Insurance-linked securities (ILS) and catastrophe bond limits at risk of losses in the Asia Pacific region continue to expand, according to reinsurance broker Guy Carpenter, which results in increasing global diversification opportunities for the ILS investor base.

The Asia Pacific region has always been seen as the most likely source of global expansion and as a result diversification for the ILS market, given the need for reinsurance limits to cover the regions burgeoning catastrophe exposures.

The Asia Pacific region has always been seen as the most likely source of global expansion and as a result diversification for the ILS market, given the need for reinsurance limits to cover the regions burgeoning catastrophe exposures.

The catastrophe bond market has played a role in Asia, particularly Japan, since the late 1990’s and the amount of cat bond limits at risk has been growing there.

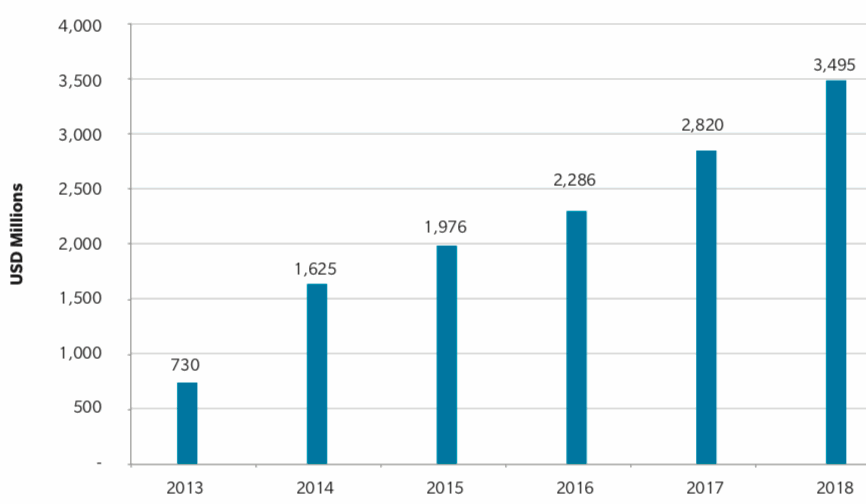

In fact, Guy Carpenter’s latest Asia Pacific Catastrophe Reinsurance report shows the steady growth of Asia Pacific exposed catastrophe bond limit, even if the majority is solely exposed to Japan.

Guy Carpenter explained that the amount of 144A catastrophe bond limit outstanding covering risk in the Asia Pacific region grew 24% over the year from September 2017.

As of October 2018 this figure stood at just under $3.45 billion, which represented a new record high for Asian perils in the cat bond market. More details on the growth of Asian perils in the cat bond market can be seen in this chart from Guy Carpenter (below).

The broker noted that over the last year a number of new catastrophe bond issuances have benefited Japanese buyers. Details on all of these and every other cat bond can be found in the Artemis Deal Directory.

After this surge of issuance and new record in terms of Asia Pacific cat bond risk capital outstanding, Guy Carpenter sees cedants based in the Asia Pacific region accounting for around 12% of the global catastrophe bond limit outstanding.

The broker noted that this is likely to increase, as “capital markets investors have the appetite for more risk in the region.”

At the same time Guy Carpenter said that cedants in the Asia Pacific region who want to diversify their reinsurance capital sources are likely to continue to turn to the cat bond and ILS market.

This trend, of the growth of capital markets backed reinsurance solutions in Asia Pacific, is continuing, with an increasing amount of collateralised capacity backing reinsurance programs in the region as well, on top of quota share activity that involves some ILS investors.

While reinsurance and retrocession in Asia Pacific does remain dominated by traditional market players, the use of alternatives and the amount of ILS capital at-risk in the region is on the rise.

Driving this is increased reinsurance buying and also reinsurance being purchased as a tool to protect earnings as well as capital.

The ILS market is well-positioned to capitalise on these trends, offering flexible reinsurance and retrocession products that can be an attractive addition to re/insurers protection in the region.

“In the Asia Pacific region increasing amounts of catastrophe protection are being bought to protect earnings rather than simply protect capital,” Guy Carpenter explained. “Generally, the most suitable vehicle for buyers wishing to achieve this goal is through aggregate excess of loss covers.”

The recent loss activity in Japan has triggered some of these aggregate excess of loss reinsurance programs, resulting in impacts for ILS funds and showing that ILS penetration has been able to increase a little with this shift.

Guy Carpenter rightly notes that traditional markets in the region should beware, as if they look to hike rates after recent losses the ILS market is becoming increasingly well-positioned to step in at efficient pricing.

While the traditional market has been able to discount Asia Pacific risks for the sake of the diversification they offer, this has been harder for ILS managers.

But as the region increasingly opens up to ILS capital the likelihood that the capital markets will increase its share of limits at risk in Asia Pacific is on the rise.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.