The Northern California wildfires that started on Sunday, October 8th, could drive insurance industry losses of $4.6 billion or higher, adding further pressure to the profitability of the property & casualty (P&C) industry following an active third-quarter, says Moody’s.

The fires broke out on October 8th, and spread rapidly with the help of high winds, low humidity, high temperatures and dry conditions, claiming 40 lives as it tore through Northern parts of the state, as of Saturday.

The number of structures reportedly damaged and historical fire data suggests the insured loss total for the California wildfires will be in the billions of dollars, says Moody’s, providing an initial loss estimate of around $4.6 billion, which it feels could rise.

The figure is based on reports from the California Department of Forestry and Fire Protection (CAL FIRE) that 5,700 homes and commercial structures had been destroyed by the fires, as of Saturday, to which Moody’s then applies an average insured loss per structure of $802,000 (which is based on historical Cali wildfire loss estimates).

Moody’s says that using the above estimations and data, suggests “losses would be close to $4.6 billion and growing as the fire continues.”

For the re/insurance and possibly insurance-linked securities (ILS) markets the wildfires will likely drive additional pressure to 2017 profits, after extremely costly events in the third-quarter, namely hurricanes Harvey, Irma, Maria, and the Mexico earthquakes, drove increased catastrophe losses for companies.

However, when compared with expected industry losses from the hurricanes experienced in Q3, the insured losses from the wildfires will likely be minimal, and Moody’s predicts most of the damage to fall to homeowners and commercial property coverages.

Furthermore, Moody’s says the low insured losses from the fires relative to Q3 hurricane events suggests “few reinsurers will be affected under their per-occurrence catastrophe reinsurance contracts.”

Although, some reinsurance players are expected to suffer some losses via their quota share, per risk, or aggregate contracts.

For ILS market participants, it’s also the aggregate covers that could be of some concern, especially if the insured loss estimate continues to rise, which is likely. ILS capital is increasingly participating in aggregate reinsurance contracts, ultimately making investors more at risk to deductible erosion in years with high losses from a series of events.

Moody’s states that 2017 could be a record year for wildfires, with some 8.5 million acres burned nationwide through October 6th, 2017, according to data from the Insurance Information Institute.

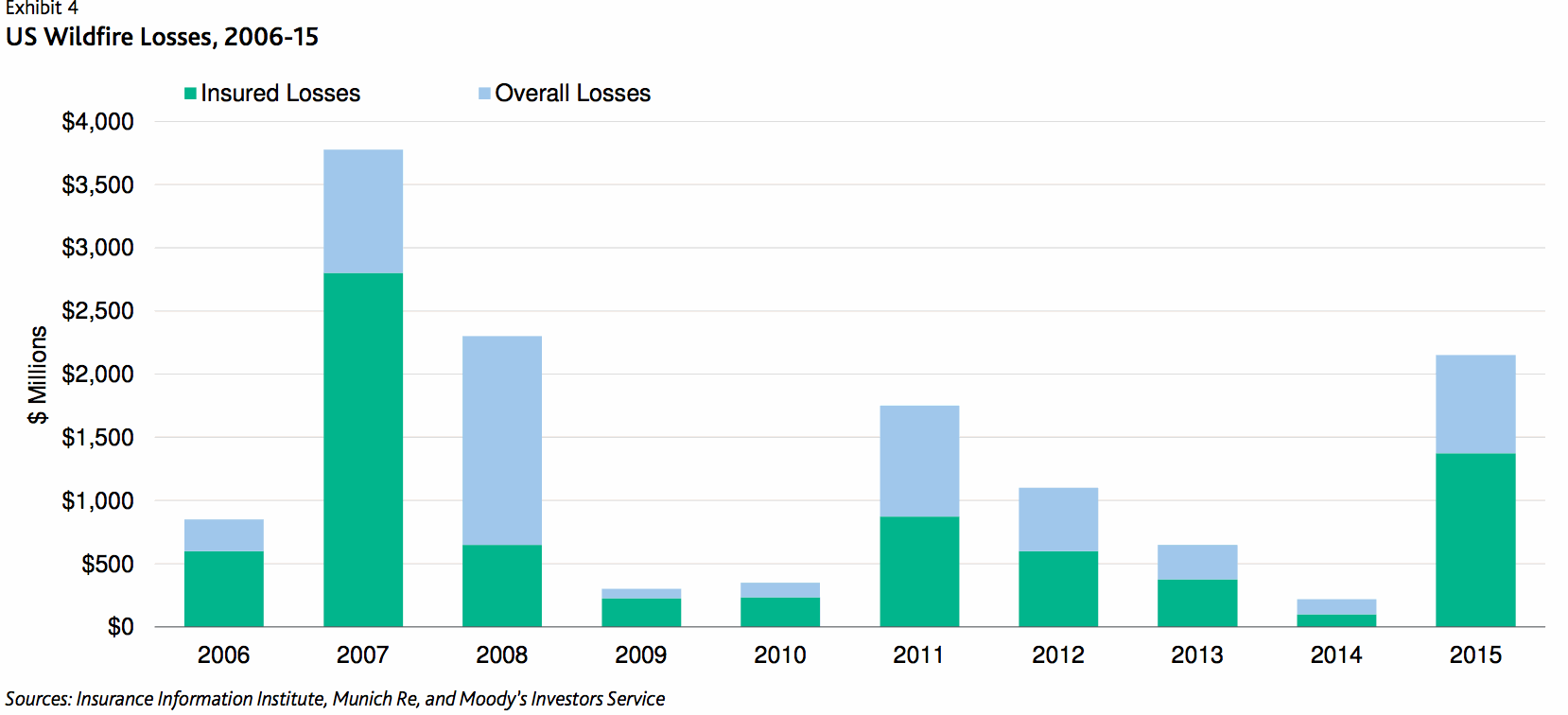

While the insurance and reinsurance industry loss from wildfires is likely to be up there with the highest of the last decade, as shown by the chart below, provided by Moody’s.

“Several recent academic studies have concluded that wildfire exposure for the western US has increased in recent years because of drier forests, a longer burning season, and higher average temperatures. California homeowners and commercial property insurers may take further actions to reduce wildfire risk, including reducing policies in affected regions, buying additional reinsurance, or raising rates,” said Moody’s.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.