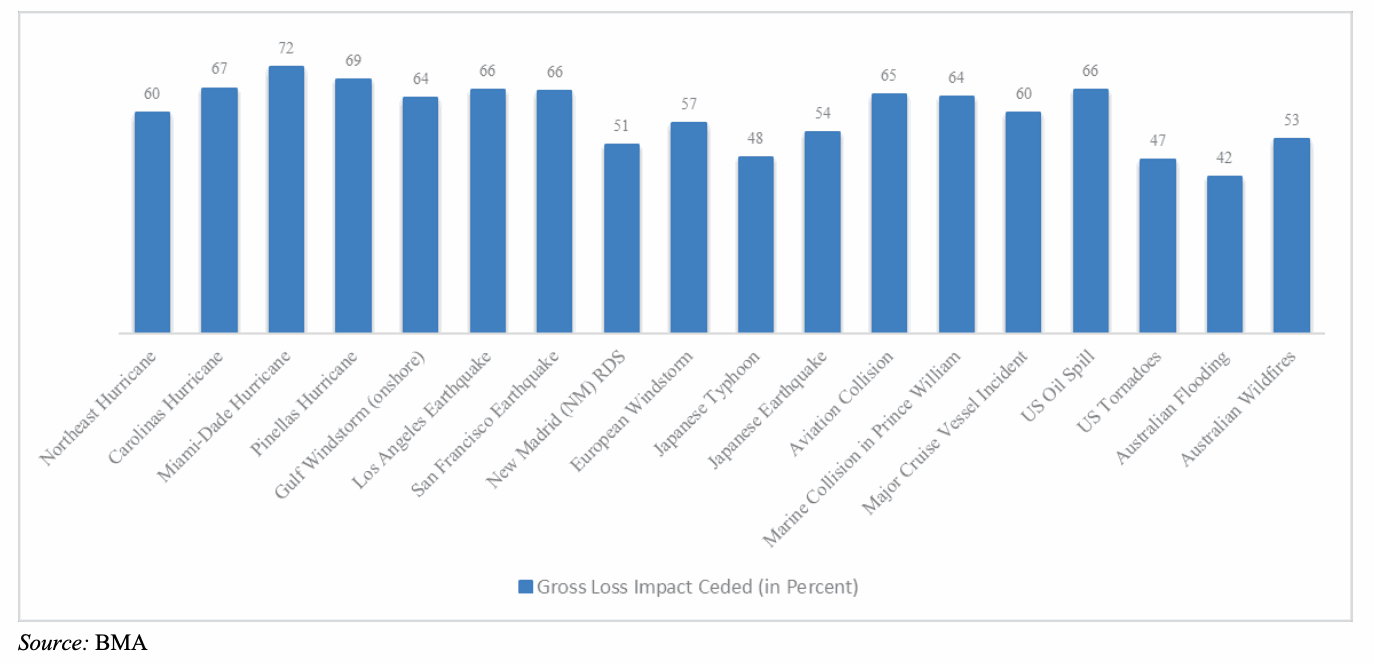

The chart below shows major loss scenarios and how much of the loss would be ceded to reinsurance capital, based on the 2020 figures.

It’s interesting to note that some of the so-called secondary perils, such as tornado, wildfire and flooding risks, have seen their gross loss percentage ceded increase, while some primary peak perils such as a Miami-Dade hurricane actually declined slightly.

In terms of what was actually ceded in 2020, versus 2019, the figures were very close, at 58.6% versus 59%.

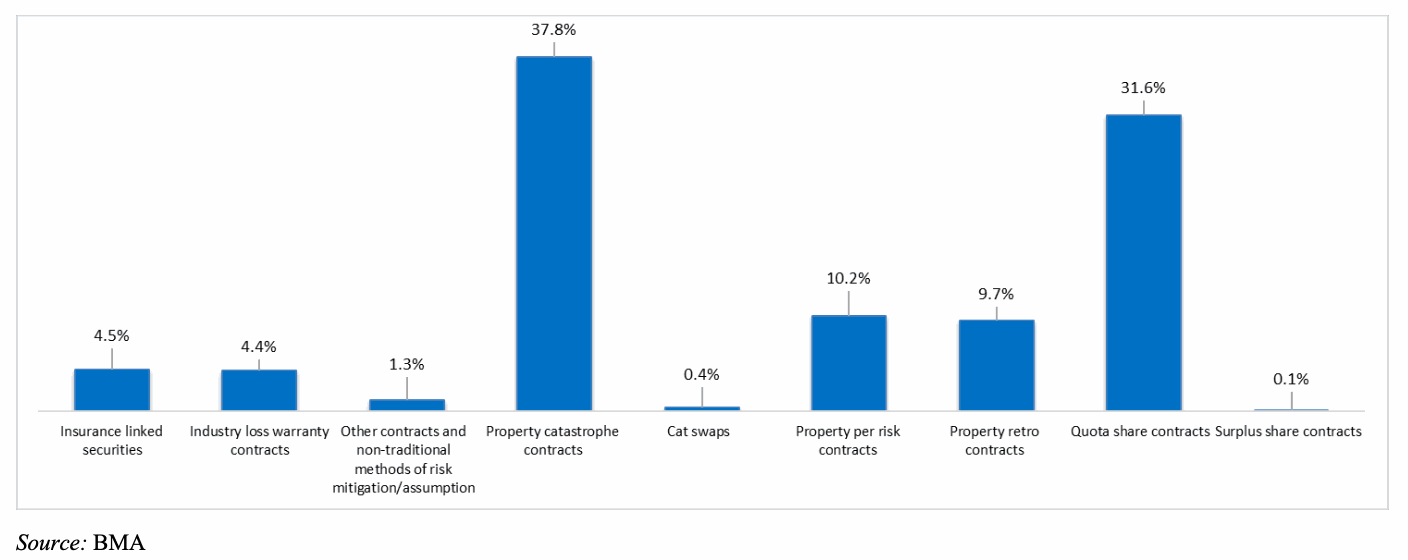

The BMA also looks at what reinsurance instruments were being used and here there is a telling shift in risk transfer product, which will have partly been down to the pricing environment in 2020.

Quota share reinsurance arrangements increased by 4.6% in 2020 over the prior year, which will include collateralized arrangements with certain insurance-linked securities (ILS) investors that are becoming staples within many Bermuda re/insurer reinsurance arrangements.

Conversely, insurance-linked securities (ILS) declined by 3.5% in 2020, as re/insurers looked to other sources.

Industry loss warranty (ILW) contracts were another area of growing influence, as their use increased by 2.4% in 2020, over 2019.

You can see the full mix of reinsurance products being used by Bermuda’s re/insurance sector in the chart below, from the BMA that shows aggregate occurrence limit in percent.

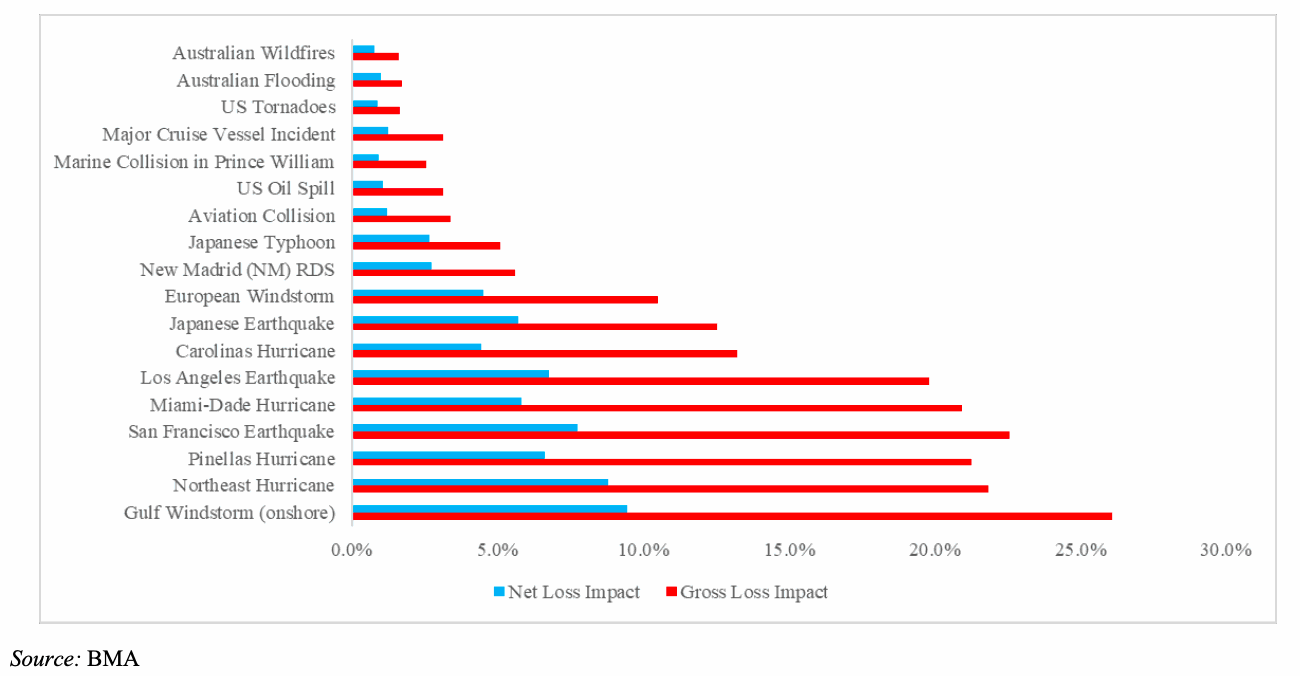

Also noteworthy, is the BMA’s analysis of Bermuda re/insurers catastrophe loss stress test results, that show a significant reliance of reinsurance to reduce gross loss impacts down to a manageable net level.

The chart below shows scenario cat losses as a percentage of total capital and surplus, highlighting the vital role of reinsurance capital in making the industry sustainable in the face of large catastrophe loss events.

The BMA points out that even though the year-on-year ceded loss exposure increased overall among the Bermuda re/insurer cohort, more exposure has been assumed which has driven an increase in the net loss exposure compared to 2019.

We’d expect that to have continued through 2021, as a function of the improved pricing environment making retaining a little more exposure attractive.

Finally, it’s also interesting to see that Bermuda’s insurance and reinsurance industry increased its importance through 2020, with the global share of gross estimated potential loss assumed by Bermuda players for major catastrophe perils (combined) increasing by 3%, to 24% (from $181.9 billion to $193.1 billion) year-on-year.

It reflects the important role Bermuda’s re/insurers play in provision of global catastrophe capacity, which of course in many cases has at least a portion of those risks underpinned by alternative sources of reinsurance capacity, including ILS funds and their investors.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.