The UK flooding caused by storm Desmond at the beginning of December is estimated to have caused £717 million ($1.035 billion or €950m) of insurance, and perhaps reinsurance, industry losses, according to PERILS AG.

PERILS AG, provider of industry-wide European catastrophe exposure, industry loss data and indices, provides its first estimate for the insured flooding losses related to storm Desmond today.

PERILS AG, provider of industry-wide European catastrophe exposure, industry loss data and indices, provides its first estimate for the insured flooding losses related to storm Desmond today.

Desmond struck the UK on the 4th December, with flooding impacts calculated by PERILS up to the 24th of the month. Over that period the insured property market loss from the flooding is estimated at £717 million, while windstorm losses from Desmond are estimated at a further £42 million (below the threshold at which PERILS reports, hence only covering the flood event).

Whether the event and other storms that caused floods will hit reinsurance layers remains uncertain, although it has been reported that some ILS funds have small exposures to the severe winter weather in the UK.

Storm Desmond was identified and named as such by the UK Met Office / Met Éireann. The storm was also named Ted by the Free University of Berlin (which is the more typical source of names for European windstorm events, Helga by the Danish Meteorological Institute, and Synne by the Norwegian Meteorological Institute.

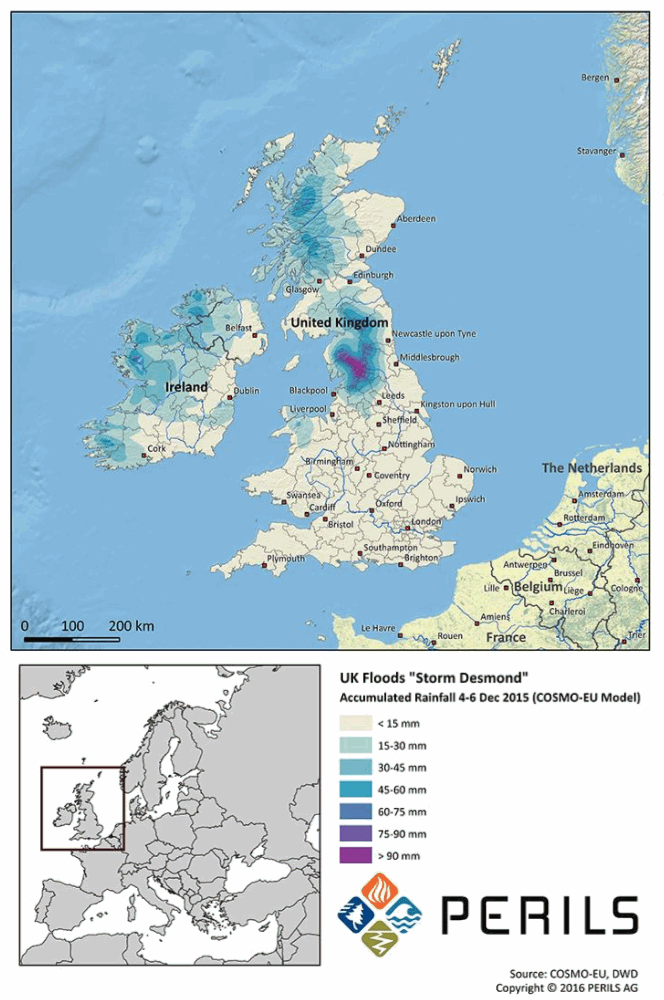

Desmond brought record-breaking rainfall to the UK, PERILS explains, which fell on ground already saturated from a series of storms and depression systems during November. Severe flooding mainly affected the counties of Cumbria and Lancashire in Northwest England, with flood waters peaking on the 5th and 6th December 2015. In addition to the UK, Ireland and Scandinavia were also affected by wind and rain from storm Desmond between 4th and 6th December 2015.

Luzi Hitz, CEO of PERILS, commented on the announcement; “Given the record-breaking amount of rain which fell over Northwest England from 4 to 6 December, and the fact that it fell on water-saturated soil following an exceptionally wet November, it is no surprise that extensive flooding occurred from overflowing rivers and surface water run-off. After 2005 and 2009, this is the third time that the Northwest of England has been affected by severe floods. This clearly underpins the need for the reliable UK flood insurance data which PERILS strives to provide, helping to further improve the industry’s understanding of UK flood risk and ultimately making it easier to insure.”

Eduard Held, Head of Products at PERILS, added; “After careful investigation and numerous discussions with data-providing insurance companies and other key market players, we concluded that for our initial estimate we would view the flooding from Desmond as an event on its own. In subsequent loss reports, and in line with our approach of applying the prevailing event definition used by the re/insurance markets, we may need to combine the flood losses from storm Desmond with flood losses from later events.”

A second flood loss report for storm Desmond will be made available on 4th March 2016, according to PERILS schedule, with a third loss report due on 4th June 2016 in which the loss data will be broken down by CRESTA zone, and by the property sub-lines Residential and Commercial.

PERILS noted that for subsequent loss reports it “may need to re-evaluate the loss aggregation period to take into account the flooding which resulted from storms “Eva” and “Frank” later in December.”

With the flooding event in the UK essentially spanning all of December, from Desmond on, it makes it very difficult to identify which specific storm caused which level of insured damages. Some towns were flooded a number of times during the month and by each of the storms, making identifying the event that claims emanated from difficult.

PERILS said it will consider factors such as “objective scientific data, information received from the data-providing insurance companies, and the prevailing event definition used by re/insurance buyers and sellers,” to make any decision to aggregate losses from different events.

PERILS initial estimate of £717m (or over $1 billion) seems aligned with other estimates that have suggested that the flood insurance bill could reach £1.3 billion or £1.5 billion in total across multiple storm events.

As we noted the other day, some ILS funds are reported to have small exposures to the UK flooding insurance and reinsurance loss events.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Storm Desmond accumulated rainfall amounts from 4-6 December 2015: The map shows the accumulated rainfall amounts for the UK and Ireland for the period of 4-6 December 2015 (source: DWD, COSMO-EU model). The rainfall peaks over the Lake District in Cumbria are clearly visible and exceeded historical records. The resulting flooding mainly affected the counties of Cumbria and Lancashire in Northwest England, and led to an insured property market loss of GBP 717m (PERILS initial loss estimate).