Bermuda domiciled insurance and reinsurance firm AXIS Capital Holdings Limited has been steadily building on its relationships with third-party capital providers, or strategic capital partners as it calls them, resulting in the firm ceding nearly $500 million of premiums to them in 2017.

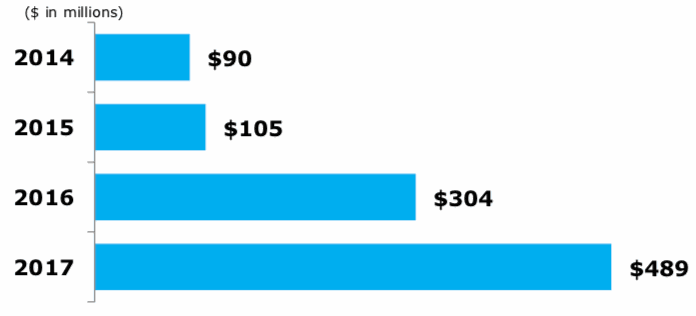

The total amount of premiums ceded to third-party capital providers by AXIS Capital jumped by over 60% in 2017, coming in at $489 million for the year, up from $304 million in 2016.

At the same time, the re/insurer earned a significant chunk of fee income for the work of originating, structuring and passing on reinsurance risks to third-party capital providers, taking $36 million for this work in 2017, up by over 65% on the prior years $21.8 million.

AXIS Capital recently said that it had grown its third-party capital under management to an impressive $1.9 billion by the end of 2017, with around 55% (or $1.05 billion) dedicated to the property catastrophe reinsurance space and the rest to other lines of business.

CEO Albert Benchimol said at the time that he hoped for further growth in these metrics over the coming year, as third-party capital plays an increasingly important role and provides an increasingly important source of fee income for AXIS Capital.

AXIS’ growth into third-party capital management has been particularly impressive, among its cohort of re/insurers its size.

In terms of premiums ceded to strategic capital partners, AXIS has grown this by an impressive 443% over just four years.

AXIS Capital premiums ceded to strategic capital partners (from a company presentation)

At the same time as witnessing this impressive growth of its third-party capital ceding business, AXIS has been realising the profitability of originating business for investors as well, with fee income earned rising by 471% across the same four years.

AXIS Capital fee income earned from strategic capital partners business (from a company presentation)

AXIS and others of similar size, are making the origination of risks for investors a key part of their business models.

The hope will be that the fee income makes it worth continuing to originate and underwrite risks which no longer sit as well on their own balance-sheets, putting the lower cost-of-capital of the ILS and institutional investor markets to work, while using their own capacity for risks or initiatives that can pay them enough to continue meeting their own cost-of-capital.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.