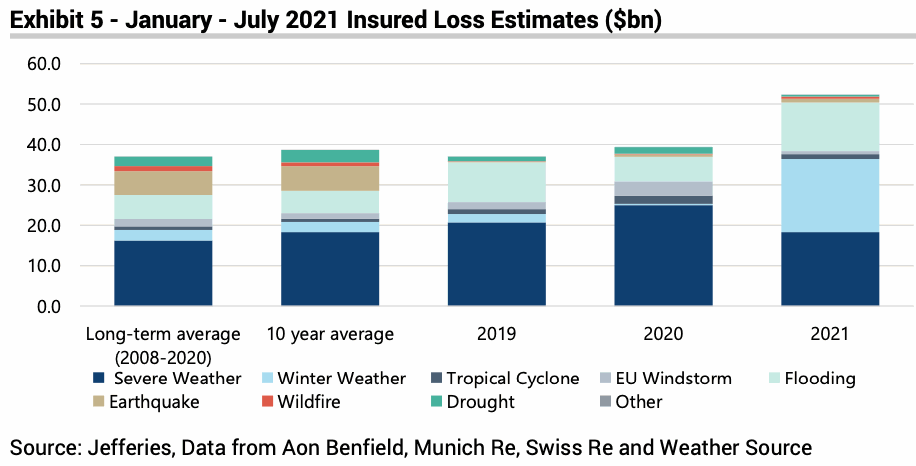

With catastrophe and severe weather losses running an estimated 41% above the long-term average after July for the global insurance and reinsurance industry, analysts at investment bank Jefferies warn that it is becoming increasingly likely catastrophe budgets are exceeded this year.

July’s catastrophe and severe weather events have ramped up losses across the global insurance and reinsurance industry, with events of note being the European floods, US severe weather events, Hurricane Elsa and also the ongoing US West Coast wildfires.

Recent industry estimates have suggested that first-half 2021 catastrophe losses may be as high as $42 billion.

Jefferies estimate had been pegged at $39 billion earlier than that.

Now, after July, Jefferies has catastrophe losses for 2021 to-date running at around $51 billion to $52 billion, with the flooding across Germany and Europe the main cause of the significant increase for one month.

For the European flooding, Jefferies estimates the total insurance and reinsurance market cost could be as high as US $8.6 billion.

This is higher than other estimates and suggests others may raise theirs in the coming weeks.

Jefferies noted that, at this level of loss, “We expect that reinsurance deductibles will be exceeded in Germany, Belgium, Switzerland and Austria, with a higher proportion of net losses thus falling on reinsurers.

“As such, we expect this to create additional rate rises in European property excess of loss contracts.”

We’ve detailed many of the cases where reinsurance deductibles have indeed been exceeded in our coverage of the floods, the latest article detailing these can be found here.

July also saw over $1 billion of insured losses in China from flooding, plus an estimated $1.7 billion of insured losses from US severe weather, with additional notable impacts from hurricane Elsa and wildfires, Jefferies said.

Commenting on what this means for the industry, Jefferies said, “Following the 1H 2021 results, catastrophe loss ratios across the industry appear to be on track to exceed corporate budgets. With insured losses year-to-date running +41% above average and most of the Atlantic hurricane season still ahead of us, we see this as a material risk.”

When catastrophe budgets are exceeded it naturally pushes more losses to the reinsurance sector, with clear ramifications for insurance-linked securities (ILS) funds, especially those invested in collateralised reinsurance and quota shares.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.