The use of collateralised sources of reinsurance and alternative reinsurance capital is providing a significant diversifying element to the protections adopted by United Kingdom insurers and Lloyd’s of London syndicates, according to information from the Bank of England.

The Bank of England’s Prudential Regulation Authority (PRA) division said today, in discussing the results of its 2017 General Insurance Stress Test (GIST), that, “There is no evidence that the level of interconnectedness, reflected by the concentration to specific reinsurers, has increased.”

In fact, there is evidence that risk concentration to specific individual reinsurance companies has fallen marginally since 2015, while at the same time alternative capital remains an important part of reinsurance panels for the tested group of general insurers and syndicates.

But the data shows that collateralised sources of reinsurance capacity play a vital role in the reinsurance provisions of this cohort of UK and London market players, helping to broaden the universe of counterparty diversification which has no doubt helped to ensure that interconnectedness remains under control.

The stress tests involved the 26 largest general insurers in the UK, 16 large syndicates at Lloyd’s, and the Society of Lloyd’s itself, which together account for around £80 billion of premiums and 82% of the UK general insurance sector.

The stress tests, as we wrote at the time, were designed to identify the use of different types of reinsurance capital, as they sought information from participating insurers on how their capital would respond to severe loss scenarios.

Stress tests used included four major catastrophe events and one economic event, all of which would hit the UK, Lloyd’s and London insurance markets hard. The data identifies that collateralised reinsurance and alternative capital would provide a significant proportion of the financial support to the UK sector after any such events.

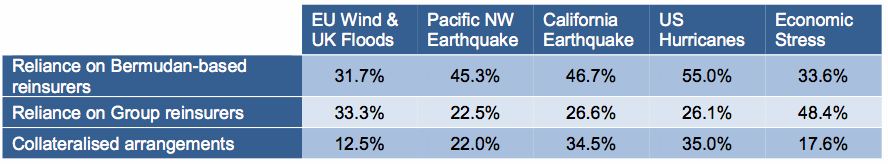

Bermudian reinsurance firms would provide the most support to the UK insurance industry from most of the events, followed by group reinsurers, but collateralised arrangements are a growing piece of the puzzle and across the four nat cat scenarios and the one economic loss event the data shows that collateralised coverage would support approximately 24% of the losses.

For certain perils, such as California earthquakes and U.S. hurricanes, the support from collateralised reinsurance arrangements would grow to 35%, while even the economic loss scenario would result in nearly 18% of support from collateralised sources.

Interestingly though, European windstorms and UK flood loss events would see the lowest level of collateralised reinsurance support, which we would suggest is due to the very low pricing of these perils in the traditional market, that make them less attractive to ILS managers.

The full data breakdown can be seen below:

The stress test results show that reinsurance is the largest risk mitigation tool used by the UK insurance sector, with almost 70% of the gross loss reinsured for the European windstorm and UK floods, California earthquake and U.S. hurricanes scenarios.

The amount of reinsurance used has increased since the last tests in 2015, which the regulator notes could be due to the soft cycle in the reinsurance market.

We’d also add that the growth of ILS and alternative capital has likely assisted here, helping to make reinsurance more plentiful and also bring new protection options to market.

While the PRA didn’t identify any significant concentration to a single reinsurer, the highest was 10% which is still a meaningful amount of the total and shows how exposed some of the bigger players are to really market moving catastrophe losses.

However the PRA noted that it lacks information on exposures that are assumed by reinsurers from other cedants or through retrocession arrangements.

Bermuda represents around 55% of reinsurance recoverable for the U.S. hurricane stress tests of the UK market (collateralised reinsurance is 35%), or an average across the five loss scenarios of 42.46% (which is more comparable with the 24% average figure for collateralised reinsurance arrangements.

The 35% of U.S. hurricane loss events that would be taken by the collateralised reinsurance market is actually the same percentage as was reported in the 2015 stress test, suggesting that the ILS market’s penetration of U.S. wind risk hasn’t changed a significant amount, pointing to growth having been elsewhere or that the UK’s writing of that business hasn’t increased significantly either.

Cash and assets held in a trust account remain the majority of the collateral held against reinsurance, the PRA said.

The stress test results show that collateralised sources of reinsurance capacity are essential to the health of the UK, London and Lloyd’s insurance market’s, while also ensuring that no one market gets overexposed to major loss scenarios.

Given the whole reason for bringing the capital markets more directly into the provision of reinsurance risk capital through insurance-linked securities (ILS) and collateralised reinsurance was to more broadly diversify risks into the largest available pools of capital, this premise does seem to be working.

Join us in New York in February 2018 for our next ILS conference

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.