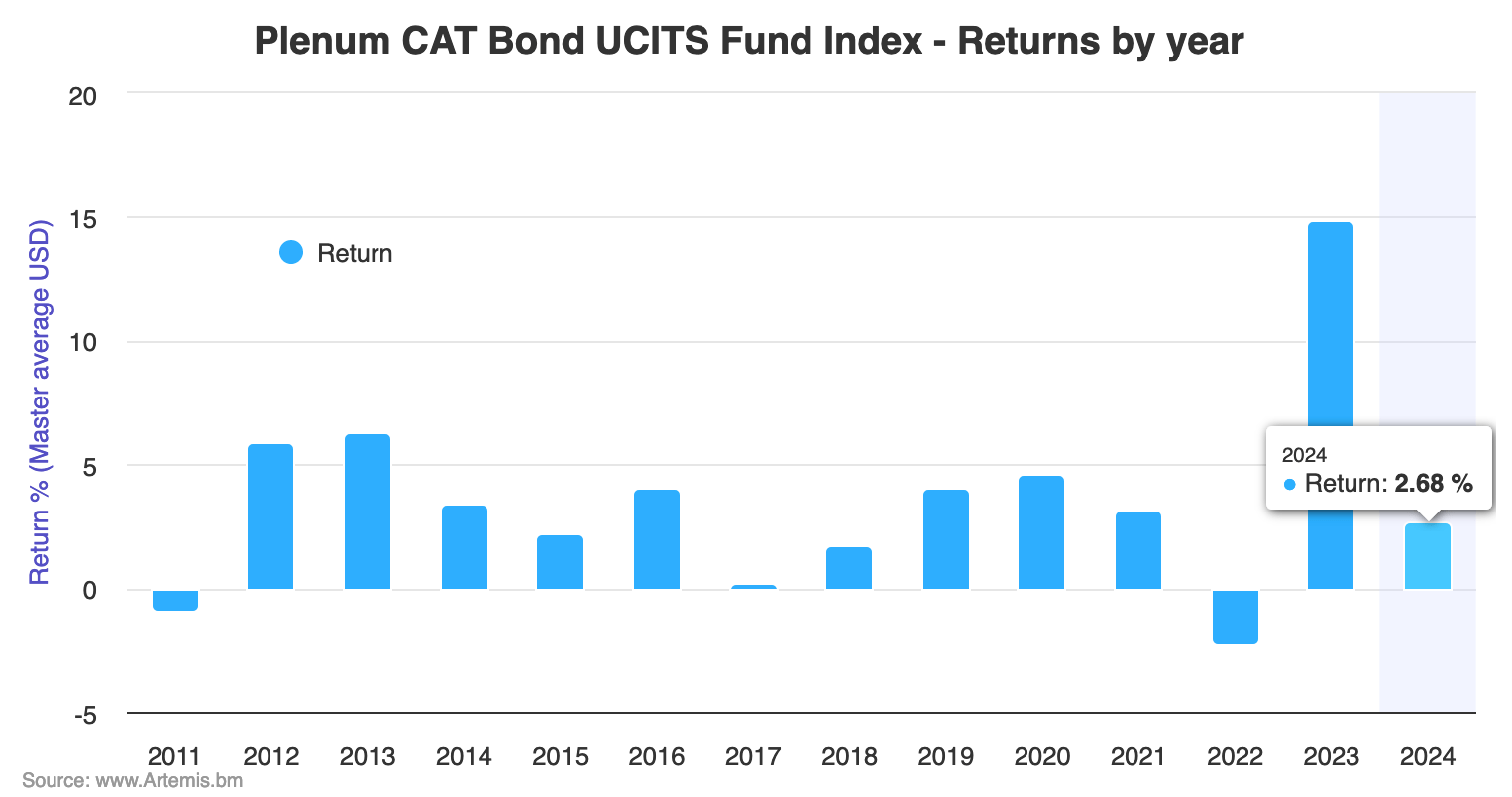

By March 1st 2024, catastrophe bond funds in the UCITS format had already delivered a 2.68% average return in 2024, as the cat bond asset class continues to benefit from strong demand that has been driving prices higher.

It’s a particularly strong start to the year, as January and February are typically seen as slower months, in terms of the returns they deliver.

But, in 2024, demand for cat bonds has been driving secondary market prices higher, benefiting investors in these cat bond funds.

So, it’s not just the higher pricing of new cat bond issuance benefiting investors, once again it is market supply and demand dynamics that have started the year off strongly.

The Plenum Investments Index that tracks the returns of catastrophe bond funds in the UCITS format, the Plenum CAT Bond UCITS Fund Indices, has risen strongly through the first two months of 2024.

Having delivered a stunning performance in 2023, beating the records and returning 14.88% in USD for the Master Average Index, while the capital-weighted average return for USD share classes of the group of UCITS catastrophe bond funds tracked by Plenum Investments reached just under 16%, the strong performance has continued into 2024.

Up to and including March 1st, the Plenum UCITS cat bond fund index is now up 2.68% so far this year.

You can analyse this performance using the Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format and provides a broad benchmark for the performance of cat bond investment strategies. Click the chart below for an interactive version and index development by week.

Right now, this master average USD return of the Plenum CAT Bond UCITS Fund Indices is actually running ahead of the return delivered over the comparable period a year ago.

That’s telling of market conditions, as it is secondary pricing that has been driving the returns higher this year, as well of course as the growing component of cat bonds priced at higher levels over the last year that sit within cat bond fund portfolios.

We believe this is the strongest start to the year for this UCITS cat bond fund Index in its history and the data runs back to early 2011.

All of which means that investors will not have seen any slow-down in returns they are receiving from their UCITS cat bond fund investments, despite primary cat bond issuance pricing moderating somewhat, as the demand factors driving the secondary market continue to elevate pricing and therefore returns.

Of course, secondary prices can only rise so high and at some point supply of new cat bonds will help to moderate demand, while seasonality will also come into play and prices will correct.

So gains due to secondary cat bond price rises are not typically permanent, but with investment managers constantly evolving their portfolios, to accommodate new issues and take advantage of trading opportunities that emerge, investors do stand to benefit from this very strong start to the year.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.