The insurance-linked securities (ILS) and catastrophe bond market saw the highest average quarterly risk interest spread in four years in Q2 2016, as issuance met investor demand for higher returns, according to Aon Securities latest report.

Aon Securities, the capital markets, ILS and investment banking unit of global insurance and reinsurance broker Aon, highlights the lower second-quarter ILS and cat bond issuance, but notes the change in trend as more risky tranches of notes came to market, helping to satisfy investors demand for improved returns.

Catastrophe bond issuance has seen the average coupon paid, or yield, fall over recent years, both due to the softening of reinsurance pricing but also a gradual reduction in the level of risk issued in ILS transactions.

The level of risk transferred to capital markets investors through new cat bonds and ILS transactions has risen steadily since the last quarter of 2015. Aon Securities notes a weighted average risk interest spread of 8.40%, with a weighted average expected loss of 5.05% issued during Q2, representing the highest risk interest spread seen in the catastrophe bond market in four years.

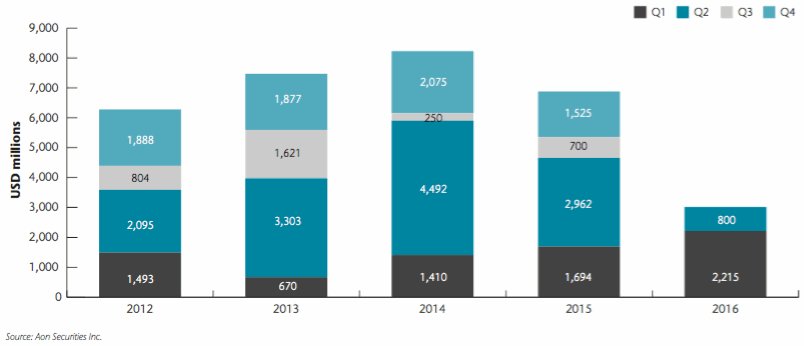

Issuance, though, in Q2 2016 was “relatively low” Aon Securities explains, with the firm counting just five transactions and $800m of risk capital issued among the few 144A cat bonds it analyses.

Catastrophe bond issuance by quarter

Meanwhile collateralized reinsurance products continued to proliferate, as the capital markets and ILS funds continued to grow their share of global reinsurance markets.

Paul Schultz, Chief Executive Officer of Aon Securities, commented; “Catastrophe bond issuance volume was down considerably in Q2, with only five new cat bonds issued during the quarter. Capital deployed across all collateralized products though was higher, reflecting the trend we have seen over the past few quarters in which growth in collateralized reinsurance significantly outpaced growth in cat bonds.”

Aon Securities explains that competition from traditional reinsurance markets drove some of the decline, as did the fact that a number of sponsors came back to the market earlier than perhaps expected which perhaps drove the record first-quarter issuance.

U.S. named storm and earthquake risks dominated catastrophe bond issuance in Q2, as did aggregate structures, with half of tranches offered showing sponsors growing preference for aggregate coverage from the capital markets.

Aggregate spreads tightened relative to occurrence during the quarter, as competitive pricing helped to drive the preference for this kind of protection, additionally an increasing numbers of perils and enhanced structures have become available on an aggregate multi-year basis, which is attractive to ceding companies.

Looking ahead, Aon Securities forecasts more activity through the second half of 2016, as the relative value of the catastrophe bond product is heightened thanks to spread compression.

We’ve been noting this for a while, that cat bond protection is becoming relatively more attractive once again, as investor demand for product provides an opportunity for sponsors to bring new deals to market and to have them execute at efficient pricing levels.

Schultz explained; “Looking ahead, and while the primary market is not typically as active during the third quarter, our firm does expect an active second half of 2016. Many investors have capital to deploy which should continue to lead to further secondary price increases and a relative improvement in attractiveness of the efficiency in the cat bond market.”

The third-quarter has already started briskly, with one major cat bond issuance and a number of private transactions helping to keep investors appetites whetted. With investor appetite perhaps near a high for new catastrophe bond product it is expected that some sponsors will note this opportunity to bring new deals to market.

Aon Securities latest cat bond market report can be accessed here.

Artemis’ Q2 2016 Catastrophe Bond & ILS Market Report – A quiet quarter fails to keep up with investor demand

We’ve now published our Q2 2016 catastrophe bond & ILS market report.

We’ve now published our Q2 2016 catastrophe bond & ILS market report.

This report reviews the catastrophe bond and insurance-linked securities (ILS) market at the end of the second-quarter of 2016, looking at the new risk capital issued and the composition of transactions completed during Q2 2016.

Q2 2016 issuance failed to hit $2 billion, with just $1.624 billion of new risk capital issued from 14 transactions. This is the first time since 2011 that Q2 issuance has failed to reach $2 billion.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.