In the latest updates to the Hurricane Irma forecast path the Miami-Dade area of Florida coastline is firmly in the center of the forecast cone, with Irma predicted to hit somewhere around Biscayne Bay to Miami Beach, the results of which are estimated as a $131 billion realistic disaster scenario (RDS) by Lloyd’s.

There remain significant uncertainty in the eventual path, but markets are beginning to hone in on the potential for a Miami area impact from a major Category 4 or 5 hurricane Irma and the center of the forecast path is practically on top of it right now.

There remain significant uncertainty in the eventual path, but markets are beginning to hone in on the potential for a Miami area impact from a major Category 4 or 5 hurricane Irma and the center of the forecast path is practically on top of it right now.

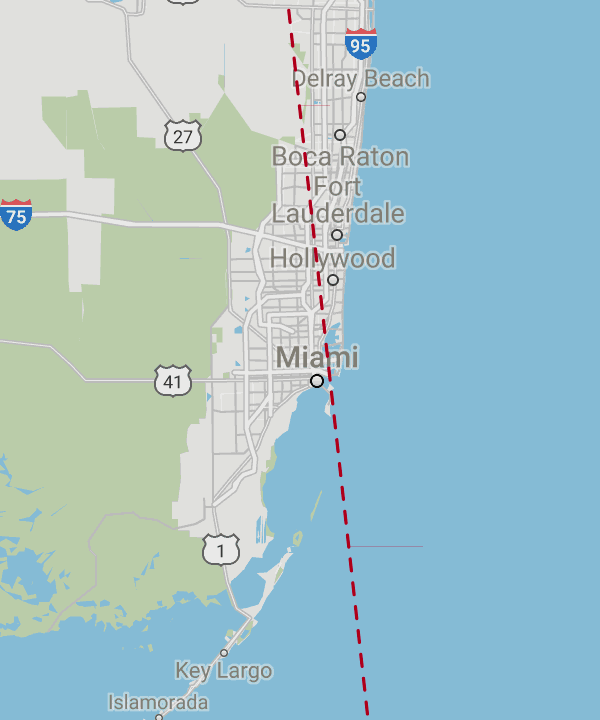

The image below shows the location of the NHC forecast center line as of 12:00 UTC on Thursday 7th September. It has to be stressed that this can easily move and the cone of uncertainty remains wide, as the graphic above and to the right hand side shows.

The center of the NHC forecast cone for hurricane Irma showing a Miami area landfall

But given the current center of the forecast path shows what would be among the worst case scenario land-falls that hurricane Irma could make, it seems appropriate to look at the possibility.

Analysts at Peel Hunt said that the Lloyd’s of London realistic disaster scenario (RDS) outcome for a Miami Dade area landfall from a storm like hurricane Irma is for a massive $131 billion industry loss to the insurance and reinsurance sector.

This scenario breaks down as a possible $66 billion in residential property insurance loss, $65 billion commercial property insurance, $2.25 billion Auto insurance and $1 billion Marine insurance, according to Peel Hunt. The reinsurance and insurance-linked securities (ILS) market would take a significant share of such an impact.

Many primary insurers would exhaust their reinsurance arrangements, including a number of catastrophe bonds and ILS structures as this is exactly the magnitude of loss that the ILS market’s capacity is deployed to protect against.

How impactful it would be to ILS interests is impossible to speculate, but it’s safe to assume that a Cat 4 or Cat 5 landfall on the path shown above would cause a significant loss to ILS funds and their investors.

Peel Hunt’s analysts believe that the Lloyd’s of London market is well-prepared to absorb such a loss, but given the softened state of the market it is very difficult to know who could be most exposed and how disciplined they have been in recent years. The same goes for Bermudian and other global reinsurers, as well as ILS funds, as a loss of such magnitude could show up any lack of discipline in underwriting practices.

A major hurricane Irma landfall around Miami would erode catastrophe budgets, leaving insurers and reinsurers lacking coverage for the rest of the year in some cases.

Demand could therefore be high for coverage after any such event and while no doubt there will be pressure to increase rates, there is also expected to be post-event capital inflows that could dampen upwards pressure even for such a large loss.

The scenario currently suggested by the NHC’s forecast cone and track is not a good one, for the residents of south Florida or for the insurance, reinsurance and ILS industry. However the availability of cheaper coverage in Florida in recent years and abundant reinsurance capital will help in recovery for any region impacted by major storms this year.

We have to stress, there is significant uncertainty over the eventual impacts to the United States from hurricane Irma, but as each day passes and the storm gets closer the chances of Florida impacts are rising and should the storm follow the currently forecasted path it could be catastrophic.

There is plenty of time left for the track to deviate however, so we provide the above for information only and RDS estimates are based on many assumptions, so even if the track remained static till landfall the loss could be very different.

But it is time to take Hurricane Irma very seriously, if you weren’t already, as the time left to make preparations for its arrival close to Florida are reducing.

You can track the hurricane season over at our dedicated page and all the graphics in this article will update automatically, so stay tuned.

Also read:

– Blue Capital halts ILS fund buy-backs as hurricane Irma approaches.

– Cat bond trading slight on Irma, Kilimanjaro II Re trades down.

– Hurricane Irma leaves trail of destruction, Florida still in its path.

– Hurricane Harvey re/insurance industry loss over $10bn: AIR.

– Irma & Harvey losses combined may still just be an earnings event: Morgan Stanley.

– Citrus Re 2017 cat bond notes trade down 50% on hurricane Irma threat.

– Hurricane Irma live cat activity focused on $40bn+ loss, pricing uncertain.

– Hurricane Irma landfall in Florida would hit reinsurers hard: KBW.

– Hurricane Irma a potential U.S. (Florida) threat this weekend.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.