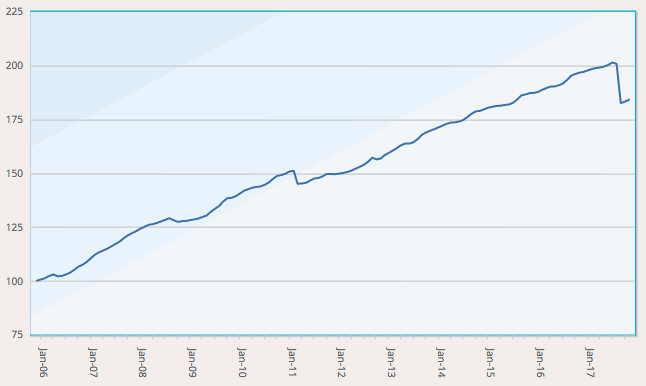

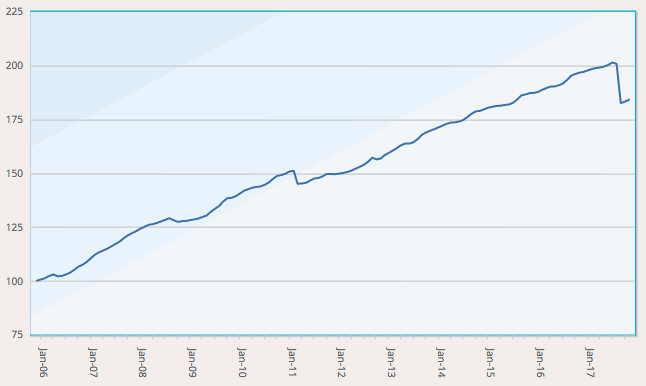

The insurance-linked securities (ILS) fund market recorded an average return of 0.38% in November 2017, according to the Eurekahedge ILS Advisers Index, however 6 of the tracked ILS funds fell to a negative return for the month as the impact of recent catastrophe events continued to affect the sector.

The ILS funds which suffered a negative November were those investing in private ILS and collateralized reinsurance arrangements, some of which were impacted due to the California wildfires, while others adjusted loss reserves for the hurricanes and still more set up new side pockets.

The ILS funds which suffered a negative November were those investing in private ILS and collateralized reinsurance arrangements, some of which were impacted due to the California wildfires, while others adjusted loss reserves for the hurricanes and still more set up new side pockets.

The impact of the 2017 catastrophe events and in particular the three major hurricanes (Harvey, Irma and Maria) and the California wildfires is still playing out in the ILS sector.

Due to uncertainty in the level of losses a handful of ILS funds had to establish new side pockets in November, seeking to segregate potentially at risk assets to protect their fund investors.

Segregating reinsurance assets that were potentially exposed to the aggregation of assets has been especially important in recent weeks, with the January renewals fast approaching ILS fund managers were eager to ensure any new capital coming into their fund structures would not have any exposure to the 2017 events. We understand this stimulated some revisiting of reserves and setting up of side pockets during the month.

As the ILS fund industry comes out the other side of the recent losses the returns have picked up and bounced back to more normal levels.

September saw the ILS fund market experience its largest ever losses, with a -9.04% negative return for the month across the fund’s tracked by ILS Advisers Index. October then bounced back to a positive 0.35% return, but with 10 funds experiencing a negative month, so November’s 0.38% and only 6 negative funds is further signs of a recovery getting underway.

In fact, it looks like December’s returns could be a little better still, as some ILW positions have been able to recover a little value after estimates for the industry loss from hurricane Irma dropped at the latest update. That could result in a boost for December returns as some loss reserves are able to be released.

The releasing of loss reserves is likely to be a talking point over the coming months as well, as some ILS fund managers will have reserved more cautiously than others enabling them to release reserves as loss amounts crystalise.

Conversely, there could also be some ILS fund managers that have not reserved sufficiently, and we could see some strengthening of reserves happening as well.

Commenting on ILS fund performance in November 2017, Stefan Kräuchi of ILS Advisers said, “28 of the 34 funds represented in the Eurekahedge ILS Advisers Index were positive for the month. The difference between the best and the worst performing fund was 7.82 percentage points, which was higher than previous month’s figure.

“Pure cat bond funds as a group were up by 0.48% while the subgroup of funds whose strategies include private ILS increased by 0.31%. Private ILS funds underperformed pure cat bond funds by 9.10 percentage points on annualized basis year-to-date.”

It’s interesting to see catastrophe bond funds outperforming for the month, suggesting the setting or strengthening of loss reserves and the California wildfire loss could have impacted a reasonable number of the private ILS funds in November.

Of course the pure cat bond funds have also benefited from a steady recovery of mark-to-market losses, as a number of cat bond positions bounced back as the potential for them to face losses reduced.

That should continue through December, which along with any return of value from released ILW loss reserves could mean December’s average return is a little higher.

Join us on February 2nd in New York for our upcoming ILS conference

Eurekahedge ILS Advisers Index, showing average return of ILS and cat bond fund market - Click the image for more data on ILS fund performance

You can track the Eurekahedge ILS Advisers Index on Artemis here, including the new USD hedged version of the index. It comprises an equally weighted index of 34 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.