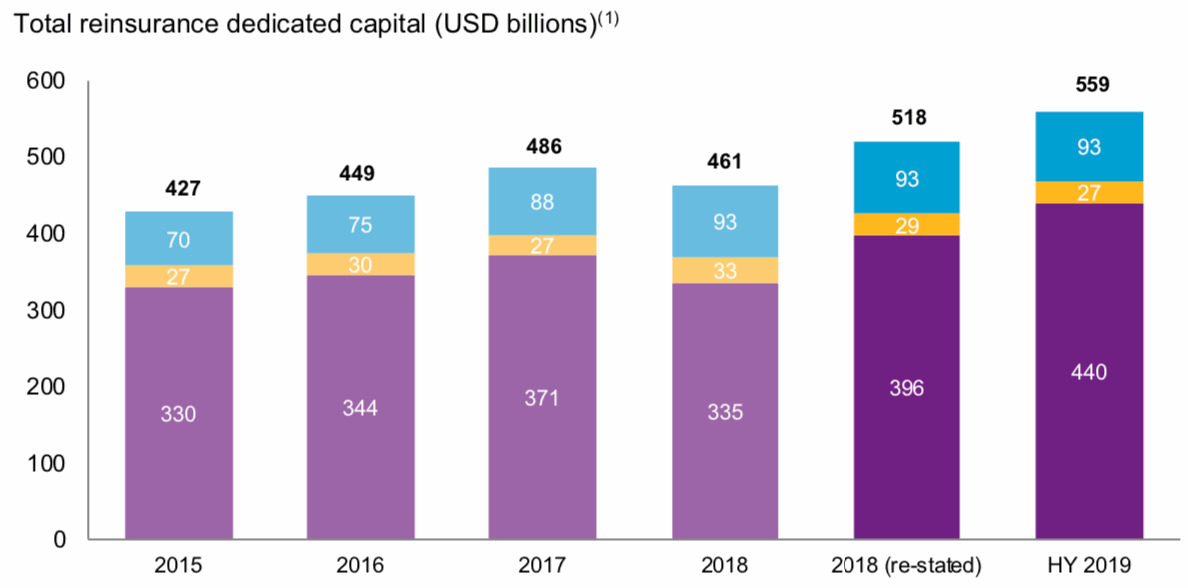

Alternative reinsurance capital, largely contributed by insurance-linked securities (ILS) funds, stayed roughly flat through the first-half of 2019, but traditional reinsurers benefited from their investment returns to post 10% capital growth.

Alternative reinsurance capital has remained at around $93 billion at the middle of this year, according to data from broker Willis Re.

That’s despite the losses and loss creep it seems, although the figure does include trapped but not loss collateral we believe.

On the other side of the market, traditional reinsurance firms had a good first-half, boosting their own capital base by around 10%, to reach $467 billion.

Overall, that put global reinsurance market capital at $559 billion as of the end of June 2019, an increase of 8% since the end of 2018.

Strong investment markets were the main driver of the reinsurance industry’s capital growth in the first-half of 2019, Willis Re explained.

The 36 reinsurance companies tracked in the broker’s Willis Reinsurance Index saw their capital rise by 11% to $440 billion, which Willis Re noted was “principally due to falling bond yields and rising equity markets.”

In addition, fresh capital backing startup insurance and reinsurance firm Convex also helped in growing the total.

Performance looks significantly better in the first-half of 2019, despite any impact from creeping prior year catastrophe losses.

Return on Equity (RoE) for the subset of the Willis Reinsurance Index that the broker analyses more deeply increased to 13.9% from 8.5% at the middle of 2018.

But, as ever the figures are not always clear at first glance and again it was the strong investment gains that were the main driver of this.

Excluding these investment gains, the RoE of the subset of reinsurance firms Willis Re tracks was actually only 7.3%.

Normalised for natural catastrophe losses and removing reserve release benefits gives an underlying RoE of 10.8%, or 4.2% excluding investment gains, for the subset.

This is slightly better than H1 2018’s 3.9% underlying RoE, or 3.3% excluding investment gains, but still the figure for this year is far from impressive.

The subset’s combined ratio deteriorated a little, from 93.3% in H1 2018 to 94.9% on a reported basis, which is largely due to diminishing reserve releases and higher catastrophe activity.

Stripping out all prior-year development and replacing actual catastrophe losses with a more normalised level, Willis Re said it results in an underlying combined ratio of 100.5%, an improvement on H1 2018’s 101.5%, but again not impressive.

James Kent, Global CEO, Willis Re, commented, “Looking behind the headline figures reveals a positive direction of travel for reinsurers so far this year, with modest but important reductions in non-catastrophe combined and expense ratios. This improvement is supported by the positive trajectory seen in 2019 market pricing across many lines. The slowdown in reserve releases continues, however, so in the months and years ahead reinsurers will need to further realize these trends.”

This positive direction of travel is still not putting reinsurers clear into the profit zone, as any increase in catastrophes while reserves continue to dwindle could tip them into unprofitability much more quickly again.

With the investment climate having worsened again now too, that side of the balance-sheet may not be as significant a contributor in the second-half.

It would be fascinating to strip out the effects of third-party capital usage and management for these reinsurers, to see how that contributes to lowering their combined ratios by sharing in their losses, while investors deliver fee income as well to boost their bottom-line.

While alternative capital remains a significant component of the market and its growth is likely to resume, it is destined to increasingly support reinsurer profitability going forwards, we believe, becoming another lever than can help them better sustain profitability.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.