The market for live cat (live catastrophe) trading and protection buying saw a little activity yesterday, as hurricane Irma continued its approach towards Florida, with at least one trade completed with an industry loss trigger of $80 billion reported to Artemis this morning, and a few other deals getting done.

The $80 billion industry loss trigger live cat industry loss warranty (ILW) was traded at a rate-on-line somewhere between 20% and 21.5%, we’re told.

The $80 billion industry loss trigger live cat industry loss warranty (ILW) was traded at a rate-on-line somewhere between 20% and 21.5%, we’re told.

When hurricane Irma’s threat to Florida and the U.S. first became clear protection buyers were looking for industry trigger live cat protection at around a $40 billion loss level, but sellers were more focused on higher trigger levels, leaving trading very light and with uncertain pricing.

Interest then emerged at slightly higher levels, but still the spread between what protection buyers wanted and were willing to pay, versus protection sellers appetite for risk and return, remained wide so few deals executed.

Interest also emerged in so-called back-up reinsurance covers, second-event covers (given Harvey’s impacts) and coverage to the end of year, as some re/insurers have already seen protection layers eroded somewhat.

Yesterday there were buyers looking for coverage at a $70 billion industry trigger who could not get the deals done, we’re told.

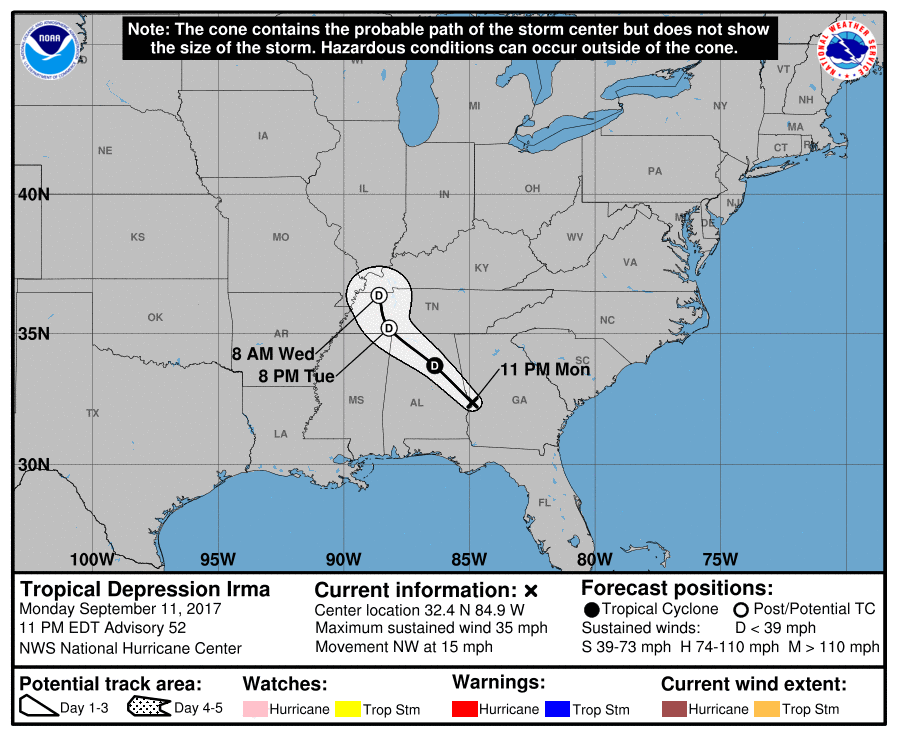

There is an expectation that more live cat coverage will be purchased today, although the triggers may fall a little given the westward shift in hurricane Irma’s forecast path this morning.

There were no trades of Irma exposed catastrophe bonds, according to Trace data, only non-hurricane bonds changed hands it seems.

Also read:

– As Irma tracks west, impact to ILS market lessens: Brookes, RMS.

– Increased use of retro to limit reinsurers’ Irma exposure: A.M. Best.

– Cat bonds drop 16% on hurricane Irma, prices discounted heavily.

– Hurricane Irma track in westward shift, remains on course for Florida.

– Stone Ridge reinsurance and ILS fund drops 8%+ on Irma threat.

– Interest in back-up reinsurance rises on Irma, live cat still quiet (so far).

– Billions of catastrophe bonds at risk from Hurricane Irma.

– CCRIF to pay $15.6m on Hurricane Irma impact to Leeward Islands.

– Hurricane Irma track aims at Miami, a $131bn realistic disaster scenario.

– Blue Capital halts ILS fund buy-backs as hurricane Irma approaches.

– Cat bond trading slight on Irma, Kilimanjaro II Re trades down.

– Hurricane Harvey re/insurance industry loss over $10bn: AIR.

– Irma & Harvey losses combined may still just be an earnings event: Morgan Stanley.

– Citrus Re 2017 cat bond notes trade down 50% on hurricane Irma threat.

– Hurricane Irma live cat activity focused on $40bn+ loss, pricing uncertain.

– Hurricane Irma landfall in Florida would hit reinsurers hard: KBW.

– Hurricane Irma a potential U.S. (Florida) threat this weekend.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.