The dedicated insurance-linked securities (ILS) mutual investment fund operated by Amundi US Investment Management, the Pioneer ILS Interval Fund, fell to a small -0.11% loss for its last fiscal year to October 31st, as impacts from the European flooding and hurricane Ida wiped out first-half returns.

At the same time, the mutual ILS fund shrank slightly in the last quarter of record, ending October 2021 with total net assets of almost $983 million, down roughly 2% from the record $1.01 billion in size that Amundi Pioneer’s flagship ILS fund had reached by the end of July.

It’s worth noting that, at October 31st 2021 the cost of ILS investments in the portfolio is reported as almost $1.006 billion.

A quarter earlier, total net assets were almost $1.01 billion, but the cost of ILS investments was cited as $965.7 million.

The change, in the cost of the ILS investments now being higher than the fund’s net assets, appears to be a reflection of impacts from catastrophe loss events over recent months, as some assets held were marked down for possible losses.

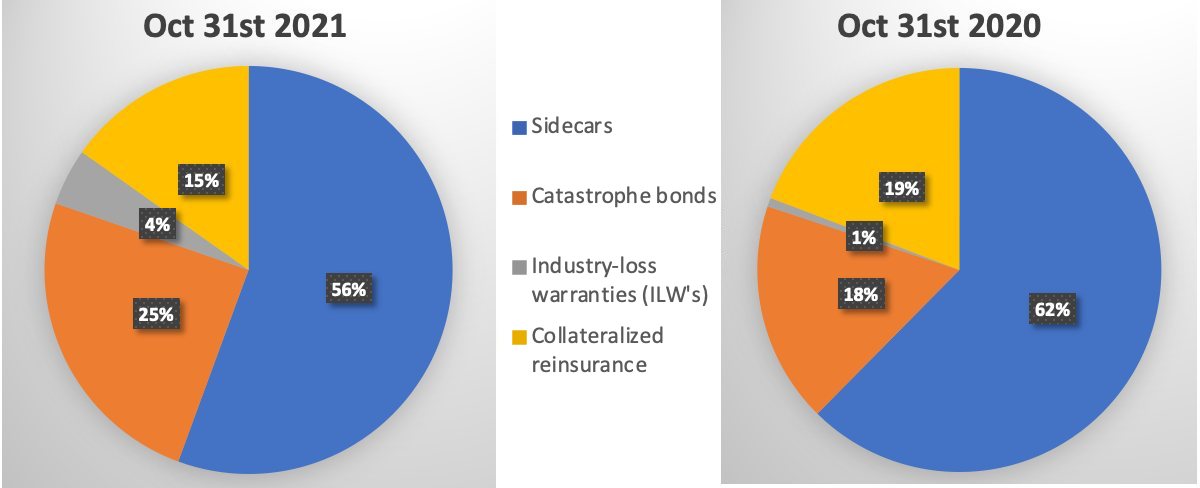

In the last year, Amundi Pioneer has invested more of the assets of its flagship mutual insurance-linked securities (ILS) fund into catastrophe bonds and industry-loss warranties (ILW’s).

At the same time, allocations to sidecars and private quota shares, as well as other collateralized reinsurance deals, have fallen, as a percentage of the larger portfolio.

You can see the change in portfolio mix of the Pioneer ILS Interval Fund over the last fiscal year in the graphic below:

Commenting on the performance of the Amundi Pioneer ILS Interval Fund, Chin Liu, Portfolio Manager Director of Insurance-Linked Securities (ILS) and Quantitative Research, explained how the loss activity in the latter half of the year to October 31st drove performance down for the fund.

“The ILS market was fairly quiet in the first half of the 12-month period, with few major claims-triggering events, positive rate-on-line (ROL) increases, and orderly market conditions. Other than Winter Storm Uri, which hit Texas in February 2021 and led to insured losses, favorable trends across the industry characterized the first six months of the Fund’s annual reporting period,” Liu explained.

Favourable trends in the ILS and reinsurance market at the start of 2021 included continued rate-on-line improvements across many perils and geographies, Liu noted.

At the same time, terms and conditions also improved, especially for communicable-disease exclusions and cyber coverage, Liu further explained.

In addition, the ILS industry experienced “market and capacity dislocations that have been creating market imbalances, thus potentially leading to opportunistic investment transactions,” Liu said.

While at the same time risk modelling, underwriting and claims practices are all seen to continued improving, which can also positively affect results, Liu explained.

But the second-half of the fiscal year for Amundi Pioneer’s ILS Interval Fund saw significant catastrophe loss activity, thanks to the aforementioned floods and hurricane activity.

Liu commented that, “In the second half of the 12-month period, however, two loss events led to weaker market performance, and the Fund’s exposures to those events had a negative effect on its total return for the period. First, severe flooding in Germany in July 2021 led to estimated losses of $11 billion to $15 billion due to damage to infrastructure, property, and vehicles. The second triggering event was Hurricane Ida, which made landfall as a Category 4 hurricane in Louisiana on August 29, 2021. The storm subsequently transitioned into a post-tropical cyclone as it travelled through the northeast United States, breaking multiple rainfall records in various locations. As of the close of the 12-month period, total estimated losses from the hurricane stood in a range from $30 billion to $35 billion.

“The Fund experienced performance similar to that of the overall ILS market during the period. From November 2020 through July 2021, the Fund showed gains in eight of those nine months, but posted losses in August and September 2021, due primarily to the aforementioned portfolio exposures to Hurricane Ida and the European floods, which helped push the Fund’s total return for the full 12-month period into negative territory.

“Historically, approximately 60% to 70% of the annual return for the broader ILS asset class has come in the latter part of years when overall losses have been limited. However, the nature and timing of both Hurricane Ida and the European floods disrupted that return pattern during the Fund’s annual reporting period.”

Liu and the ILS portfolio management team at Amundi Pioneer continued to invest selectively through the last fiscal year, he said, using terms and condition negotiation as much as rate to improve the overall quality of the ILS fund portfolio.

“During the period, we maintained a steady approach that sought to keep the portfolio well diversified across different regions and perils, focusing on sponsor quality and deal structure, while trying to avoid investments in the riskiest parts of the ILS market. Our goals are to have the portfolio broadly reflect the risks and returns associated with the reinsurance industry, to collect sufficient premiums in an effort to offset a reasonable level of losses, and to deliver an attractive return for the Fund’s investors,” Liu said.

Adding, “We have typically not invested the Fund in every new ILS deal; instead, we have continued to employ a comprehensive due diligence process to evaluate each investment for the appropriate structure as well as potential alignment of interest between the Fund and the ceding insurer. We have remained sponsor-agnostic, meaning that there are no direct affiliations or ownership conditions in place with a reinsurer. We believe that policy may help avoid potential conflicts of interest and could help limit the Fund’s exposures to the idiosyncratic risks associated with holding large positions with one reinsurer. We focus on the ILS market as a whole, attempting to add value through our security selection process, by paying rigorous attention to sourcing investments that offer what we believe are attractive yields, and through careful management of the portfolio’s risk profile.”

Liu said that Amundi Pioneer continues to believe that ILS can offer investors a source of diversification, “especially during a time featuring elevated equity valuations, an ongoing low-interest-rate environment, and tight yield spreads in the bond market’s credit-sensitive sectors.”

Finally, Liu also cited “meaningful improvements” in reinsurance pricing at the the January, April, and June 2021 renewals, which helped to improve return potential of the portfolio.

But he stressed that rate is not everything in ILS and reinsurance, as “the potential risks, loss probabilities, and contract terms associated with each investment opportunity,” are also very important to consider.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.