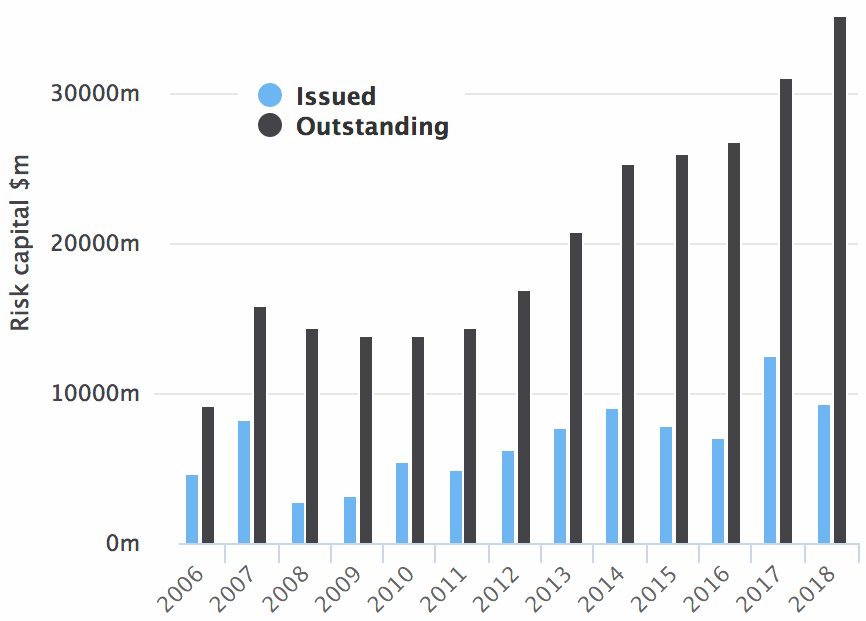

The outstanding market for catastrophe bonds and related insurance-linked securities (ILS) has experienced impressive growth in 2018 so far, growing by 14% across the first half of the year, to a new record size of $35.3 billion.

The market for catastrophe bonds and related ILS has been growing steadily quarter by quarter over the last few years, but the growth in terms of cat bond risk capital outstanding seen so far in 2018 was at a particularly fast rate, as $5.15 billion of second-quarter issuance on top of a record first-quarter helped to propel the market higher.

The amount of risk capital outstanding increased by 7% in Q2 alone to reach the new record high of $35.3 billion, but more impressively the figure has risen 14% in the first-half of 2018 and by a huge 20% year-on-year.

At the end of the second-quarter of 2017 the amount of cat bond and related ILS risk capital outstanding, as recorded by Artemis, stood at just $29.3 billion. So the cat bond market has grown in size by $6 billion, or 20%, in just one calendar year.

Cat bond & related ILS risk capital outstanding by year and to-date (click the image for interactive charts)

This impressive growth of the outstanding market for catastrophe bonds and related ILS is testament to the resilience of the investor base, following the catastrophe losses of 2017, as well as the ability of ILS fund managers to continue building their capital in order to take advantage of underwriting opportunities through the first-half of this year.

Considering that less than a year ago many were wondering whether the ILS market might shrink or stagnate for a period, following the losses caused by hurricanes and other catastrophes, the market has demonstrated its ability to keep on growing to support both investor demand for access to insurance risk linked returns and ceding company demand for efficient reinsurance and retrocession.

The more than $5.15 billion of second-quarter issuance in 2018, on the back of the most active first-quarter in the market’s history, took full issuance for the first-half of 2018 issuance to $9.39 billion, according to Artemis’ data.

Although this is $372 million less than the first-half of last year, issuance in 2018 already makes this the second most active full-year on record in the catastrophe bond and related ILS market, as shown by the Artemis Deal Directory.

With only $1.6 billion of cat bond maturities scheduled for the rest of 2018, it’s highly likely that the catastrophe bond and related ILS market will continue its outright growth.

It’s also extremely likely that annual issuance will exceed $10 billion for the second year running and there is every chance that 2018 issuance levels breaks new records.

For full details of the second-quarter of 2018, including a breakdown of cat bond issuance by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year, download your free copy of Artemis’ Q2 2018 Cat Bond & ILS Market Report here.

For full details of the second-quarter of 2018, including a breakdown of cat bond issuance by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year, download your free copy of Artemis’ Q2 2018 Cat Bond & ILS Market Report here.

For copies of all our reports, visit our archive page and download them all.

Don’t forget to check out our Cat Bond Market Dashboard as well, for a snapshot of the ILS market, and our range of catastrophe bond market charts and data visualisations which allow you to analyse the outstanding market in more detail.

Note: Artemis’ data on catastrophe bond issuance includes every transaction we can source information on, including private deals, new diversifying insurance perils, and the usual 144A broadly marketed property catastrophe issues. Hence our figures are typically higher than those quoted by reinsurance broker reports, but we feel this offers a holistic look at market activity.

Not long until our Singapore conference, July 12th. Final tickets on sale here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.