Issuance of new catastrophe bonds and related insurance-linked securities (ILS) in 2018 has now reached $10 billion, as deal flow keeps pace with last year’s records and this year now becomes only the second to see a double-digit volume of new cat bond transactions.

As of this week issuance of new cat bonds and related ILS transactions that we track here at Artemis has reached $10 billion, only the second year in the market’s history for issuance to reach that level.

At the same time the outstanding cat bond and related ILS market is now $35.3 billion in size, according to Artemis’ data on risk capital outstanding.

Last year saw the catastrophe bond and related ILS market that we track break all records, becoming the first year to see double-digit issuance.

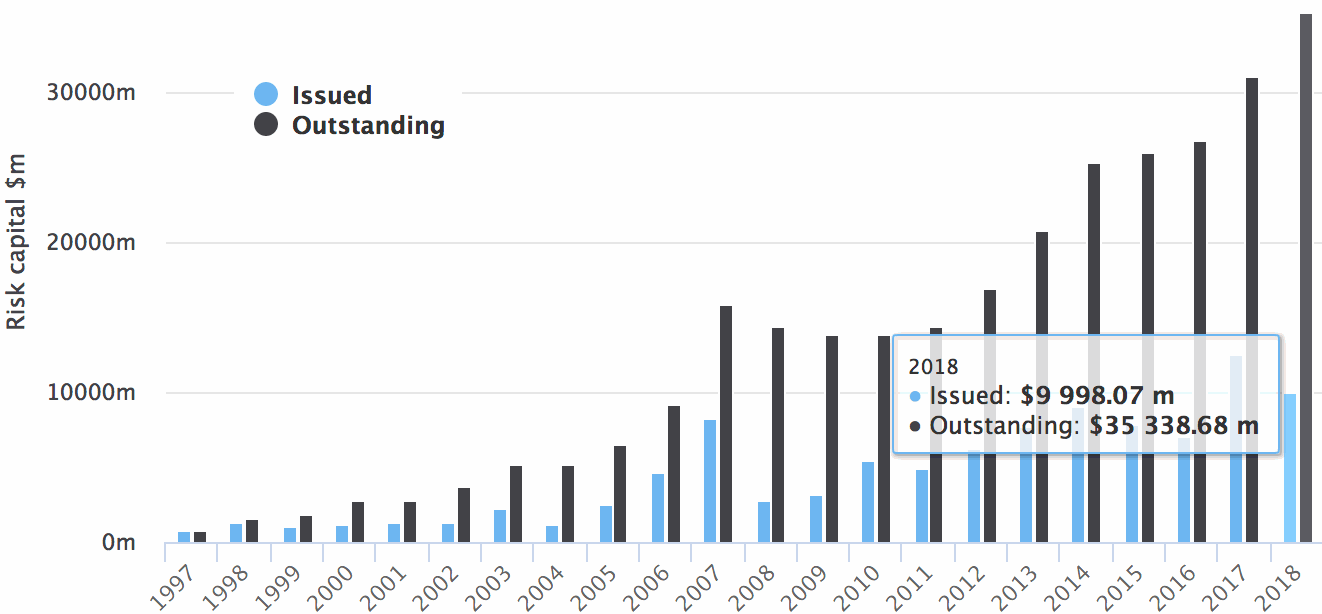

In 2017, the cat bond and related ILS market reached $10 billion of issuance as of July 7th, while in 2018 it has taken just a few days longer to reach the same milestone, with the completion of the new parametric earthquake cat bond Acorn Re Ltd. (Series 2018-1) taking the total issuance recorded in the Artemis Deal Directory for 2018 so far to precisely $9.998 billion (as good as $10 billion with rounding).

The year started strongly with a record first-quarter and second-quarter issuance was brisk, despite falling slightly behind the prior year, as detailed in our latest quarter cat bond and ILS market report.

But the fact that ILS market activity has managed to keep up such a strong flow of transactions even after the market faced its heaviest losses in history in 2017 is testament to the important role ILS instruments such as catastrophe bonds now play in global reinsurance and retrocession arrangements.

The continued growth of the cat bond and related ILS market has been strong through 2018 so far and sources tell Artemis that the pipeline for deals through the rest of the year remains relatively full, with a number of interesting sponsors, risks and transactions set to emerge throughout the year.

In terms of growth, the size of the market as denoted by the amount of risk capital outstanding grew by 7% in Q2 alone to reach the new record high of $35.3 billion, 14% in the first-half of 2018 and by a huge 20% year-on-year, as recorded by Artemis.

Catastrophe bond issuance and outstanding by year through 2018 (Click the image for an interactive chart)

With around $1.2 billion of maturities left to roll out of the market over the remainder of 2018 it is clear that the market will achieve further outright growth.

There is also a very strong chance that the cat bond and related ILS market achieves another record year in 2018, as just $2.6 billion more issuance would help it to surpass last year’s record of $12.56 billion that was recorded by us at Artemis.

For full details of the second-quarter of 2018, including a breakdown of cat bond issuance by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year, download your free copy of Artemis’ Q2 2018 Cat Bond & ILS Market Report here.

For full details of the second-quarter of 2018, including a breakdown of cat bond issuance by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year, download your free copy of Artemis’ Q2 2018 Cat Bond & ILS Market Report here.

For copies of all our reports, visit our archive page and download them all.

Don’t forget to check out our Cat Bond Market Dashboard as well, for a snapshot of the ILS market, and our range of catastrophe bond market charts and data visualisations which allow you to analyse the outstanding market in more detail.

Note: Artemis’ data on catastrophe bond issuance includes every transaction we can source information on, including private deals, new diversifying insurance perils, and the usual 144A broadly marketed property catastrophe issues. Hence our figures are typically higher than those quoted by reinsurance broker reports, but we feel this offers a holistic look at market activity.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.