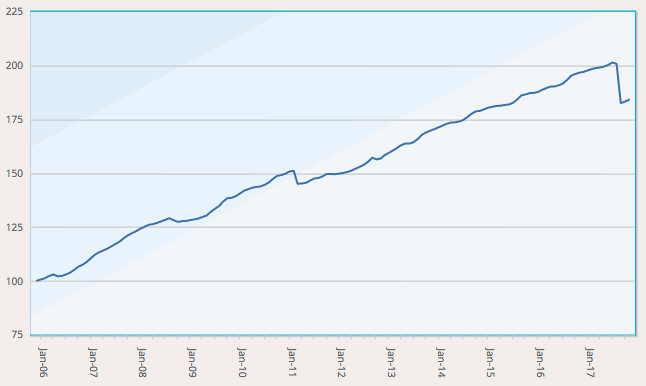

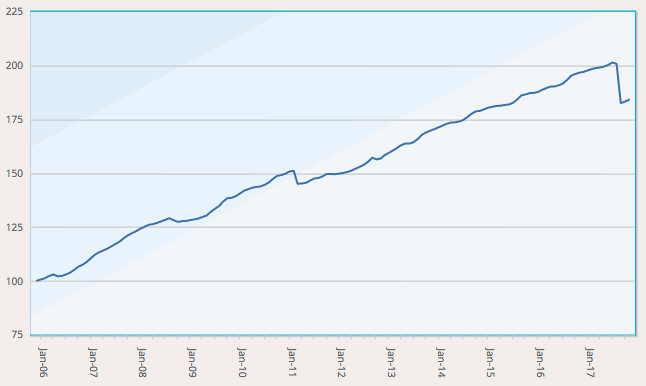

The average return of insurance-linked securities (ILS) and reinsurance linked investment funds was 0.31% in December 2017, as ILS fund manager performance diverged with the impacts of catastrophe loss events continuing to drive performance for many, which took full-year returns to -5.57% according to the ILS Advisers Index.

Certain ILS funds took charges during the last month of 2017, due to the impacts of the second outbreak of California wildfires as well as some reserve strengthening for earlier losses from the major hurricanes that struck the United States and the wildfires in northern California from October.

Certain ILS funds took charges during the last month of 2017, due to the impacts of the second outbreak of California wildfires as well as some reserve strengthening for earlier losses from the major hurricanes that struck the United States and the wildfires in northern California from October.

But other ILS funds fared better in December 2017, including some of the pure catastrophe bond funds which were able to recoup some market-to-market losses during the period, as a number of cat bond prices recovered.

According to the Eurekahedge ILS Advisers Index, 24 out of the 34 ILS fund strategies that it tracks reported positive performance in December 2017, leading to the average ILS fund return of 0.31% for the month. This is below the average for December, which is around 0.45%.

That took full-year 2017 average ILS fund returns to -5.57%, which is the lowest annual return ever recorded by the Index. But when you consider the size of the losses and the long-term average annual return of +5.41%, it’s easy to understand why investors find the asset class attractive as a long-term alternative asset class.

ILS Advisers explained the impacts suffered by ILS funds in December, “The increase of loss reserves in the past events along with the second California wildfires added pressure to some private ILS funds.”

On the catastrophe bond fund side, some reported gains due to the recovery of pricing value on a number of positions during the month.

This meant that pure cat bond funds outperformed those investing in collateralized reinsurance and private ILS in December 2017, with the cat bond funds reporting an average return of 0.88%, while the private ILS funds only rose by 0.09%.

It also meant a stark difference between the best and worst performing ILS fund in December, with a gap of 26.09% between the two. This really shows the gulf between strategies in ILS now, with some capable of massive returns and declines from losses, while other ILS funds offer much lower volatility returns to their investors.

Over the full-year the group of ILS funds that invest in reinsurance contracts and private ILS underperformed the pure cat bond funds by a huge 9.33%, demonstrating that the collateralized reinsurance market took the bulk of the losses from 2017 catastrophe events.

But despite all the losses in 2017, ILS Advisers highlights that the ILS market grew to a new high by the end of the year, which it says, “Demonstrates strong investor interest and the ability of the asset class to sustain historic losses.”

2017 has been a good demonstration of how the ILS fund market reacts to and deals with its losses. The reserving practices have become clearer and more evident than ever before, while the different levels of risk taken by different strategies has also been apparent.

Having come out the other side of the losses with more capital to deploy and a firmer reinsurance rate environment in January, it is going to be interesting to see how the ILS funds perform as we move through 2018.

Eurekahedge ILS Advisers Index, showing average return of ILS and cat bond fund market - Click the image for more data on ILS fund performance

You can track the Eurekahedge ILS Advisers Index on Artemis here, including the new USD hedged version of the index. It comprises an equally weighted index of 34 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.