Insured losses from severe convective weather, including tornadoes, severe thunderstorms and hail, in the United States continue to rise in 2014, with the total now estimated to have reached an insurance industry loss of $5.5 billion by Impact Forecasting.

Incidence of tornadoes and severe thunderstorms has ticked upwards in the last week or two, with a number of deadly tornado strikes causing loss of life and rising losses. However, despite this uptick the amount of tornadoes recorded this year remains below average and the level of insured losses is also lower than seen in recent years.

Steve Bowen, associate director and meteorologist at Impact Forecasting, the catastrophe modelling unit of reinsurance broker Aon Benfield, said of the $5.5 billion estimate for 2014 losses to date; “The vast majority of the losses have occurred in April, May and June, and we are still likely to see a further uptick as full assessments are made.”

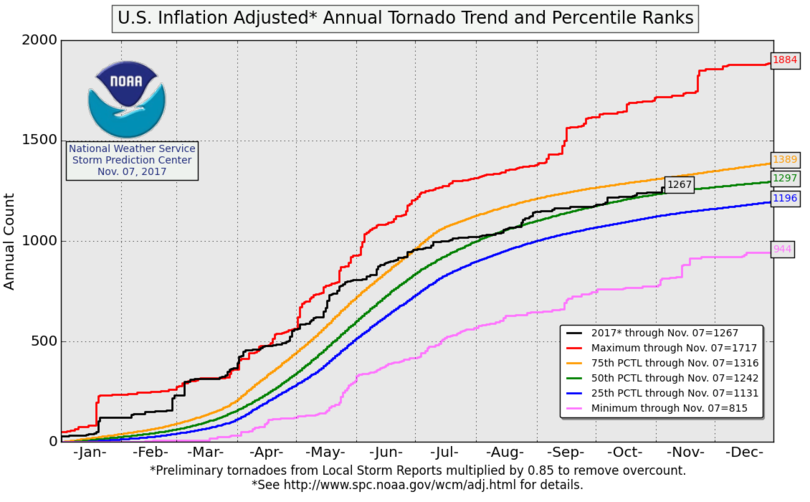

Looking at the incidence of tornado reports, using the chart below from the U.S. NOAA’s Storm Prediction Center, it is clear that the convective storm season remains far below average activity levels, but also clear is the uptick in the last week or two, bringing the 2014 trend closer to the 25th percentile rank.

U.S. Inflation Adjusted Annual Tornado Running Total

Bowen explained that despite the $5.5 billion and rising insured impact figure losses are also running below normal so far this year; “To put the losses into context, when comparing 1H 2014 U.S. convective storm losses with previous years, we are currently on pace to see the lowest 1H severe weather losses since 2007.”

Bowen noted that with ten days left of June and more severe thunderstorms and tornadoes forecast there is no guarantee that the first-half will end as the lowest insured loss since 2007.

This week U.S. primary insurer Allstate announced that it had suffered a pre-tax loss from catastrophe events in May of $400m. Analysts at KBW Research said that it sees the rising severe weather losses in the U.S. as a negative drag on earnings for U.S. property insurers, but that reinsurers probably have limited exposure so far.

With insurers globally having faced over $7 billion of catastrophe and severe weather losses from the first-quarter of 2014 and the second quarter figure rising due to U.S. convective storm and severe weather losses, the bill for insurers is steadily rising. That bill remains below average though and any impact to reinsurance companies will be manageable at this stage.

Visit our U.S. tornado and severe thunderstorm page for more useful forecast and trend graphics.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.