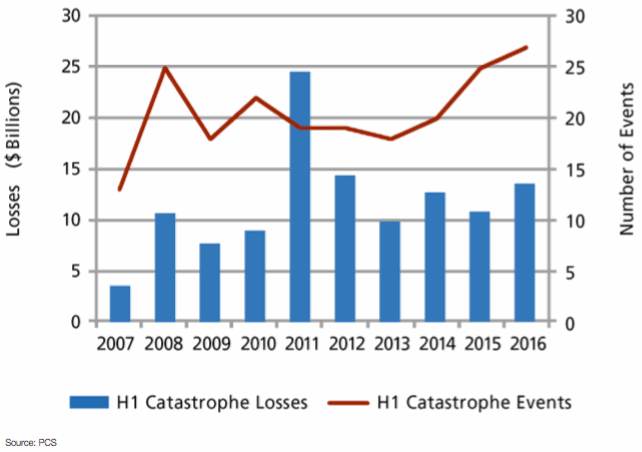

An increase in catastrophe activity during the first-half of 2016 across the U.S. resulted in insured losses of $13.5 billion, which is 20% higher than the ten-year historical average, according to Property Claim Services (PCS).

First-half 2016 U.S. catastrophe loss activity increased modestly on the same period last year, as the frequency of events grew significantly, says PCS in its Q2 2016 Catastrophe Review.

PCS designated 27 U.S. events during the first six months of the year, incurring insurance and reinsurance industry losses of $13.5 billion, and that has the potential to increase further still as resurveys are pending for seven H1 events, says PCS.

In order for PCS to designate an event a catastrophe it must incur an industry loss of at least $25 million and impact a substantial number of insurers and insureds, says the firm.

The ten-year historical average (2007 – 2016) for U.S. insured cat losses is roughly $11.6 billion, meaning that the $13.5 billion reported by PCS in H1 is 20% higher than this average, driven by the increased frequency of events. In fact, PCS notes that the 27 designated events recorded in first-half of this year are above the ten-year frequency average, of 21 events.

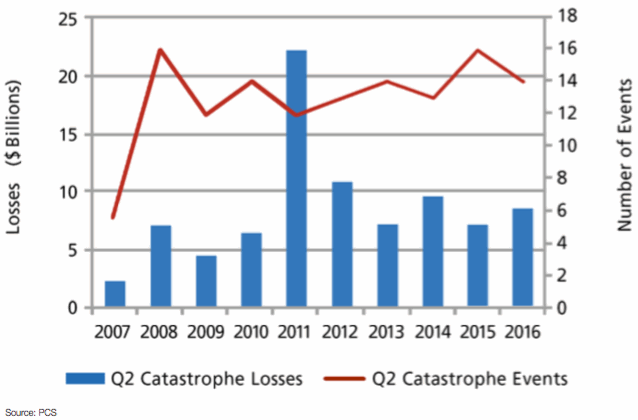

“First-half catastrophe losses are up modestly year over year, while event frequency has spiked significantly. Second-quarter losses are slightly above the ten-year average of $8.4 billion, while frequency is in line with the past ten years.

“But beneath the headline stats of what, in aggregate, has been a mundane first half are significant concentrations of loss,” explains PCS.

H1 2016 PCS-Designated Events and Insured Losses in U.S.

U.S. catastrophe losses in the second-quarter of 2016 alone totalled $8.5 billion, which is just below the ten-year average of $8.6 billion. PCS notes that only two second-quarter U.S. cat loss totals have surpassed $10 billion, which occurred in 2011 and 2012, and as highlighted in the below graph.

Q2 2016 PCS-Designated Events and Insured Losses in U.S.

PCS underlined the concentration of U.S. cat losses experienced in H1, and also noted the occurrence of significant hail and flooding in certain states, perils that typically result in losses below the PCS-designation threshold but which spiked in 2016.

The only U.S. state to experience losses above the $1 billion during H1 was Texas, which topped the list of the top-ten catastrophe-affected states in the opening six months of the year, according to PCS.

14 events impacted Texas during H1, incurring insured losses of roughly $7.6 billion. While Texas was the hardest hit state in the U.S. last year, aggregate losses totalled just $2.4 billion, so $5.2 billion less than witnessed in H1 2016, reveals PCS.

“Thirty-nine states were affected by first-half catastrophe events this year – up from 27 in the first half of 2015 and 24 in the first half of 2014. Wind and thunderstorm activity with significant hail and flooding occurred in several states that usually aren’t affected sufficiently to be included in PCS-designated events,” said PCS.

After Texas, Nebraska was the next most-affected state in terms of insured industry loss, with two events incurring losses of $550 million. Followed by Missouri ($440 million), Arkansas ($410 million), Illinois ($360 million, and also the second-highest number of events at seven), Virginia (340 million), Kansas ($290 million), Indiana ($280 million), Montana ($260 million), and finally New York ($250 million).

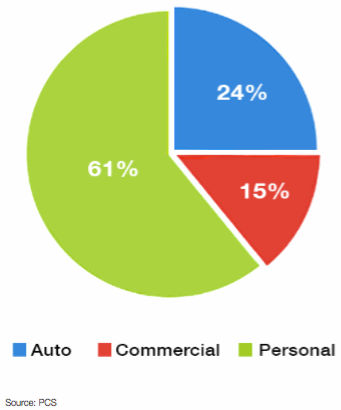

H1 2016 Losses from PCS-Designated Events by Category

As shown by the above chart, personal losses accounted for the majority of H1 2016 activity, followed by auto and then commercial losses.

PCS also reports on designated events in Canada as well as the U.S., explaining that activity in H1 was fairly active and included the largest catastrophe event in the history of the Canadian market, in the Fort McMurray, Alberta wildfires.

“The sheer magnitude of the Fort McMurray event certainly affected year-over-year changes in insured catastrophe losses in Canada. Even with two quarters remaining in the year, 2016 has the highest annual catastrophe loss since the inception of PCS Canada in 2010,” explains PCS.

H1 2016 PCS-Designated Events and Insured Losses in Canada

The preliminary PCS estimate for the Canada wildfire event of C$4.67 billion (USD3.63 billion) accounts for approximately 98% of H1 insured cat losses in Canada, and roughly 29% of PCS North America cat losses, explains PCS.

In total, PCS designated four events in Canada during H1, which incurred an insured industry loss of C$4.7 billion, with personal losses again accounting for the majority (83%) of losses, as seen in the U.S.

PCS has discussed previously how the frequency of catastrophe events appears to be on the rise, and it’s easy to see how losses can aggregate quickly across the U.S. and Canada, especially when large events as seen in Canada and Texas, really start to increase losses for insurers, reinsurers, and increasingly insurance-linked securities (ILS) funds/manager.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.