In line with the first-quarter of this year and the second-quarter of 2015, all Aon insurance-linked securities (ILS) Indices posted gains in Q2 2016. However, and again continuing the trend witnessed in Q1, relative to benchmarks the Aon ILS Indices performed with mixed results, according to Aon Securities.

Aon Securities, the capital markets arm of reinsurance broker Aon Benfield, has reported that gains posted by Aon ILS Indices (which are calculated by Bloomberg using month-end price data provided by Aon Securities) increased at a much larger rate than seen in Q2 2015, a quarter that also saw all Aon ILS Indices post gains.

The indices track the performance of catastrophe bonds in the secondary market, so are not indicative of the entire ILS sector as that is now more than half made up of collateralised reinsurance. However the indices are a good indicator of the performance of the more liquid side of ILS, the area often looked to by institutions and fixed income type investors.

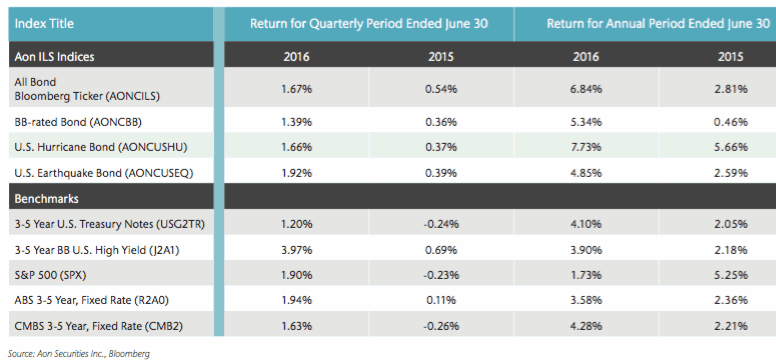

In its Q2 2016 ILS market update, Aon reveals that the greatest growth rate was seen with U.S. Earthquake Bond index, with returns of 1.92% in the quarter, compared with a 0.39% gain the previous year and 1.09% in Q1 2016.

As seen in the second-quarter of last year, the Aon BB-rated Bond index posted the smallest gain in the period at 1.39%, however, and underlining the larger growth rate mentioned by Aon in its report, this compares to 0.36% in Q2 2015.

The All Bond index and U.S. Hurricane bond index reported gains of 1.67% and 1.66% in Q2, respectively. Compared with 0.54% and 0.37% in Q2 2015, again underlining the increased growth rate in 2016 when compared with the previous year.

While all Aon ILS Indices reported gains in Q2 and at a far larger growth rate than the previous year, in comparison to benchmarks the index performance varied, says Aon, a trend that has been evident in recent quarters.

“The Aon ILS Indices performed with mixed results relative to benchmarks, outperforming the 3 to 5 year U.S. Treasury Notes index and with comparable returns to the S&P 500 and the CMBS 3 to 5 year Fixed Rate indices,” explains the report.

The 3 to 5 year U.S. Treasury Notes index posted a gain of 1.2% in the quarter, while the S&P 500 and the CMBS 3 to 5 years Fixed Rate index posted returns of 1.9% and 1.63% in Q2 2016, respectively.

For the annual return period ending June 30th 2016, all Aon ILS Indices posted gains when compared with the previous year, again following the trend witnessed in the first-quarter, and making it the second time since Q4 2013 that all Aon ILS Indices outperformed the prior year’s annual return.

As the above chart provided by Aon highlights, the Aon All Bond index improved from 2.81% to 6.84% in the annual return period, while the BB-rated Bond index improved from 0.56% to 5.34%.

The U.S. Hurricane Bond index and U.S. Earthquake Bond index improved to 7.73% and 4.85%, respectively, from 5.66% and 2.59% for the annual return period in 2015.

“The index gains are in part attributable to price appreciation driven by increased demand in the secondary market, which has persisted in the continued absence of a major catastrophe event.

“The 10-year average annual return for the Aon All Bond index, 8.56 percent, further produced superior returns relative to all other benchmarks. This demonstrates the value a diversified book of pure insurance risks can bring to long term investors’ portfolios,” said Aon.

The continued strong performance of ILS indices, especially that some are shown to consistently outperform relative benchmarks, is a sign of the diversification and uncorrelated benefits the asset class offers investors.

Something that will only support further market expansion as investors become increasingly comfortable with ILS as a reliable stream of diversifying investment income, regardless of the lower, but steady available returns.

Also read:

– All Aon ILS Indices posted gains in Q1 2016.

– Aon ILS Indices outperform all fixed-income benchmarks in 2015.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.