AbsoluteClimo, a climate and weather modeling, forecasting and risk management firm based in Hawaii, has launched what it calls the “World’s First Catastrophic Risk Models Linked To Skillful Climate Physics Prediction.”

Climo๏Cats (ClimoCats), as its climate catastrophe risk models are called, will enable insurance, reinsurance and insurance-linked securities (ILS) market participants to operate their businesses based on a forward-looking view of climate related risks, rather than reactively following the output of models that analyse historical data.

Climo๏Cats (ClimoCats), as its climate catastrophe risk models are called, will enable insurance, reinsurance and insurance-linked securities (ILS) market participants to operate their businesses based on a forward-looking view of climate related risks, rather than reactively following the output of models that analyse historical data.

These climate catastrophe risk models will provide outputs based on AbsoluteClimo’s climate physics prediction engine that uses machine learning to links climate physics (such as temperature, rainfall, wind, etc.) with perils resulting in casualties and financial losses driven by climate change and variability, the company says.

ClimoCats accrue actual experience and knowledge over time, which is unique for a risk modelling tool and demonstrates where machine learning can make a real difference to underwriters day jobs, ensuring they are always working on the latest data and insights.

AbsoluteClimo notes that these insights and learned data experience can be essential to financial decisions made in a dynamic climate regime, including to insurance, reinsurance and ILS market specialists.

Speaking to Artemis, Brendan Lane Larson, Co-Founder, Climatologist, Physical Meteorologist at AbsoluteClimo, explained, “Clim๏Cats will empower insurance companies to proactively align to forward climate-driven risk correctly, rather than react to past risk as the predictor.

“For example, when insurance companies shop for their hurricane reinsurance months prior to the start of the hurricane season, Clim๏Cats could help the buyer confidently decide to buy less or more percentage of cover from a reinsurer.”

ClimoCats are able to probabilistically predict casualties, losses and other related details for events not limited to:

- Global total climate-driven cat losses

- U.S. hurricane, tornado, flood damage, hail/wind/lightning, and fire acres burned cat losses

- U.S. flood casualties

- Australia cat losses from weather/climate events

- Europe flood cat losses

- Japan typhoon cat losses (% GDP)

- China typhoon cat losses

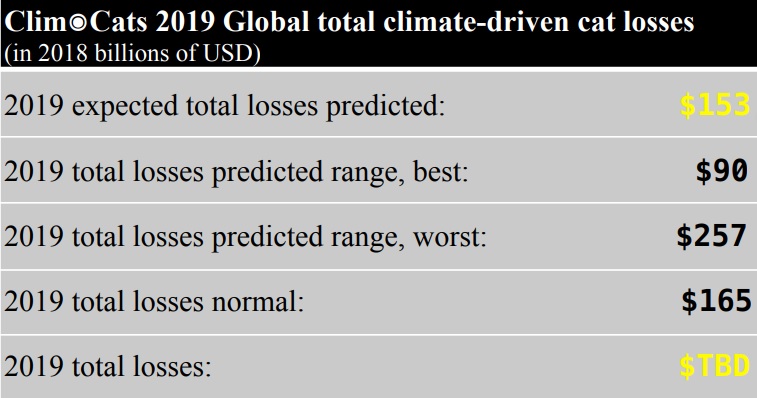

For the year 2019, ClimoCats is forecasting near normal expected Global total climate-driven catastrophe losses of $153 billion USD, the company says, with a probability range of $90 billion (best) to $257 billion (worst).

The model correctly forecasted the 2018 and 2017 risk directions of Global total climate-driven catastrophe losses, the company added.

AbsoluteClimo said that its models are available to any business concerned about climate-driven catastrophic perils.

Making decisions based on forward-looking, intelligence and machine learning-backed risk models has to be part of the future for insurance, reinsurance and ILS markets. AbsoluteClimo believes it already has something the market could already benefit from and hopes to pick up users from the risk market’s space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.