US primary insurer Allstate has revealed a significant approximately $1.3 billion gross loss from the winter storms and severe winter freeze, primarily impacting Texas, which it warns mean its aggregate reinsurance will trigger, which is provided by its Sanders Re catastrophe bonds.

Allstate said that the $1.3 billion of gross losses from the winter storms and deep freeze are set to be significantly reduced thanks to reinsurance recoveries.

Allstate said that the $1.3 billion of gross losses from the winter storms and deep freeze are set to be significantly reduced thanks to reinsurance recoveries.

Net losses from the winter events are estimated at $567 million, pre-tax, by Allstate ($448 million, after-tax), which the carrier says reflects anticipated reinsurance recoveries, but partially offset by reinstatement premiums.

This suggests reinsurance recoveries of somewhere around the $733 million delta between the gross and net, but offset by the cost of reinstatements.

Overall, Allstate said February catastrophe loss events cost it $577 million, pre-tax ($456 million, after-tax), consisting of two events costing $590 million, pre-tax ($466 million, after-tax), offset by some favorable prior period reserve re-estimates.

Because of the heavy losses in the month of February, Allstate said that it has “surpassed the retention level of the nationwide aggregate reinsurance cover, with the annual risk period ending March 31, 2021.”

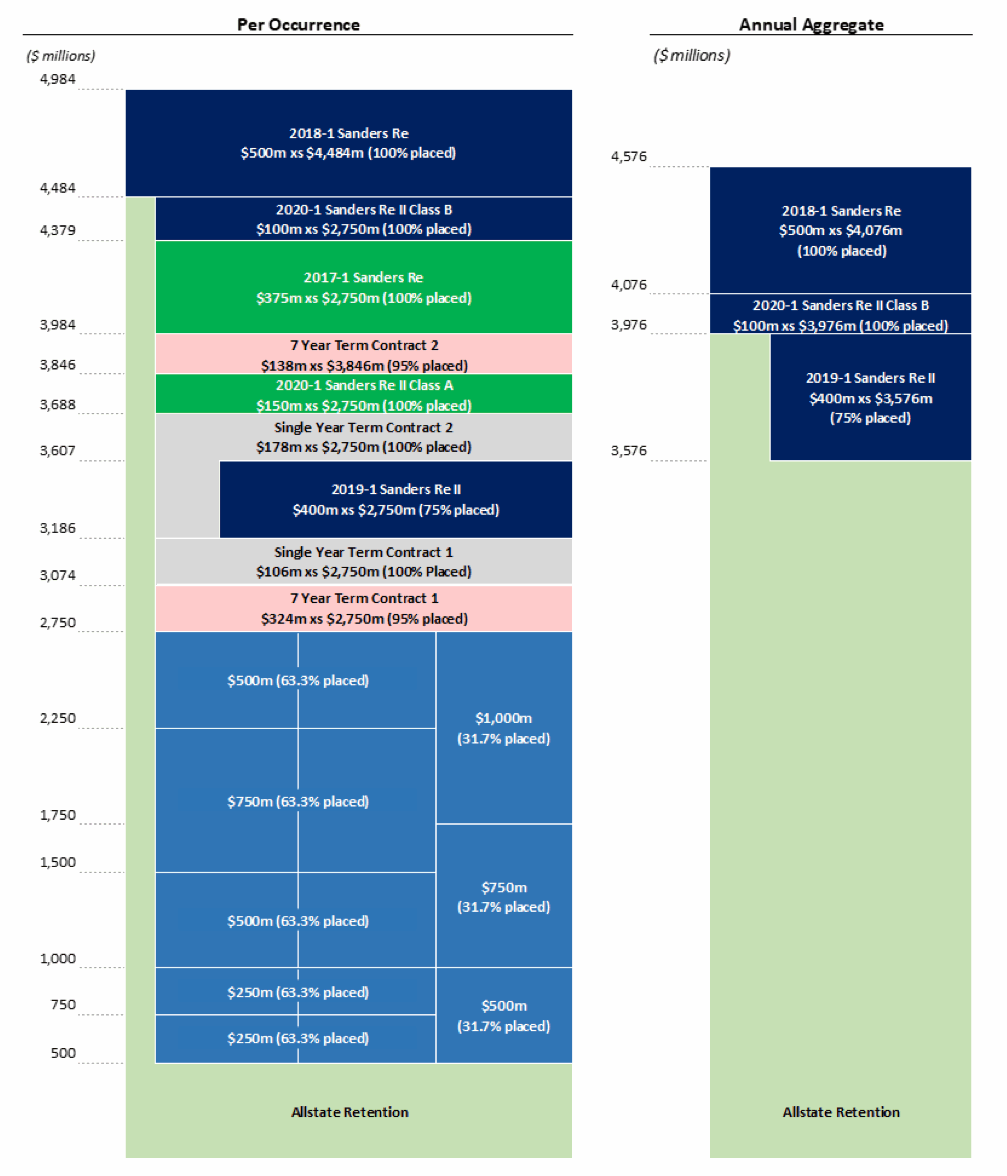

Allstate’s nationwide aggregate reinsurance tower is provided by three of its Sanders Re catastrophe bonds, with the Sanders Re II 2019-1 cat bond that provides the carrier with both occurrence and aggregate reinsurance protection sitting lowest in the tower currently.

Allstate’s nationwide aggregate reinsurance attached at $3.576 billion of gross losses as of the current risk period, with the Sanders Re II 2019-1 cat bond then providing $300 million of aggregate reinsurance protection above that trigger point across a $400 million layer, so it covers 75% of the losses above that.

Allstate has not revealed its exact gross aggregate loss for the current risk period year at this time and given the effects of subrogation and previous period recoveries, as well as the fact Allstate reports its catastrophe losses net throughout the year, it’s tough to estimate how far above the trigger point losses have stretched at this time.

However, the sole $300 million Class B tranche of notes from the Sanders Re II 2019-1 catastrophe bond had been marked down for bids as low as 10 or 20 cents on the dollar at the end of last week, suggesting the market was anticipating a loss as high as 80% to 90% of the $300 million of principal.

While investors in the Sanders Re II 2019-1 catastrophe bond look set for an as yet unknown loss of principal, we assume the carrier will let this develop a while longer before reporting the actually losses to holders of the cat bond, it also looks as if Allstate may be able to make some recoveries under its per-occurrence reinsurance arrangements as well.

Given how significant the losses from the Texas freeze and related winter storms have been for the carrier, at around $1.3 billion of gross losses, Allstate’s nationwide occurrence reinsurance attaches at $500 million of losses, suggesting reinsurers and any ILS funds backing the lower layers in that tower will also help the carrier in paying its claims.

You can see Allstate’s occurrence and aggregate nationwide reinsurance towers below.

It will take some time for the losses to be finalised and for holders of the Sanders Re II 2019-1 catastrophe bond to fully understand the scale of principal loss faced and development could be prolonged with this winter event, we’d imagine.

With the notes still priced down for as much as a 90% reduction in principal, it suggests the cat bond market could face as much as a $270 million payout to cover some of Allstate’s losses.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.