The value of insurance claims in the state of Florida from hurricane Irma has risen by just over 7% to reach almost $6.3 billion, according to the latest information from the Florida Office of Insurance Regulation.

As of 8am local time yesterday, December 4th, the regulator pegs estimated insured losses from hurricane Irma at $6.297 billion, up from $5.879 billion as of November 13th.

As of 8am local time yesterday, December 4th, the regulator pegs estimated insured losses from hurricane Irma at $6.297 billion, up from $5.879 billion as of November 13th.

Insured losses have been rising slowly from hurricane Irma and it’s understood that some of the early estimates of the impact this storm has made on the insurance and reinsurance sector have been downgraded as it became clear that claims were not filed in the numbers initially thought.

In total the Florida regulator has counted 853,356 claims filed, 381,584 of which have been closed and paid out to policyholders, while another 227,744 claims remain open.

That suggests room for the total to keep growing and it is often the costly and more difficult claims that can take the most time.

But it now seems clear that the figure from the FLOIR is unlikely to reach the levels anticipated for an overall insurance and reinsurance loss when hurricane Irma made landfall.

Commercial property claims continue to be slow to resolve, with 51,290 claims filed, 7,077 closed and paid, but still 32,546 commercial insurance claims open.

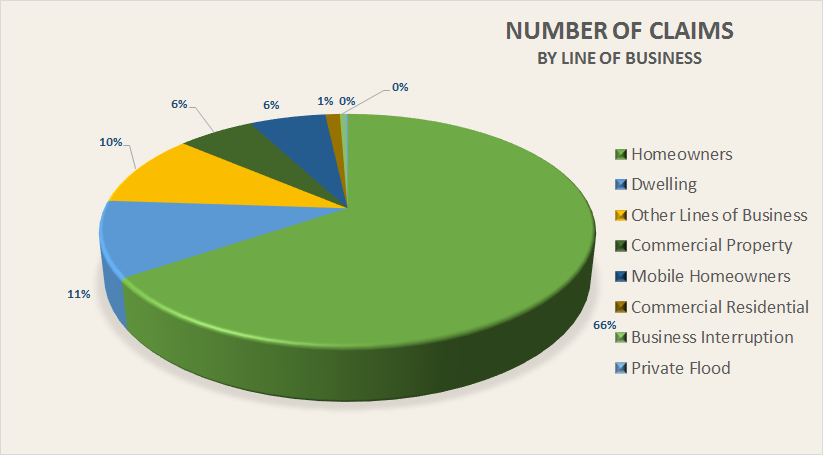

Homeowners claims make up the bulk of those reported and are also the fastest to be resolved.

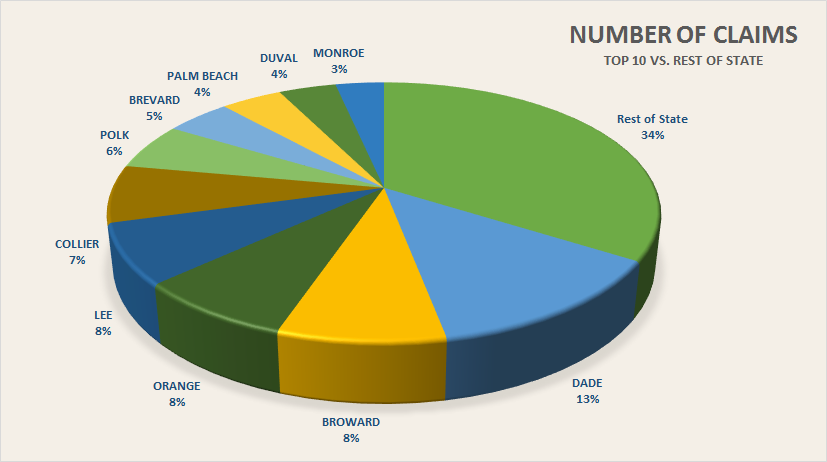

Despite the fact hurricane Irma impacted the west coast of Florida most severely, the highest concentration of claims has been seen in east coast counties such as Dade and Broward.

With Florida claims from hurricane Irma looking set to continue to rise beyond the $6.3 billion and Georgia having another roughly $700 million of claims so far, we understand, the total is still not nearing the early estimates from risk modelling firms.

It will be interesting to see in months to come whether some companies that have reserved for losses at the upper levels of the early estimates may be able to release more of those reserves if losses from Irma do not reach the level originally anticipated.

That could benefit some collateralized reinsurance and ILS fund players, who may have the ability to release some side pocketed assets if their losses are lower than had been assumed.

Data on the split of claims by line of business and by county can be seen below:

Join us in New York in February 2018 for our next ILS conference

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.