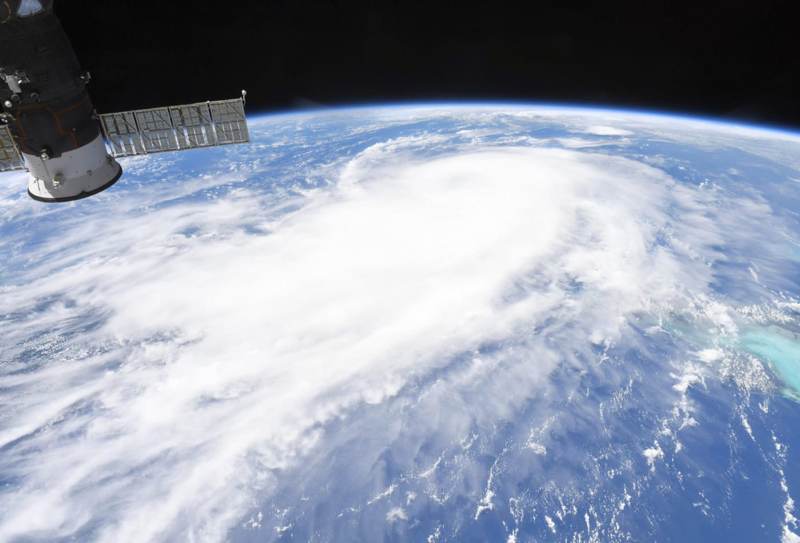

Insurance and reinsurance broker Aon has announced the launch of a new Florida hurricane catastrophe risk model developed by its specialist Impact Forecasting unit, as it seeks to provide an alternative view of the risk to market participants.

Aon said that the new Florida hurricane model brings together the latest research and technology to provide insurers with an additional view of risk when submitting Florida rate filings.

Aon said that the new Florida hurricane model brings together the latest research and technology to provide insurers with an additional view of risk when submitting Florida rate filings.

Of course, with Florida hurricane risk still the peak peril within the insurance-linked securities (ILS) and catastrophe bond market, a new catastrophe model focused on that peril will also be of interest to ILS market participants and investors.

Aon said that the new hurricane model includes a range of wind mitigation options and secondary building characteristics, to help insurers refine their views of risk.

In this way the model can reflect users portfolio-specific risk appetites and underwriting approaches, while the model results bring together regional variations in building code requirements and construction practice information that has been validated using claims data contributed by Aon’s clients.

The hurricane risk model also features an event set that calculates wind hazard across the entire lifecycle of any simulated hurricane, allowing for variations in hurricane intensity that are associated with varying ocean temperatures.

Aon also said that the new model can be used to develop a bespoke view of risk, which can help users shape their underwriting, portfolio management and reinsurance purchasing decisions.

Adam Podlaha, Head of Impact Forecasting at Aon, commented on the release, “The state of Florida is no stranger to tropical cyclone risk – from 2016 to 2020 alone, the state recorded eight named storm landfalls, including three striking at hurricane intensity. These landfalls, plus impacts from non-landfalling storms, have resulted in public and private insured losses in Florida of nearly $40 billion during this period.”

George deMenocal, CEO of U.S. Reinsurance Solutions, also said, “Aon actively engages with re/insurers that write Florida business to evaluate alternative views, identify and quantify uncertainty, and customize their view of risk. Our new Florida hurricane model will be instrumental in this process and demonstrates our continuing commitment to enhancing the understanding of this peril and helping clients navigate new forms of volatility.”

The model can also be used to calculate portfolio loss metrics, which could be valuable to ILS funds as they assess exposure held.

In addition, Aon noted that its collaboration with Columbia University is creating a climate change solution for its global tropical cyclone catastrophe model suite, using Coupled Model Intercomparison Projects CMIP 6 climate data.

With this, users can generate a probabilistic view of potential insured losses that could arise from hurricanes impacting Florida, as well as the variability in those losses due to future climate scenarios.

Aon also highlighted its Automated Event Response, which now includes 10 forecasting models in addition to the official National Hurricane Center (NHC) forecast and can provide an early view into loss projections for hurricanes in the water.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.