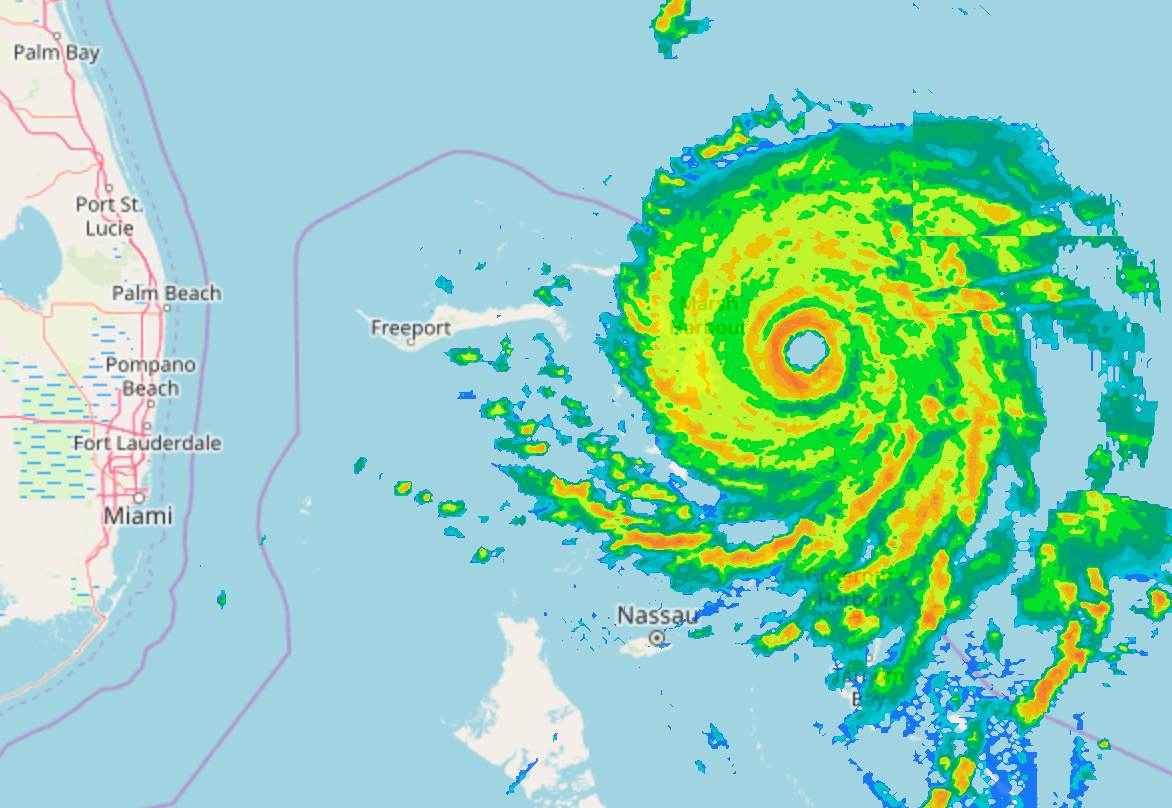

Loss expectations from hurricane Dorian are rising towards $2 billion for the primary insurance carriers located in the Bahamas, as the latest company updates emerge and the financial impacts of the devastating storm continue to rise for the local industry.

We reported last week that local insurers in the Bahamas were expecting to take as much as $1.5 billion of losses from the impacts of claims from hurricane Dorian earlier this year, the local insurance association had said.

We reported last week that local insurers in the Bahamas were expecting to take as much as $1.5 billion of losses from the impacts of claims from hurricane Dorian earlier this year, the local insurance association had said.

Estimates are now said to have risen again, with up to $2 billion of impact expected, the local Tribune newspaper has reported, as more of the property and casualty insurance industry on the island have reported their losses.

Ratings agency A.M. Best last week removed a number of Bahamas insurers from being under review and affirmed their ratings, explaining that having analysed their loss estimates and related reinsurance contracts they expect the losses to fall within the carriers current reinsurance coverage.

That’s a positive for the Bahamas insurance industry, reflecting the fact a significant amount of financial support will be provided by their reinsurance panel and perhaps also some ILS funds or collateralised reinsurers that participate there.

It’s a reflection of the vital role reinsurance plays for primary P&C insurance carriers located in regions of the world that are exposed to major catastrophe event risks.

Anton Saunders, managing director of primary insurer RoyalStar Assurance, told the Tribune that the local industry loss will end up between $1.5 billion and $2 billion, but added that claims are being paid quickly.

Reinsurance payouts made rapidly after the occurrence of hurricane Dorian will be providing significant support in paying these claims.

Of course, now these local Bahamas carriers need to renegotiate their reinsurance renewals and will be facing increases as a result.

But the well-capitalised reinsurance and ILS market should mean that rates, while higher, will not jump as much as has been seen historically after major loss events on the islands.

The economic impact of hurricane Dorian in the Bahamas has been estimated at as high as $7 billion, with as much as $3 billion potentially covered by local and international insurers and reinsurers.

It is the largest loss in dollar terms that the islands have ever suffered and clearly demonstrated the potential for significant damage to occur there, which should mean reinsurers re-rate their business on the islands and push hard for increases to reflect the threat of similar losses occurring in the future.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.