The market for live cat (live catastrophe) trading on the back of the approaching major hurricane Irma has not yet sprung into life, with plenty of potential buyers looking for last-minute protection but only a few trades and a market that is trying to find the right pricing levels to get deals executed.

Two industry loss warranty (ILW) specialist brokers told Artemis that so far they have yet to see hurricane Irma live cat trades completed, but both said they are seeing interest and the number of enquiries has been rising. Trades have reportedly been seen by other brokers, although at small volumes so far.

Two industry loss warranty (ILW) specialist brokers told Artemis that so far they have yet to see hurricane Irma live cat trades completed, but both said they are seeing interest and the number of enquiries has been rising. Trades have reportedly been seen by other brokers, although at small volumes so far.

Interest has also been seen in parametric risk transfer solutions, both on the insurance and reinsurance or retrocession side, with these products seen as an effective hedge that can provide a level of disaster relief and risk transfer against the impacts of a storm the size of Irma.

With hurricane Irma remaining on course with 185 mph winds and the NHC’s forecast still showing a landfall in southern Florida as a major storm, it’s expected that enquiries will continue to increase and that the market will find its level likely today, resulting in more trading of risk.

Most sellers are only offering protection at a $40 billion or greater industry loss trigger, suggesting that the reinsurance market sees the potential for Irma to become one of the biggest industry losses in history.

While considerable uncertainty remains in the forecast, we understand that the model runs and disaster scenarios from catastrophe model specialists are suggesting any hit at category 4 or greater to southern Florida would be at least a $15 billion loss, with some scenarios of 1-in-100 year like impacts suggesting something closer to $100 billion or even greater, while a direct Miami hit could go even higher than that.

So it’s no surprise that live-cat markets are a little reluctant to bind deals yet, with such a spread in the potential impact scenarios.

The location of hurricane Irma’s landfall matters, with any hurricane Irma scenarios impacting the Broward, Miami, Palm Beach area having the greatest loss potential. A hit to the western edge of the Florida peninsula could be less damaging, although Irma may curve north and east taking it back across the state.

Hurricane Irma’s size also needs to be considered, as the storm could have impacts across the whole width of the Florida peninsula, so insurance and reinsurance losses are likely to come not just from the area of immediate landfall and where the eye of Irma tracks, but also from further afield.

Reinsurance and ILS markets will be setting to work in analysing their exposure, using scenario models, to identify if or how additional protection could help them.

Industry loss warranties (ILW’s) are the live-cat instrument of choice, typically, as they allow protection to be bought that will pay out should the reported industry loss (typically from PCS catastrophe series data) surpass the trigger level.

Live cat coverage can also be purchased using a parametric trigger, so for example buying protection that will pay out should a Category 3 or greater hurricane make landfall along a specific stretch of coastline, or should recorded wind speeds pass a certain figure at specified locations.

Brokers told Artemis that activity is likely to pick up as hurricane Irma nears the United States coastline, with the forecast path becoming more certain with each day that passes making buying protection accurately easier, but also likely ending up in prices rising as well (if the forecast outcome remains particularly bad).

Some of the latest forecast model runs have shifted further east this morning, with the consensus of a few now showing a greater chance of hurricane Irma running up the Florida coastline, or just missing the peninsula entirely and heading for a landfall further north in the Carolina’s. It will be interesting to see whether the NHC’s cone shifts back east at the next update of its graphics.

Given the levels of uncertainty over when hurricane Irma will make that northwards turn, there is every chance the model runs shift back west again. But this is something to watch over the next few days.

The demand for live cat coverage was evident yesterday and will likely continue to be today, however any increase in uncertainty could see the market find executing deals difficult.

But for every hour that passes the potential price of live cat coverage could increase also, so buyer demand is likely to remain as insurance or reinsurance companies and ILS funds look to lock in last-minute protection and it’s likely more sellers will come to the fore and find the pricing levels that suit them as certainty over any hurricane Irma U.S. landfall rises.

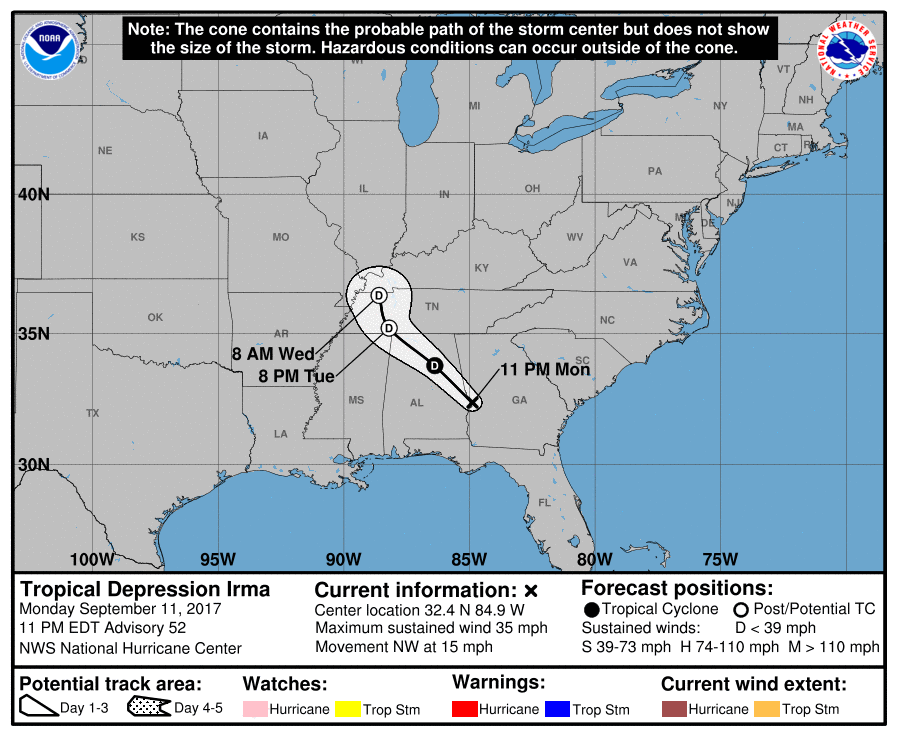

Hurricane Irma tracking map, forecast model runs and wind speed intensity predictions.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.