Reinsurance and insurance-linked securities (ILS) investment manager Blue Capital Management said today that it is suspending its share repurchase programme for the listed Blue Capital Alternative Income Fund (formerly known as the Blue Capital Global Reinsurance Fund), as it waits to see if there will be any impact from Hurricane Irma to its portfolio.

Blue Capital Management, the Sompo (previously Endurance) owned ILS fund manager, has been buying back shares of its stock exchange listed collateralized reinsurance and ILS fund since May as a way to offer investors liquidity.

Blue Capital Management, the Sompo (previously Endurance) owned ILS fund manager, has been buying back shares of its stock exchange listed collateralized reinsurance and ILS fund since May as a way to offer investors liquidity.

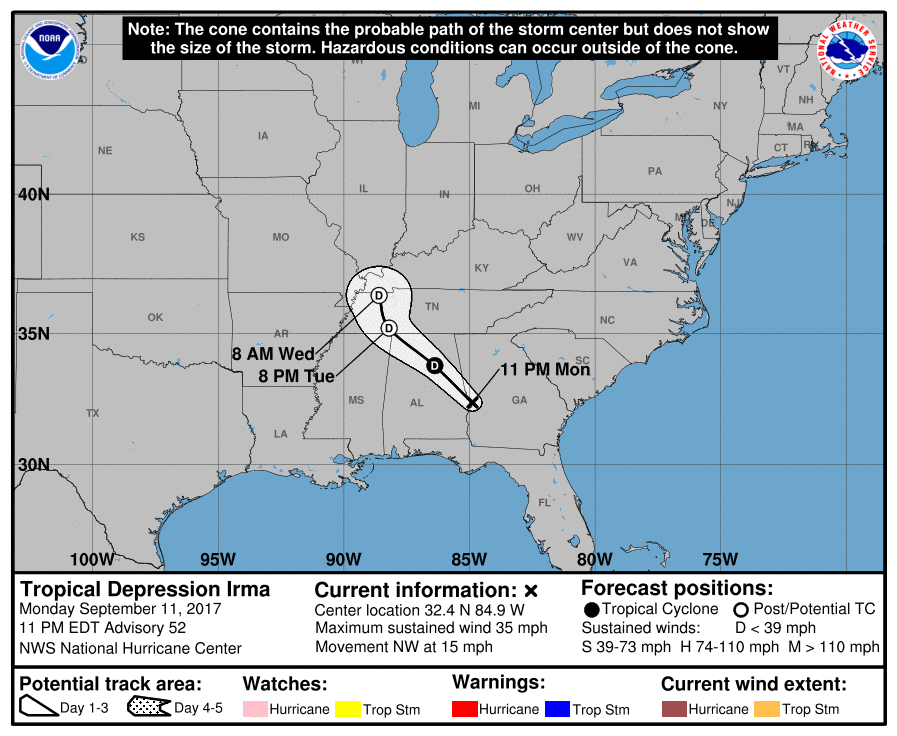

But with category 5 Hurricane Irma in the water and heading for the U.S. coastline and a possible Florida landfall as a major storm, the buy-backs are suspended as the storm poses a potential threat to the portfolio (as it does to every ILS fund portfolio).

The management of the fund explained that it, “Makes this decision based on the potential impact to its investments from a U.S. landfall of Hurricane Irma, although it will not know what, if any, material impact there may be until it has completed its normal post-event procedures.”

It’s not a surprising move at all, as there is so much uncertainty over the eventual outcome for the reinsurance and ILS market from hurricane Irma. The storm could miss Florida entirely, hit the Carolina’s, or make a Category 4+ landfall in the Miami-Dade area, all of which scenarios have vastly different industry losses attached.

So uncertainty remains the watch-word with hurricane Irma and ILS fund managers will be taking action to protect their portfolios, their investors and also themselves, as this major hurricane approaches the United States.

Also read:

– Cat bond trading slight on Irma, Kilimanjaro II Re trades down.

– Hurricane Irma leaves trail of destruction, Florida still in its path.

– Hurricane Harvey re/insurance industry loss over $10bn: AIR.

– Irma & Harvey losses combined may still just be an earnings event: Morgan Stanley.

– Citrus Re 2017 cat bond notes trade down 50% on hurricane Irma threat.

– Hurricane Irma live cat activity focused on $40bn+ loss, pricing uncertain.

– Hurricane Irma landfall in Florida would hit reinsurers hard: KBW.

– Hurricane Irma a potential U.S. (Florida) threat this weekend.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.