Perhaps contrary to what many would believe, it is forecast to be the advanced markets of the world that will drive future non-life insurance premium growth, as the premiums they add to the global total is expected to outweigh premium growth in emerging markets.

Reinsurance firm Swiss Re looks at this in its latest sigma report on world insurance premium trends, finding that advanced markets such as the United States can be expected to be the source of the majority of global insurance premium growth in the future.

“Although the insurance markets in emerging countries have solidly outperformed the corresponding economies for decades, the Swiss Re Institute estimates that, in the years to come, advanced markets will contribute more than half of the additional premiums in absolute terms,” the reinsurance firms research team explains.

Much of this is put down to the strengthening of the U.S. economy, hence Swiss Re believes that the U.S. market will be the overall driver of non-life insurance premium growth in years to come.

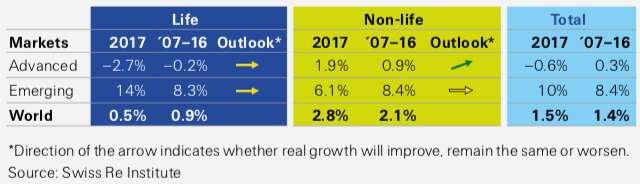

Real premium growth in 2017, vs average 2007‒16 and outlook

Global insurance premiums increased by 1.5% in real terms to nearly USD 5 trillion in 2017, Swiss Re explains, a slowdown from the 2.2% increase seen in 2016.

Of this, global life premiums increased by 0.5% in 2017, while global non-life premiums rose by 2.8%. Global life premiums were roughly USD 2.7 trillion in 2017, while global non-life premiums were approximately USD 2.2 trillion

But premium growth in both life and non-life slowed, Swiss Re said, with reducing life insurance premiums in advanced markets such as the U.S. and Western Europe the main drag on overall global premium growth.

Key emerging markets like China will continue to be a major driver of growth though and life insurance penetration will also drive premiums higher as well, the reinsurance firm said.

Jérôme Haegeli, Swiss Re Group Chief Economist, commented on how insurance premium patterns have changed since the 1960’s saying, “Back then, Advanced and Emerging Asia accounted for 5% of global insurance premiums versus 22% in 2017. For the next decade, the shift to China is likely to continue. Given the impressive number of infrastructure initiatives underway in China, China’s contribution to world insurance premiums could yet again exceed expectations. In the following decades, other markets such as India, Indonesia, Brazil, Mexico, Pakistan, Nigeria or Kenya could become more important.”

Reflecting the continued importance of emerging markets, even at a time when premiums are likely to be driven by advanced economies like the U.S., Swiss Re highlights that insurance penetration (premiums/GDP) has increased consistently in emerging economies, but non-life penetration has virtually stagnated in the advanced markets since 2000, and has also been on a declining trend in the life sector of advanced markets as well.

This suggests that premium growth in advanced markets will be tied to economic performance, while penetration is still continuing to increase in emerging markets.

That means in years to come that as the value of each contract continues to rise in emerging markets their contribution to global insurance and reinsurance profitability will also be on the rise.

The Swiss Re Institute expects rising global life insurance premiums to be largely driven by strong growth in China, but notes that profitability remains under pressure due to low interest rates, increasing competition and regulatory changes.

Haegeli said, “The ongoing low interest rate environment remains a major concern for life insurers’ profitability and their ability to offer attractive long term life insurance products, particularly in combination with Solvency II types of regulatory frameworks.”

On non-life insurance, the company warns, “Competition has remained fierce because of insurers ́ strong capitalisation and the availability of alternative capital. Additionally, the US tax reform is expected to have a significant long-term impact on growth and structure of the re/insurance market. The viability of the current Bermuda business model is in question, while onerous base erosion tax rules level the playing field between domestic and foreign-owned US carriers.”

The promise of growing insurance premiums in advanced markets like the U.S. will result in greater opportunities for the capital markets to deploy and take a share of the growing base of risk there.

The emerging markets look set to be driven primarily by life growth to begin, but as economies grow it can be expected that non-life cover will increase as well, again providing more opportunities for the capital markets in years to come.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.