1347 Property Insurance Holdings, Inc. said that its reinsurance panel took all of its catastrophe losses from a single hail storm event in Texas during the first-quarter of 2019.

1347 Property Insurance Holdings (1347 PIH) is in the midst of a transition to a reinsurance and investment management services company, having sold its Maison homeowners insurance underwriting operations to FedNat Holding Company recently.

1347 Property Insurance Holdings (1347 PIH) is in the midst of a transition to a reinsurance and investment management services company, having sold its Maison homeowners insurance underwriting operations to FedNat Holding Company recently.

That acquisition is set to complete at the end of June, the parties involve hope, with FedNat set to pay $51 million for the homeowners operations.

Until that transaction completes though, 1347 PIH remains on the hook for losses to the subject property insurance business. Luckily for the firm, the robust reinsurance measures it has in place have helped to minimise losses in Q1 after severe thunderstorm related hail events caused a significant catastrophe loss for the firm.

The company said that it experienced a single catastrophe loss event during the first-quarter of 2019. 1347 PIH defines a catastrophe loss as a PCS designated event where its estimated costs exceed $2.5 million.

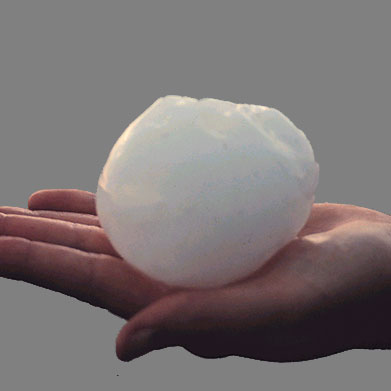

In Late March a severe hail loss event in Texas drove a significant impact to 1347 PIH’s portfolio, which the firm now believes will result in a $12.5 million gross incurred loss to it.

However, the company explained that its external reinsurance program demonstrated its worth in the quarter, as the Texas hail event is actually estimated to cost 1347 PIH zero in net incurred losses.

Other weather related non-catastrophe losses amounted to another $5.9 million of gross loss in the quarter, while non-weather losses were also elevated at $3.47 million. None of these were passed onto reinsurers, meaning 1347 PIH reported an elevated net loss ratio compared to the prior year.

Once again reinsurance proves its worth for the company though, which is intriguing as after the sale of this homeowners business to FedNat completes, 1347 PIH itself is destined to become a reinsurer of it, as the acquisition agreement will see the firm get five-year rights of first refusal to provide reinsurance of up to 7.5% of any layer in FedNat’s catastrophe reinsurance program, subject to an annual reinsurance limit of $15 million.

Meaning in years to come 1347 PIH could find itself paying reinsured losses on the book of business it once underwrote on a primary basis, becoming one of the reinsurance capital providers that have supported this book through its growth in catastrophe exposed regions of Texas, Louisiana and Florida.

———–

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

We’re returning to Singapore for our fourth annual ILS market conference for the Asia region. Please register today to secure the best prices. Early bird tickets are still on sale.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.