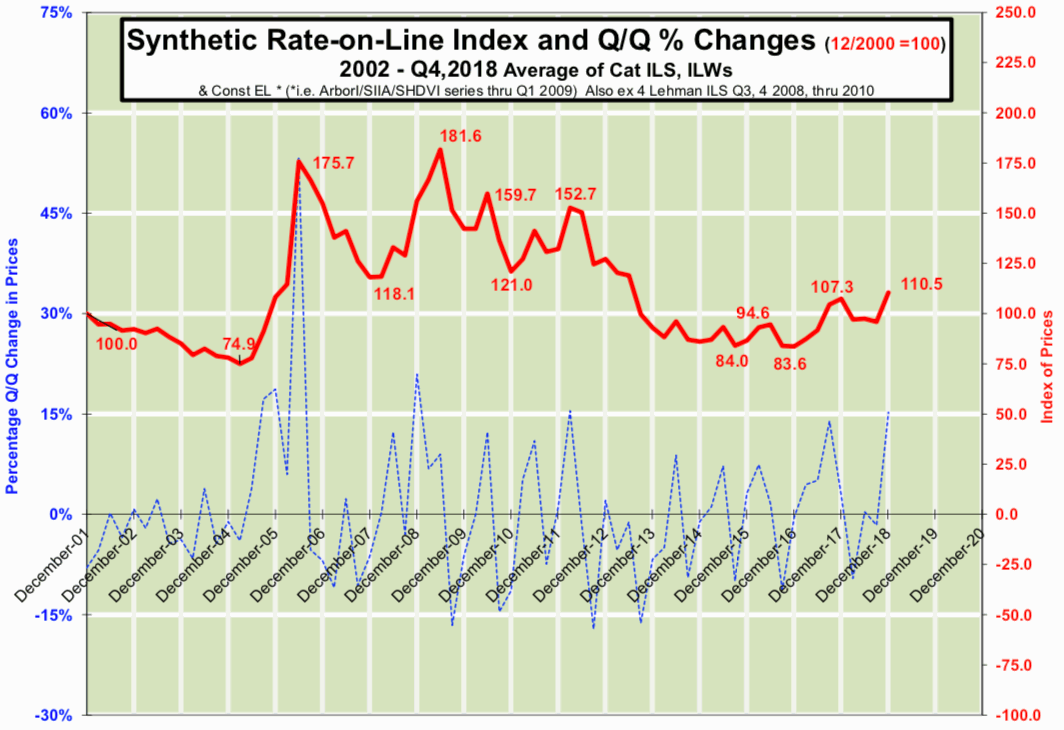

The Lane Financial LLC synthetic insurance-linked securities (ILS) rate-on-line index rose 15% during the final quarter of the year as ILS rates look to have entered hard market territory, while its analysis indicates ILS rates could rise up to 20%.

Based on ILS and catastrophe bond market pricing as of mid-December, the Lane Financial team conclude that “we are once again within hard market territory” explaining that “Our numbers indicate a 10 – 20% increase in rates.”

Based on ILS and catastrophe bond market pricing as of mid-December, the Lane Financial team conclude that “we are once again within hard market territory” explaining that “Our numbers indicate a 10 – 20% increase in rates.”

The reason for this is of course the recent loss experience of the ILS market, after the realised impacts of 2017 hurricanes and wildfires, the ongoing loss creep and increasing impact to aggregate structures from those same events, and now the added burden of fresh losses from 2018 catastrophes as well.

The Lane Financial team explain that a year ago the hard market it reported from its analysis proved particularly short-lived, as fresh capital poured into the ILS market and rates quickly became depressed.

This resulted in the firms rate-on-line index falling back into neutral territory by the end of first and second quarters of 2018, but by the third quarter “an upward pointing heartbeat was being detected” as 2018 saw the first meaningful loss events for ILS and catastrophe bonds.

While 2018’s loss events have not been particularly significant on their own, the aggregation of losses across multiple events topped off by unexpectedly large California wildfires losses hit certain ILS positions resulting in some significant mark-to-market hits to exposed catastrophe bonds.

The ILS market continued to take its losses in its stride, but the “irksome phenomenon” of loss creep from the 2017 hurricanes, particularly Irma, showed a number of other cat bond positions to be at-risk of losses.

The net effect is a further upwards shift in Lane Financial LLC’s synthetic insurance-linked securities (ILS) rate-on-line index, which rose 15% in the fourth quarter (as seen below).

As a result, the analysts say that ILS and cat bond rates are back in hard market territory once again, with their numbers suggesting rate increases from 10% to as much as 20%.

Pricing on recent catastrophe bond issues that we’ve seen, as well as pricing we’ve seen on some collateralized reinsurance renewals and sidecar layers all seem to bear this out. However the experience does not appear to be market-wide at this time.

Lane Financial’s experts warn though that, “Capital will not rush-in as it did in 2017. It may take rates staying up longer to be enticing this time round.”

If the market can stand firm and demand rate increases right through the first-half up to the key Florida reinsurance renewals and if issuance remains as brisk as seen this year, it will bode well for investors but we’d expect to see capital increasing once again.

That could have a moderating effect on ILS rates once again, so this ILS hard market may not last for long without further losses to help sustain the demand for higher returns.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.